Blessing Tarfa Mam was inspired to start her business because she worked in education and realised learning in NIgeria was too strict and formalised. Her solution to this was Play.Ed, an innovative way of introducing play into the educational curriculum.

PiggyVest spoke to Blessing to learn about her fascinating startup and how children can find playful ways to learn about money.

Hi Blessing, please introduce yourself and your business.

Hi, my name is Blessing Tarfa Mam, and I am the founder and Creative Director at Play.Ed Limited. Play.Ed is concerned with changing the way education and learning are presented to children, curating experiences and resources that foster learning through purposeful play. We make flashcards, sell books, organise events and consult for establishments that are concerned with the holistic development of children.

How did you get into education?

After graduating university with my Biochemistry degree, I had a 7-month waiting period because my uni did not send our names to be mobilised for NYSC in time. I did not want to stay at home, so I applied for a few jobs. I thought to start at hospitals and laboratories, but those ones wanted free labour considering I “do not have a medical laboratory degree and biochemistry is not a professional course.”

I then applied to a school, and they made me do a mock teaching interview and a written interview. I remember being asked to derive the Almighty Formula, and thankfully, I could do that in my sleep. I was hired as an assistant class teacher in year 1, which was February 2016. By September of the same year, I was promoted to the position of Class Teacher in Year 4, already with an award for ‘Best Teacher at creating Teaching Aids.’

When I was finally called up for NYSC in November of the same year, I realised I did not want to leave my learners barely two months into being their teacher; I was in love with my job, and I was in love with the children. I was initially posted to Kano, but I decided to be posted back to Abuja and to the same school. I have worked in the sector ever since.

In 2017, I got promoted to Sectional Head, which is Vice Principal. This encouraged me to be more professional, so I enrolled for a Post Graduate Diploma in Education. I am now a teacher in every sense, from experience to educational qualification.

At what point did you decide you wanted to build a business around your passion for education?

One of the challenges parents and even teachers had during the 2020 pandemic lockdown was meaningfully engaging their children with creative activities outside of screen time. I wanted to use my experience creating teaching aids and projects to make learning toolkits that would help families facilitate learning independently.

The concept came together in June 2021, during a conversation with my best friend. But creating these kits and sourcing the materials to use was going to take some time, so I thought about creating place-holder products: Affirmation Cards, Number Flashcards and Alphabet Flashcards. I also decided to put some children’s books up for sale.

Education as a business is a no-brainer, but not many people see it that way. How were you able to convince people to pay for the service Play.Ed offers?

In 2016, shortly after I got my job teaching, my aunt thought it would be great if I took on the task of teaching my 4-year-old cousin to read. I remember creating something I called “sound pockets,” which was a sheet that had cards of each of the phonetic sounds in little pockets. That is my first creation, and I toyed with the idea of actually taking it into production as a teaching aid. Everyone was able to witness my process of teaching my cousin, and she never stopped talking about how well I taught her.

No better critic than a child; definitely a convincing customer review. I also received awards and commendations at every speech and prize-giving day since I started teaching, giving me an extra layer of validation. By 2018, I had friends already encouraging me to start my own school. I consider it a great trust to care for children and I talk about it any opportunity I get. By the time I started Play.Ed, it felt like there were a legion of people already waiting to patronise the business.

Did you worry that people would see your business as a distraction from your work as an educator?

No, I did not. In fact, having Play.Ed has kept me grounded in my passion for education. I started it as a pet project, an extension of what I enjoy outside my 9 – 5. I work in the development sector as a programmes officer, and I have done so much research consulting on education in conflict-affected regions. I am a Safe Schools Expert, and I develop tools for the domestication of the National Policy for Safety, Secure and Violence-Free Schools in Nigeria.

I gather evidence of what is wrong with securing education, and I make recommendations for what needs to be done to improve it holistically, from the curriculum and the infrastructure to the capacity of teachers. My 9 – 5 exposes me to the grim nature of the sector — that even with data-driven research and evidence, interventions are not working as they should.

Angel Anosike, on The True Cost of Nollywood Glamour

Play.Ed is the sliver of hope for me. It is my small-scale version of what is achievable in creating an educational system that prioritises the needs of children. Play.Ed is how I implement the lessons I have learned as an educator and make them accessible to every child.

