NYSC allawee isn’t a lot — everyone knows that. But what if you could make it work for you and still enjoy your service year? With the right strategy, even a modest ₦77k allawee can go a long way. This article contains seven simple (but invaluable) tips that you can use to get on track financially — whether you’re a freshly deployed corper or a veteran in the field.

Some actionable ways to achieve your financial goals as a corper include planning wisely, automating savings, and making smarter spending decisions. You can also reduce your expenses, explore alternative sources of income and embrace cheap thrills to ensure you hit your goals during your service year.

Adopting these tips probably won’t make you a millionaire, but they’ll ensure your money lasts and works for you—regardless of where you’re serving your fatherland. Let’s begin!

1. Define your financial goals using Target

The first step to achieving financial stability is to define what you want to accomplish. Yes, we’re saying you need to set goals. However, you need to set goals that work for you.

Ask yourself questions like these:

- Do I want to save for rent after NYSC?

- How much should I set aside for relocation?

- Am I interested in investing during or after NYSC?

- Should I build an emergency fund in case of unexpected expenses?

But don’t just write down your goals — take action as soon as you know what you want by using Piggyvest Target savings. With Targets, you can create a specific savings goal and track your progress while earning up to 12% per annum.

For example, saving ₦8,500 monthly can help you build a ₦100,000 emergency fund by the end of your service year (with interest, of course!).

2. Master your budget to maximise your allawee

A structured budget helps you manage your limited income wisely. But here’s the thing: your budget will depend on your state of deployment and your lifestyle (among many other factors). So, how can you create a budget? Try the 50/30/20 rule!

Here’s a simple NYSC budget breakdown using the 50/30/20 rule:

How To Set Financial Goals For A New Year: 7 Tips To Save Better In 2026

- Allocate 50% to your needs (₦16,500). Use this for stuff like rent, food and transport.

- Put down 30% towards your wants (₦9,900). This can be used for social outings and even entertainment.

- Allocate 20% to your savings (₦6,600). Your emergency fund or investment can come from here.

Note that this is just a template. We recommend that you create a budget that fits your goals, even if that means spending more on your needs than on the other items we mentioned.

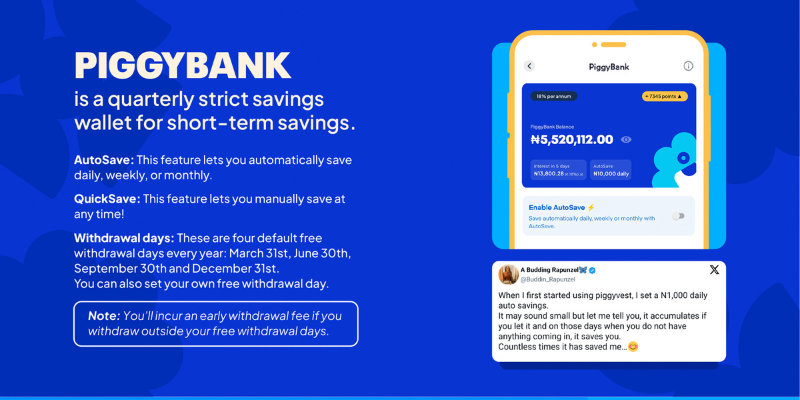

3. Automate your savings with PiggyBank to stay consistent

Another timeless strategy is to automate your savings. After all, the best way to save is to do it automatically. Instead of relying on willpower, use the PiggyBank Autosave feature on Piggyvest to transfer money to your savings before you spend.

For example, you can set PiggyBank to automatically save your funds a day after allawee comes in (say, the 28th of every month).

Besides being a great way to build discipline, PiggyBank also offers 18% annual interest on your savings — ensuring your money works for you while you serve your country.

4. Trim your expenses and avoid money drains

NYSC can be tough, but cutting out wasteful expenses can make things easier for you. That means you need to identify areas where you can cut back.

Here are a few ways to cut expenses during NYSC:

- Limit transportation costs by using cheaper alternatives like public transport or carpooling.

- Reduce data expenses by using WiFi whenever possible (especially if you work in an office that has one).

- Cancel unnecessary subscriptions that eat into your budget.

- Use your NHIA HMO instead of paying for health insurance out of pocket.

We also recommend using Safelock to lock away funds for a fixed period if you have bulk cash or a windfall.

This strategy prevents impulse spending and ensures that your savings remain untouched until you actually need them. Plus, depending on how long you lock your funds, you can earn up to 22% upfront interest.

How To Handle Black Tax: A 9-Step Guide to Setting Financial Boundaries

5. Find affordable housing so you can spend and save more

Accommodation can be one of your biggest expenses during NYSC, but there are many ways to reduce costs.

Here are some strategies for reducing rent during your service year:

How To Make Money During NYSC: 14 Side Hustles For Corpers

- Stay in an NYSC lodge if available.

- Share an apartment with fellow corps members.

- Live with family (if possible) and redirect your rent budget into savings.

If you plan to rent after NYSC, start saving towards it now using HouseMoney™ on Piggyvest. This rent-focused wallet allows you to save while earning up to 14% per annum.

6. Cook at home and embrace cheap thrills

As we noted in the Piggyvest Savings Report 2024, food is one of the biggest expenses in Nigeria. Therefore, it’s no surprise that eating out during your service year can quickly drain your funds.

Fortunately, you can save money by:

- Cooking at home instead of buying food daily.

- Planning meals in advance to avoid overspending on groceries.

- Pooling funds with friends when shopping so you can buy in bulk and split groceries.

- Exploring affordable entertainment options like free events, movie nights at home, or hanging out in public spaces.

However, being frugal doesn’t mean you have to miss out on the fun parts of NYSC. So, have fun — just do it wisely!

7. Start building your emergency fund

Life is unpredictable, and unexpected expenses can arise. Having an emergency fund ensures you’re financially prepared.

Use Piggyvest’s Flex Naira to set aside some money each month for emergencies while earning up to 12% interest per year. We recommend having 3 to 6 months of living expenses in your emergency fund, and you can use your service year to start contributing towards the fund.

Don’t worry — you don’t need to complete the fund before NYSC ends. Even saving ₦1,000 per month is a start.

What next?

You shouldn’t wait until NYSC is over to start securing your future. While ₦77,000 might not be a lot of money, it can be a great foundation to build a financially secure future. Remember: even small savings and consistent budgeting practices can change the course of your life for good.

So, don’t wait — secure your future today! Open a Piggyvest account, set up your first savings Target, and take control of your finances. You’ve got this!

The articles on the Piggyvest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.