Each second of every day, your data and your money are constantly under threat. While you seamlessly save, invest, and manage your funds, scammers and opportunists look for loopholes and openings to siphon your money or commit identity theft.

Preventing this is of the utmost priority for us, and our dedicated team at Piggyvest operates in a state of constant vigilance to mitigate the problem. The team burdened with this task is the Cybersecurity Team. While their mission is complex and constantly evolves to meet our needs, their goal is simple: to protect your money and keep your trust.

To help you understand just how much goes into securing our data and funds, we went behind the scenes with two of the unseen guardians of Piggyvest: Oluwasegun Ojumola, Senior Fraud and Investigation Analyst and Ademiju Fakoya, a Fraud Investigation Analyst. This is an account of what Piggyvest does to keep your money safe.

The battlefield: Financial fraud has become dynamic

To comprehend the extent of the defence at Piggyvest, you must first understand how pervasive fraud and financial scams have become.

In simple terms, financial fraud is the deliberate action of taking advantage of another party for financial gain. This can manifest as social engineering schemes, account takeovers resulting in unauthorised transactions, or customers setting up sham businesses to collect payments illegitimately.

More modern examples include sophisticated phishing attacks and the use of synthetic or stolen identities to open accounts for malicious purposes.

The Piggyvest Cybersecurity Team uses the term “the dynamism of fraud” to describe the extent of the problem. This phrase is a recognition that the methods used by malicious actors are in constant flux.

“What is fraud yesterday is not fraud today,” Ojumola explains. “We’re seeing that these bad guys are coming up with new formats every day, and it’s important that we [Piggyvest] as a business continue to adapt”.

In other words, the threats are no longer just simple scams. They’re now complex operations run across multiple fronts where victory determines what happens to your funds. Fortunately, the Team at Piggyvest is well-equipped to anticipate these changes and mitigate them before they cause any damage.

What exactly does the Piggyvest Cybersecurity team do?

The Cybersecurity team’s responsibilities are broad, covering everything from proactive prevention to rapid incident response.

On any given day, their duties include managing the company’s overall approach to fraud risk, proactively monitoring transactions for suspicious activity, and even stress-testing new and existing products to identify potential loopholes bad actors could exploit.

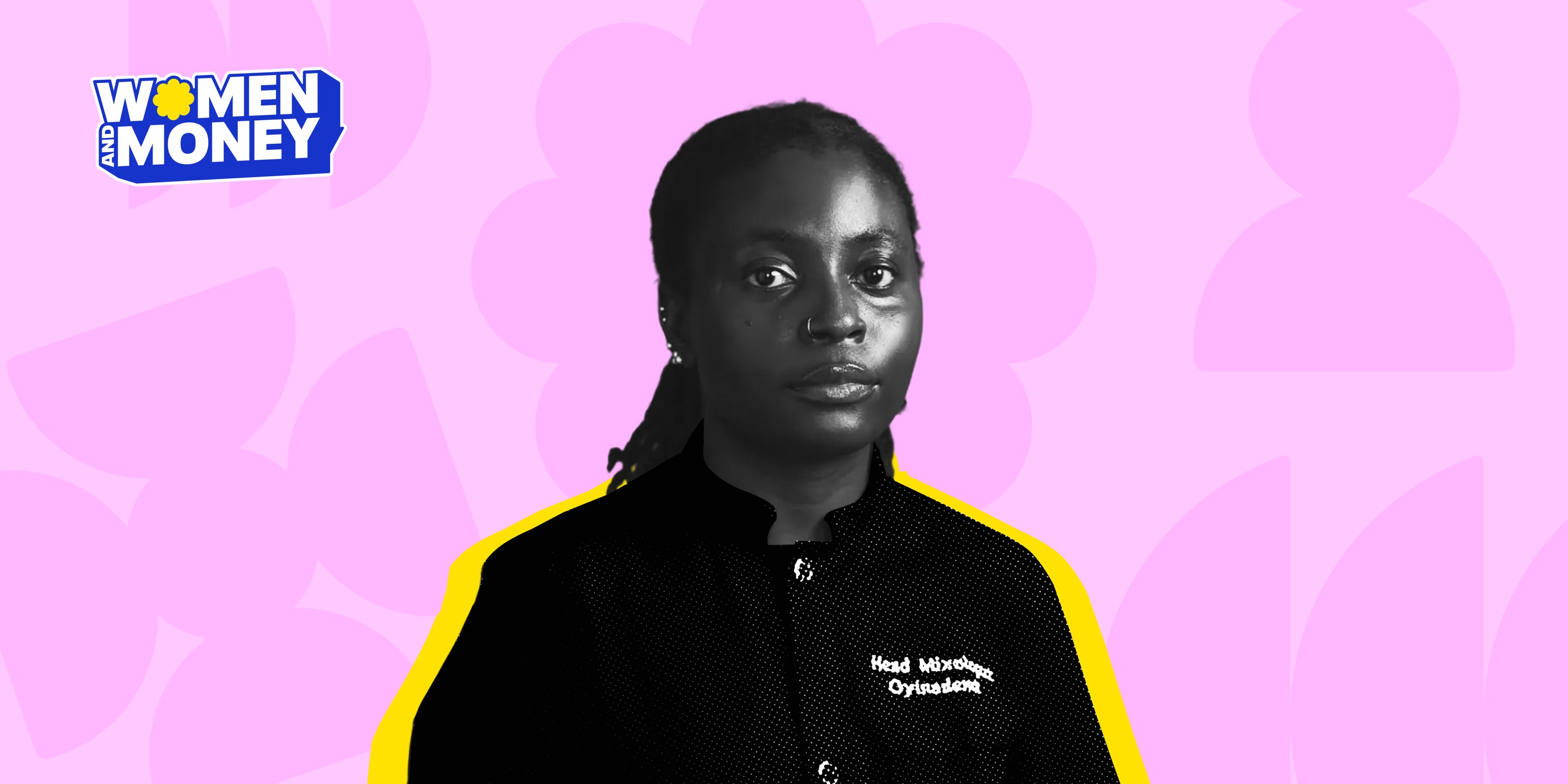

Women & Money: Adesope “Oyinademii” Ademola Is Hustling Her Way To A Cocktail Empire

When an incident occurs, they are the first responders.

