Financial abuse in relationships is often used as a tool to keep victims of domestic abuse trapped in abusive situations. Unfortunately, it usually goes undetected because, unlike other more conspicuous and violent forms of abuse (physical and verbal), the victims of financial abuse often realise too late or not at all.

Victims must be able to identify the warning signs of financial abuse, as it may aid their survival. A few telltale signs include unexplained changes to your standard of living, selling off your prized possessions, being forced to resign from your job and constant heated money arguments.

This article discusses financial abuse in romantic relationships. It unmasks the effects, forms and symptoms of financial abuse, as well as offers valuable tips for victims of financial abuse trying to find their way out of an abusive relationship.

What is Financial Abuse?

Financial abuse is the systematic financial deprivation of a romantic partner or family member, and research indicates it is present in 99% of domestic violence cases. It is a form of domestic violence that involves controlling a victim’s financial access or assets.

Financial abuse is most common in romantic relationships, with women being the primary victims of this kind of behaviour. But romantic relationships are not the only relationship dynamic where financial abuse can happen: people with physical or learning disabilities, the elderly, and even children can be victims of financial abuse.

Financial abuse can take on many forms:

Introducing GetIT: The Best Way To Save For What You Want

- Sabotage

A financially abusive partner will do anything to sabotage your ability to earn a living. This is a ploy to keep you financially dependent on them. Partners like these will either belittle your career choices, be highly critical and dissatisfied with any job offers you receive, pressure you to leave a job, prevent you from going to work, or harass you at your workplace until you’re fired.

- Controlling finances

In this case, your partner may control your (access to your) income or savings or feel entitled to it, limit your access to joint family resources, lie about money or make significant financial decisions without your consent, micromanage your spending and get angry when your “spend too much”, or have complete control over how you spend your hard-earned money.

- Financial exploitation

Financial exploitation is another form of financial abuse, and this manifests in many ways, the most common being identity theft. Some financially abusive partners will take out loans and other benefits using your identity. Exploitative partners will also try to control your assets or critical financial documents, forge your signature, constantly exhaust the limit on your credit cards, or empty your debit cards.

13 Warning Signs Of Financial Abuse In Relationships

Financial abuse in relationships can be subtle and go undetected for a long time. However, if you suspect that you or someone you know are a victim of financial abuse, here are some warning signs to look out for:

- Unauthorised transactions on your joint account.

- Forcing you to make changes to important financial documents like wills.

- Consistently “borrowing” money from you without returning it.

- Asking you to account for your spending even when the amount spent is minimal.

- Unexplained changes to your standard of living.

- Your partner demanding you prioritise their financial wants over your basic needs.

- Selling off your possessions.

- Your partner asking you to resign from your job.

- Your partner starts heated money arguments.

- Coercing you into making bad investments.

- Limited access to your friends and family.

- Refusal to contribute financially to the upkeep of your home.

- Neglect of your essential bills and expenses in the home.

Effects Of Financial Abuse

The impact of financial abuse is just as detrimental as other kinds of abuse. Having little to no financial resources can leave a victim vulnerable to all other forms of abuse. Victims of financial abuse are often also exposed to physical and verbal assault by their partners. Some experience starvation in real-time, and are deprived of other necessities essential for their wellbeing.

With bad credit, zero savings, and no work experience, it can be hard to establish independence after being in a financially abusive relationship. This fear can keep you trapped in this kind of relationship. Those who make it out may also experience difficulty getting jobs, housing or support, and often return to their abusers due to these struggles.