How did you get your first customer?

I have been collecting books since 2018 for a children’s library, and during the lockdown in 2020, I loaned some of my books to my god-nephew, whom I was teaching to read. His mother eventually asked me to help her source some books for his library. That was my first sale for Play.Ed.

In 2021, the Deputy Director of my alma mater, AUN Academy, reached out to me to curate books for their annual speech and prize-giving day. My high school shaped my love for reading and also influenced my own method of using play for learning, so getting my first contract from them felt validating. I had a lot of fun selecting the books; thinking of each child and what would be a suitable recommendation for them.

We have been supplying books to them since 2021, and this year, we are working with them to revamp their elementary school library.

Have there been any challenges in building your business over the years, especially financial ones?

Challenges! First of all, parents are already sending children to traditional schools where they spend so much money, and the children spend so much time there. They return home laden with school homework, which is important for their grades. To invest in another learning venture, even though it’s very different from what children have in school, is not always easy for parents.

Our solution was to curate themed events to drive the objective of Play.Ed. Just one day for children to have this unforgettable experience and to also display our products. The events cost a lot of money and we are yet to charge a fee to cover the expenses.

The first events were to show parents the value of what they pay for, and we have gotten people really invested and convinced about the importance of what we do. The events last a whole day, from 10 am to 5 pm, during which we have two thematic activities, two book readings, serve children a full meal and snacks, and present them with goody bags that are curated to promote independent practice.

Habib Olawale Is Making Self-Expression Profitable with Smileys

At the end of Play.Ed events, I had parents comment, “That fee was too little for the value that you gave to us.” That is what we want to hear. In the next few months, we will be drafting a new financial plan that definitely puts Play.Ed where it charges exactly what the events and products are worth.

It’s very hard for small businesses, especially in a field like education to attract grants and funding. Have you experienced similar challenges?

Yes, I think making people part with money is not an easy feat. So, we have had to be creative with how we source for support that is not necessarily monetary. We leverage partnerships and other forms of resources that Play.Ed uses.

In 2022, I was a participant at the Accord Literary Retreat in Ghana. There, I shared with Sarah Odedina, a publisher, the work I am doing, and she donated some books to the Play.Ed library. These books have been great additions, and I have not seen any of them in the Nigerian bookstores I patronise.

We also appreciate people spending time with us, too. That’s what we did with our event “I Can Do Hard Things”, where the author of our book of focus, Monsurah Alli-Oluwafuyi, was present. She read one of her books to us and donated some resources for the day’s activities as well.

How do you plan and budget for your business, especially with how crazy inflation has been in the last two years?

Experiential events are important to our growth, but they are very expensive, and we are still at the stage where we can’t really charge full price for that specific service. We have had to work creatively to break even on the last two events Play.Ed hosted in May and December 2023, even though we charged a registration fee for all participants.

For now, we are observing how the cost of living stabilises and assessing the placement of Play.Ed on the hierarchy of needs for our target audiences, while we make a few changes to our structure.

