Wouldn’t it be nice to clock out of the grind permanently? And even better, to do this long before the statutory age of retirement so you are still agile enough to explore your passions? Early retirement in Nigeria sounds like a highly unrealistic and pointless goal for the average person, but it isn’t impossible.

You can take intentional steps to retire on your own terms if you start to plan financially for it today. Making not-so-pleasant changes to your lifestyle — budgeting, making frugal choices, exploring multiple income streams, and taking saving and investing seriously — are some ways to achieve early retirement in Nigeria.

Keep reading for insights to help you turn this dream into reality. This article will discuss the importance of retirement planning, the realities of retiring early in Nigeria, and practical steps to take to achieve this goal.

What Is Retirement Planning?

Retirement refers to the point in a person’s life when they permanently leave traditional paid employment or active public service. In Nigeria, the statutory age for retirement for federal civil servants is 60 years of age, or 35 years in service, whichever comes first.

Retirement planning involves determining how much you will need to live comfortably in retirement and then plotting a savings and investment plan to achieve this goal. A retirement plan is a roadmap to financial stability even after you have left the workforce. But many people don’t start planning for retirement until they’re alarmingly close to retirement age, which is risky business.

Is Early Retirement Attainable In Nigeria?

The short answer is yes. However, the sacrifices and efforts you make today will determine how early you can hang up your boots. Early retirement is ideal because you’re still full of vigour to pursue your passions and interests, travel, and spend enough time with your family and friends.

61-year-old Mrs Akanimo*, is an excellent example of Nigerians who have had the privilege of retiring early. The Lagos resident retired after her first daughter had a baby in 2013 because she wanted to go for omugwo in the United States and also stay a while. “At that time,” she recounted, “I was working as the operations manager of one of the top banks, but I was just doing it for the sake of it. My husband had lots of real estate investments in Lagos, so it didn’t matter whether I worked or not. After he died three years ago, I became in charge of most of the estate, so I’m a full-time landlady now. And my children also take care of me.”

Some Nigerians are forced to retire early for other reasons like their health. Mr Badmus* had to quit working in 2005 because his health started to decline, and his doctor warned him to slow down as working was putting his life at risk. This was hard to digest, as he was just 53 years old and had many active years ahead of him.

Women & Money: Adesope “Oyinademii” Ademola Is Hustling Her Way To A Cocktail Empire

Reluctantly, he decided to take some time off, leaving his wife as the sole provider for the family. “She was happy to do it as long as I was healthy and alive. It wasn’t even up to 6 months that my daughter came to say she had gotten admission in the UK and she needed our support. I had to sell my car and one of my lands to get the money.”

But this sacrifice paid off, as he told PiggyVest. “The moment my daughter arrived in the UK, she started hustling and attending school. It was not easy for her, but she found a way to send money back home for my drugs and our upkeep. She made us proud o. Little by little, things got better. My wife liked her job, so she only stopped teaching about eight years ago. One by one, all our four children have now migrated to the UK. I’m happy they went there and became something of themselves. Now we travel occasionally to visit them, and we live a modest life in Nigeria.”

Like Mr Badmus, most Nigerians would rather stay employed until their bodies give out on them or the system forces them out. According to the 2023 PiggyVest Savings Report, only 22% of people are actively saving for retirement. Pervasive multidimensional poverty already makes it hard to make ends meet in real-time, so it’s no wonder early retirement is not a priority for a good majority. Why bother about something that is still decades away?

But time flies. One moment, you’re a young, budding talent climbing the career ladder; the next, you’re four years away from retirement with very little savings. 90% of senior Nigerian citizens (60 and above) live with irregular or no pension support. Don’t freak out about these figures. If early retirement is your goal, you can achieve this if you start planning today.

How to Fully Recover from a Financial Setback in Nigeria

6 Steps To Achieve Early Retirement In Nigeria

Having an employer-sponsored pension plan — a retirement savings account where employers and employees deposit a certain percentage of the employee’s salary monthly, to be accessed post-retirement — is the average Nigerian retiree’s dream. Unfortunately, only about 10 million of Nigeria’s 80 million labour force have pension accounts, leaving about 87% of the workforce without any financial cushion post-retirement.