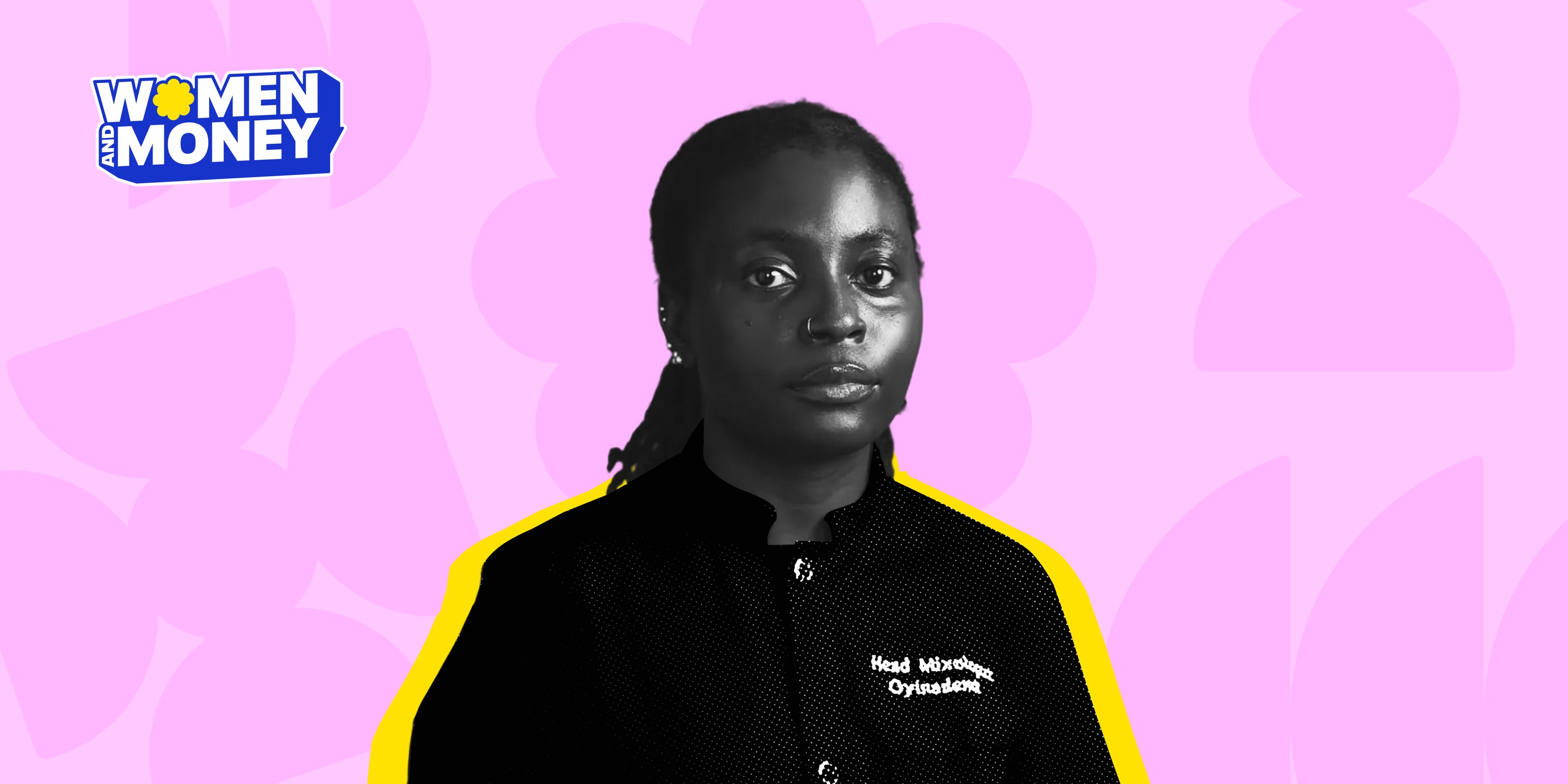

Women & Money: Adesope “Oyinademii” Ademola Is Hustling Her Way To A Cocktail Empire

How To Navigate Financial Abuse In A Relationship

Identifying financial abuse is a giant step in the right direction. But without access to clothes, food, healthcare, or money, it can be complicated for victims of financial abuse to leave their relationships.

But all hope is not lost; there are other safe steps you can take to emancipate yourself from a financially abusive situation.

How to Fully Recover from a Financial Setback in Nigeria

- Protect your critical financial information

You must understand how your finances work. No matter what, ensure you have access to your passwords and access codes. If you realise your partner or guardian has been accessing your money or accounts without your say-so, then change your passcodes or contact your financial institution to place restrictions on your account.

- Trust your gut

Financial abuse isn’t always obvious, but you may have this nagging feeling that something is off. But remember, if it looks, waddles and quacks like a duck, it’s most likely a duck. Listen to your gut about these things, and if you see any warning signs, start making plans to protect yourself.

- Create a financial safety net

Every adult must have an emergency fund and personal savings account in their name. If you find yourself in a financially abusive relationship, consider building a financial safety net with the help of a reliable savings platform like PiggyVest. PiggyVest has multiple savings and investment features to help you save for a rainy day.

- Gather proof

If you can, document instances of abuse. As part of your exit plan, keep transaction alerts and documents, take photos, timelines, and anything else that could prove financial abuse. This will paint a clear picture of the abuse for you and your support system and make things easier if you decide to take legal steps.

- Buff up your financial knowledge

Financial literacy may be the most empowering thing for victims of financial abuse. Read money blogs and books, or enrol for courses that teach you how to manage your personal finances better. You can subscribe to the PiggyVest Money Matters newsletter and Ask Odun, Piggyvest’s co-founder and COO, any money questions you may have.

- Get support

Isolation is one of the tools of abuse, so this is no time to cower in shame or fear. If you can, contact loved ones you trust and tell them about your situation. You can also contact domestic violence agencies like Lagos DVSA or the Nigerian Ministry Of Justice to make a report.