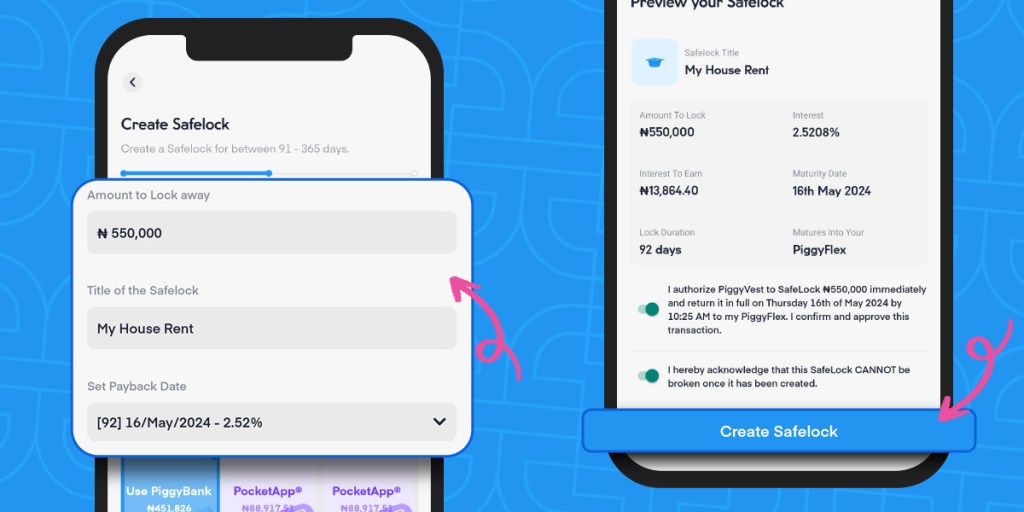

PiggyVest’s Safelock was very useful last year in helping us get upfront returns on our savings and we were able to funnel the interest earned towards improving our social media engagement and logistics for getting new partners and investors.

Lateef Salvador Is Financing His Future With Photography

Would you consider that as your biggest win as an entrepreneur?

A few things happened recently that made me feel quite accomplished. First was a new event partnership with Art Life @ The GreenHouse, where we host our Play.Ed events. Also, being able to collaborate with NGOs in our field and pay our vendors is also a big win for us!

Most heartwarming, I received a cold email application to join Play.Ed as a volunteer Social Media Manager. Everyone is working so hard to make money, so for someone who is a professional in their own right to want to volunteer because they believe in the importance of the work that Play.Ed does is a huge boost to our confidence. We now have a designated Social Media Manager who is our only volunteer on a steady allowance.

We are really excited to have started paying people and we will be working hard to continue. Can’t introduce people to a vibe we can’t maintain.

Do you have a preferred method of saving?

Play.Ed is very diverse, and we are keeping separate savings accounts for the different services we offer. Our book sales make us the most money, but we do it on a contract basis these days. We put 20% of the profit in our Flex Naira account for Play.Ed running cost. We do this for our paid partnerships, too. Each arm of the business contributes to running the business.

We aren’t doing any major projects until April and then we have our peak periods for book supplies during the summer holiday period. We have the remaining Play.Ed revenue locked in Safelock in anticipation of those periods.

Are there any lessons you have learned from your work as an entrepreneur that have improved your relationship with money?

When you start building a business and become responsible for the payment of other people’s services, it really changes your relationship with money. My initial Flashcard designs were all done on Canva. After a year, I phased out those designs and hired an illustrator to make the designs for the new and improved products so that we have something more patented to us. We own all our designs. The more I think about paying for other people’s services to improve the standard of our products, the more disciplined I am.

Do you have a long-term savings/investment strategy for growing Play.Ed into a bigger, more financially resilient business?

I haven’t figured it all out yet; I’m learning on the job. This is why Economics should be a compulsory subject in school. I chose fine arts over economics in high school. That has served me because creativity is the driver for Play.Ed, but a solid understanding of money is essential for success as an entrepreneur.

Are there any financial decisions you have made as a small business owner that you are very proud of?

The first was a loan of ₦200,000 I took in 2022. It was a step towards solidifying what I really thought Play.Ed was capable of achieving. The loan made me more invested in the finances of Play.Ed, and it was my first real attempt at making a sturdy budget and action plan for the business. We paid off the loan with a little to spare to continue running the business for a while.

I paid ₦80,000 to be CAC certified in January 2023. Educational enterprises have to be registered as companies and not businesses, so Play.Ed is officially Play.Ed limited. As a company, we are eligible to source for contracts and are in a better position to actually source for funding. I consider that paper an investment.

Outsourcing social media management is also a step in the right direction. It is not a one-man team any more.

Were there any financial mistakes you made at the beginning of your journey that you wish you could correct now?

Yes! I used the same account as my personal account, and I still do not have an accurate grasp of how much profit or loss Play.Ed has incurred since its creation in 2021. Not very good. I know we aren’t broke at least, but having a number to really evaluate growth would have been great.

What financial tips would you like to share with other young founders who want to build a financially sustainable business?

If you want people to trust that you are the person to provide a service, you should know how best to collate and present the evidence that proves you are capable and invest accordingly.

Not all the profit is for you to spend, so you need to plan your business in a way that it can pay you a salary or stipend.

Have separate accounts for your business spending account, your personal spending account, and your business savings account. If you borrow from your business or vice versa, make sure you pay back and keep track of everything. Do not fret if you do not make a profit at first, but try not to incur losses often.