They handle case escalations from customers and other financial institutions, support fund recovery efforts, act as the official interface with other banks, respond to inquiries from law enforcement agencies, and ensure outcomes are clearly communicated back to affected users.

They perform these duties while constantly analysing and building defences against sophisticated global trends.

For instance, the team studies cases like the recent incident in Asia where a financier was duped out of $25 million by scammers using AI-powered deepfake technology to impersonate a company executive in a video call. This is the high-stakes environment in which they operate. It’s why the security protocols required from users are not static — they are a living, breathing response to this dynamic battlefield.

How to Fully Recover from a Financial Setback in Nigeria

The first wall: Why your Piggyvest onboarding is deliberately rigorous

The first and most critical line of defence is the point of entry. The team’s philosophy is that preventing a threat is infinitely better than responding to one that’s already inside. This is why the onboarding process at Piggyvest is intentionally meticulous.

“We want to be sure that we’re bringing into our environment customers that are indeed genuine,” Ojumola emphasises.

This is the principle behind using your Bank Verification Number (BVN) as the “source of truth”. Mandated by the Central Bank of Nigeria, this 11-digit number ensures your identity is consistent and verifiable across the entire Nigerian financial landscape. While it may seem like an extra step, it’s a powerful barrier that makes it significantly harder for fraudulent identities to gain a foothold and easier for them to track and reverse fraudulent activity

Inside the command centre at Piggyvest: The art and science of monitoring

Once a user is on Piggyvest, the team’s daily vigilance kicks in. Their command centre is a proprietary, in-house platform, and their work is a blend of data science and keen human intuition, and it’s far more than just flagging large transactions.

Ademiju Fakoya details the granular level of their analysis:

How To Stop Gambling: 8 Practical Tips For Regaining Control And Saving Money

- Behavioural anomaly detection: “If somebody has been doing maybe ₦5,000 transactions before now and the person suddenly starts doing ₦10 million… what has happened?” she explains. Behavioural deviations are a classic red flag.

- Multi-factor analysis: They scrutinise a combination of factors, including transaction frequency, the timing of the activity, and the volume and value being moved.

- The human element of discretion: This is where expertise trumps automation. “We might see something that, to the very average eye, might not necessarily be a big deal,” Fakoya adds. “But when you investigate, that something doesn’t seem right here… This could actually potentially be fraud”.

This human intuition is a critical, non-negotiable part of the process. It’s a skill they specifically hire for: people who are “proactive in thinking” and have a “keen attention to detail.”

The investigation protocol: When red flags rise at Piggyvest

When the system flags an account, the team follows a strict protocol rooted in a core principle: investigation over accusation. “You don’t look at customers and automatically determine that a customer is fraudulent,” Ojumola explains. “And that’s where the place of investigation comes in.”

Hence, the team’s process for investigating and fixing fraud is methodical and fair:

- Direct engagement: The team reaches out to the customer to ask for context. “Can you explain these transactions?”

- A call for evidence: The user is asked to provide documentation or other evidence to support their explanation.

- Informed decision: The team analyses the evidence against their own data to make a final call.

This process is crucial because fraud often preys on human psychology. Ojumola recalls a case where a user who received fraudulent funds genuinely “thought that it was answered prayers”. This is the complex reality they navigate.

For those found to be engaging in fraud, the consequences are severe. The team works to recover the funds, the business relationship is terminated, and the user’s BVN can be submitted to be “watch-listed”, effectively flagging them across the entire Nigerian financial ecosystem.

Your role: You are our most critical ally in the fight against fraud

The recurring theme from the team is that the strongest defence is a partnership. An aware and cautious user is the ultimate security feature.

Here is the Fraud and Investigation Team’s direct advice on how to be their most effective ally:

- Stop sharing so much — online and offline. “People share too much online,” Ojumola warns. Every piece of personal data you share on social media can be collected and weaponised. Be especially wary of viral trends that ask for personal details.

- Contact Piggyvest only via official verified channels. Fraudsters now buy verified Nigerian WhatsApp numbers on Telegram black markets, so even display pictures and usernames can’t be trusted blindly.

- Beware of the public forum trap. When you encounter an issue, avoid posting your account details in a public forum, such as Twitter. Fraudsters monitor these threads, create fake support profiles, and reach out to “help” you, tricking you into compromising your account. Always use official support channels.

- Vary your passwords. Using the same password everywhere is a massive risk. “Your password should not be the same on all platforms,” Fakoya advises.

- Report suspicious activities immediately. Time is everything when your financial health is concerned. If you see something, say something — instantly. “Money moves very, very quickly,” Fakoya stresses. The speed of your report directly impacts the team’s ability to trace and recover funds. As Ojumola confirms, prompt reporting has often led to “100% recoveries”.

You can learn more about the actions you can take by reading our article on the ways to keep your Piggyvest account safe.

Your money is safe with Piggyvest

Your financial safety isn’t just a job for the Fraud and Investigation team; it’s a mission. Their unseen, tireless work allows you to save and invest with confidence, regardless of how you use your Piggyvest account.