If you’re a part of this overwhelming majority, don’t fret; early retirement is still possible. There are other measures to ensure financial security well into retirement. Here are a few:

1. Come up with a plan

Retirement planning is a type of financial planning in which you figure out how much you’ll need to retire comfortably. This can be tricky, as some experts believe you need 65% to 80% of your annual pre-retirement income. Others believe having ten years’ income saved up is enough to retire. There’s also the 4% rule, which states you can only withdraw 4% of your retirement fund annually.

In truth, the amount of money you’ll need in retirement depends on the kind of lifestyle you plan to live. So, decide for yourself what this will look like, and you can decipher how much you must set aside each month to reach this goal.

How To Stop Gambling: 8 Practical Tips For Regaining Control And Saving Money

2. Diversify your income streams

Increasing your earning power can help you reach your savings goals faster. If you can, seek other income streams. Working multiple jobs, freelancing, monetising your hobbies, or earning a passive income from leasing your property (buildings like shop spaces or homes or vehicles like buses or tricycles) are some of the ways to make more money.

3. Live modestly

Budgeting is important if you want to retire early. Aim to account for every naira you own and live below your means so you can have more money to set aside. Eat more home-cooked meals, don’t spend a fortune on rent, avoid impulsive buying, and be wary of the trap of black tax.

4. Start saving diligently

A budget helps you know how much you can afford to put towards your saving goals. And PiggyVest has different savings wallets that can help you reach all these goals. For instance, you can set aside emergency funds using Flex Naira, so that no expenses catch you unawares and derail you.

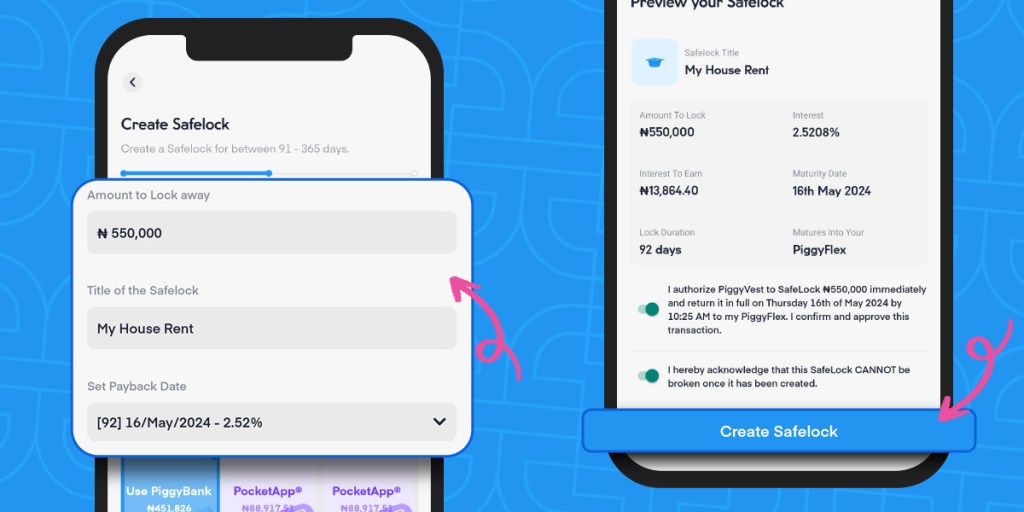

Target Savings are a goal-oriented savings wallet that helps you save for your unique saving goals over a desired period, while earning up to 11% per annum. A personalised fixed savings wallet like Safelock is also great for long-term saving goals like retirement. You can lock up these funds and earn upfront interest of 8% to 15% per annum.

5. Explore investment opportunities

Many investment options are available to Nigerians, but before investing, ensure you do due diligence or consult a financial advisor to learn more about that opportunity. You can subscribe to the PiggyVest Money Matters newsletter and Ask Odun, Piggyvest’s co-founder and COO, all your pressing money questions.

PiggyVest’s Investify is a great place to start if you’re new to investing. With vetted investments going for as low as ₦5000 and up to 35% returns per annum, what’s a better way to get started?

6. Get health coverage

Find out what affordable healthcare options exist and invest in a health insurance plan with great coverage. With your medical emergencies or hospital visits taken care of, you can focus on saving for your retirement goals.