The pros of self-employment are endless: the thrill of creative freedom, the flexibility of work hours, the potential for unlimited earnings, and the ability to set your own pace. However, one significant drawback of being your own boss is fluctuating income.

Financial planning with fluctuating income can feel like walking a tightrope. But with the right strategies, managing your finances as a freelancer, self-employed artisan, gig worker, or small business owner can be a breeze.

Your Guide To Disposable Income: Budgeting, Spending and Saving Smart in Nigeria

Are you struggling to budget with fluctuating income? This article contains practical and proven strategies for navigating unstable income in Nigeria.

How To Earn ₦90,000 Passive Income Monthly

Why is it hard to budget with fluctuating income?

Budgeting with a steady income feels like driving down a path you frequently travel; it’s familiar and reliable. Predictable income provides a level of comfort, and many financial planning frameworks also support this kind of income pattern.

On a fluctuating income, however, it’s the exact opposite. Your income ebbs and flows with every paycheck. Each month comes with fresh challenges and a new path you must navigate without getting lost. What’s worse? All traditional budgeting methods don’t quite cut it. This can be ridiculously anxiety-inducing to manage in Nigeria, where our purchasing power is constantly losing the battle against soaring inflation.

Building Wealth in Your 20s: Practical Money-Saving Strategies for Young Nigerians

Here are some challenges people with fluctuating income might relate to:

- Financial uncertainty: The greatest obstacle to creating a budget when your income fluctuates is the deep-rooted uncertainty. Not knowing when your next paycheck will come can lead to financial anxiety and make it impossible to plan long-term.

- Emotional stress: Financial unpredictability can feel like an emotional rollercoaster. Low-income months can feel like the pits — stressful, with a lingering sense of scarcity. High-income months, on the other hand, make you feel invincible. You run the risk of overspending like a baller, due to a false sense of security.

- Difficulty saving large sums: In Nigeria, we often purchase items in cash, in bulk and upfront. Saving for large expenses, like rent and school fees, can feel more complex and require a greater level of discipline when grappling with unstable income.

- Difficulty prioritising: High-income months can cause a surge in non-essential expenses and impulsive purchases, but when your income dips, it can be hard to cut back effectively. You’re left feeling stranded and unable to meet up with your responsibilities.

These challenges show why it is all too important to master budgeting, even with irregular income. You must figure out ways to take control of your finances to achieve financial stability and peace of mind.

7 common budgeting mistakes you’ve probably been making

You can still make mistakes even with the best of intentions. Here are some commonly overlooked budgeting mistakes people with fluctuating income often make:

1. Reactive budgeting:

Stop waiting until you get paid before you figure out what to do with your income. This only leads to impulsive spending and a failure to prioritise essential expenses. Learn how to budget the right way and make adjustments as you go.

2. Not tracking your spending:

If you don’t know where your money goes each month, how can you effectively budget or identify areas where you need to cut back? Tracking every expense, big or small, is crucial when budgeting with unstable income.

3. Not having emergency funds:

Fluctuating income makes having an emergency fund even more necessary. Life is full of surprises, and unexpected expenses can quickly derail your finances if you don’t have a buffer.

4. Not sticking to your budget:

Creating a budget is one thing, but adhering to it is another. Windfalls or not, good months or bad, try your best to stick to your budget. Consistency is key, even when your income fluctuates.

5. Only planning month to month:

Peak months are not the norm. Planning only month-to-month without considering longer-term expenses and income fluctuations will leave you unprepared for downtimes.

6. Neglecting irregular expenses:

Overlooking distant expenses, like rent and school fees, while crafting your monthly budget is a bad idea. Expenses that don’t occur every month, like annual fees or quarterly bills, can easily be forgotten and throw off your course when they resurface.

7. Taking quick loans:

Quick loans are the enemy of your budget. The interest rates of these loan apps are frankly ridiculous, and fees can quickly compound. This will make it harder for you to get back on track, especially with fluctuating income.

Strategies for budgeting with fluctuating income

Despite inflation and the state of the Nigerian economy, it’s still possible to create a stable and effective budget with fluctuating income. Here are some smart strategies to help you:

Figure out your average monthly income

Track your income for several months (at least 3-6 months) and calculate the average. This will give you a more realistic picture of your income than just looking at your highest or lowest-earning months.

Pay yourself a “salary”

The next step is to pay yourself a stipulated “salary”, based on your average monthly income. Even if you earn more in a particular month, stick to your allocated amount and save the rest.

Have a minimum monthly expense

This is also known as bare-bones budgeting. Identify your essential expenses, such as rent, utilities, groceries, healthcare, etc., and create a minimum budget that covers these necessities. This is the best way to ensure the lights stay on during low-income months.

Make a realistic budget

An unrealistic budget is too much of an inconvenience. Don’t create an overly restrictive budget that you can’t stick to; it defeats the purpose of budgeting. You can still factor in some flexibility when budgeting with unstable income by allocating funds for both needs and wants.

Quick savings

Setting aside a portion of your income, especially during high-earning months, helps you prepare for expected expenses. Depending on your preference, Target Savings and Piggybank are great options for saving for short-term goals and building financial discipline. All of this while earning great interest.

Percentages over fixed amounts

Instead of allocating fixed amounts to budget categories, use percentages to allocate funds. This way, your spending adjusts automatically with your income. The 50/30/20 rule provides an excellent template: 50% of your income goes to your needs, 30% to wants, and 20% to your savings.

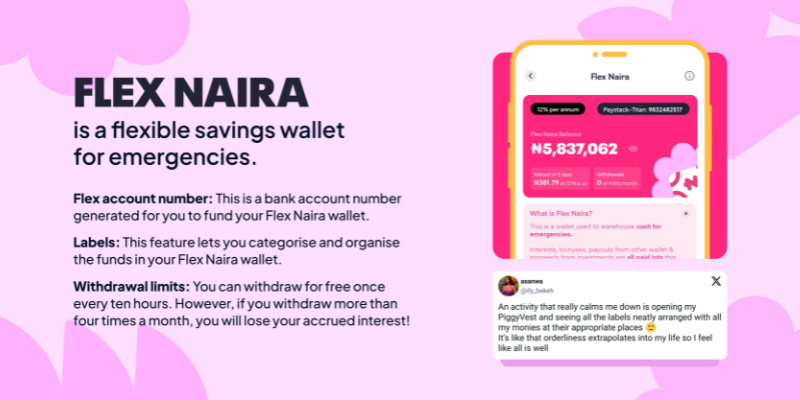

Have an emergency fund

An emergency fund is a non-negotiable when attempting to budget with fluctuating income. Aim to save at least 3-6 months’ worth of your minimum monthly expenses in an easily accessible account like Piggyvest’s Flex Naira. This way, you have a financial cushion when unexpected expenses occur.

The bottom line

Budgeting with fluctuating income is harder, but it is definitely possible. By knowing your monthly income, paying yourself a salary, and building an emergency fund, you can establish a solid baseline that enables you to create a solid financial plan that isn’t unnecessarily restrictive.