Have you ever had to recover from a financial setback? In a harsh economic climate like Nigeria, money can disappear quickly. A sudden job loss, a failed investment, medical bills, or a failed business can destabilise not just your finances, but also your mental and emotional well-being.

If you’re here because you’re currently navigating this kind of challenge, remember to go easy on yourself. You’re not alone, and more importantly, you can recover from this. To fully recover from a financial setback, you will need to combine emotional regulation with steady financial steps. Smart budgeting, cost-cutting, savings and goal setting can help you rebuild.

We wrote this article to show you how to fully recover from a financial setback in nine practical steps. Remember to break this process into small and intentional phases; focus on taking one effective step at a time.

1. Acknowledge the Setback Without Shame

Financial hardships happen to the best of us. That paralysing shame you’re feeling about your financial decline is unnecessary. So be kind to yourself.

Data from the Nigerian Bureau of Statistics reveals that a staggering 63% of Nigerians are multidimensionally poor. Rising inflation and subsidy removal are among the top contributors to the financial crisis in Nigeria. The struggle is not in your head; it’s real, and it is a systemic issue, not a personal one.

Instead of beating yourself up, focus on the next steps that will help you recover from a financial setback. Shame will only hinder your recovery. Identify the problem, chart a course, and begin your healing journey.

2. Do An Honest Financial Audit

Before embarking on any journey of financial recovery, it’s crucial to understand your current financial position. Navigating this season without this foundational knowledge can feel like driving through a thick fog.

Here are some things you can do to assess your financial situation:

- List all sources of recurring income: This includes your primary salary, any freelance work, passive income (dividends, interest, royalties), and even irregular earnings.

- Track your fixed and variable expenses: Meticulously review your bank statements, cash expenses and receipts for the past one to three months, to identify patterns in your spending and highlight any areas where you might be overspending.

- Identify any outstanding debts: Due to structural issues in the Nigerian credit and lending systems, many Nigerians turn to high-interest loans. If this is you, organise your debts in a spreadsheet, noting amounts, interest rates, and due dates. This will enable you to make more accurate financial projections.

- Spot leakages: Identify all the subscriptions you don’t use and frivolous lifestyle habits you can pause. These seemingly minor expenses can add up. The goal here is to be honest with yourself about where your money is actually going versus where you intend for it to go.

3. Adapt Your Budget For Your New Reality

A comprehensive budget is a life hack that works. Budgeting with clarity is one of the most effective ways to recover from a financial setback without feeling stressed.

If you don’t have one and are too overwhelmed to start, begin with two broad categories — “needs” and “others”. Now, based on your financial audit, define your essential expenses or needs. Ideally, these should include:

Women & Money: Adesope “Oyinademii” Ademola Is Hustling Her Way To A Cocktail Empire

- Food

- Shelter

- Utilities

- Transportation

- Basic healthcare

- Essential clothing

- Minimum debt payments.

Put a stop to any non-essential expenses like dining out, multiple streaming subscriptions, premium data, and entertainment, at least for now.

4. Manage Your Debt Strategically

Debt can feel even more overwhelming when your income is reduced or gone completely. However, there are some proactive ways to manage your debt if you’re gently trying to recover from a financial setback in Nigeria.

Here are some smart steps to take:

- List debts from smallest to largest and prioritise paying off those with the highest interest rates first.

- Add a repayment plan to your budget. Make debt payments a mandatory part of your budget to ensure you pay at least the minimum amount on time.

- Avoid borrowing to repay other debts. Avoid the cycle of debt by not taking out new loans to pay off existing ones, unless it’s a significantly better deal.

- Try negotiating with creditors. Some Nigerian lenders are open to restructuring payments, pausing or reducing interest, or extending your terms. You will never know until you ask.

5. Use Financial Tools

One of the tougher parts of navigating a financial crisis is fatigue that stems from constantly worrying about money. You track every naira meticulously and are still left feeling hopeless. This constant pressure can be demotivating, erode your optimism, and discourage you from trying.

One way to ease your worry is by using readily available financial tools. Financial tools aren’t just for number crunching; they’re a crucial ally when you’re trying to recover from a financial setback. Budgeting templates, spreadsheets, expense trackers, savings and rent calculators; these easy-to-use financial tools can help you with the maths that keeps you up at night.

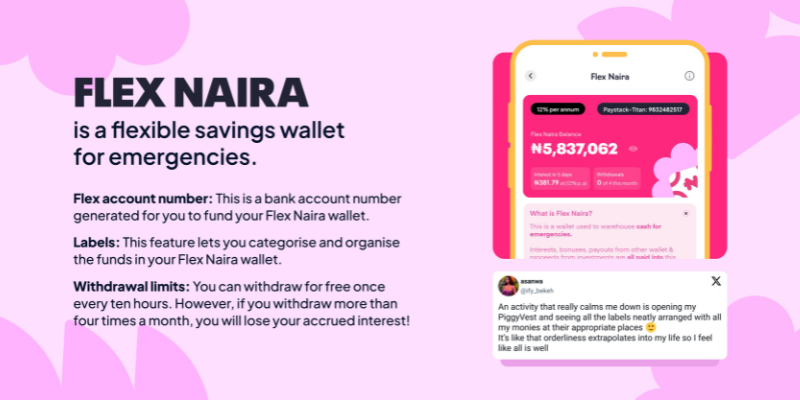

Piggyvest is also an excellent savings tool for building financial discipline and a safety net. You can set daily, weekly, and monthly Autosaves and earn up to 18% per annum on your savings. But if it’s discipline you’re struggling with, use Safelock to lock those funds until a stipulated time.

How To Stop Gambling: 8 Practical Tips For Regaining Control And Saving Money

Flex Naira is another wallet that allows you to save for emergencies. With a neat feature like Labels, you can allocate money to different bills. You can also use PocketApp to send and withdraw funds from your Piggyvest seamlessly, making it convenient to track your expenses. These tools are not here to stifle you, but to give you structure amidst the turbulence.

6. Build an Emergency Fund

We know it’s hard to save money in Nigeria. But having an emergency fund is one of the best ways to handle unexpected expenses. While navigating a financial setback, it can be tempting to wait until things are “better” before saving, but even a small amount like ₦500 makes a difference. The key is to start now, no matter how little you can spare.

- Set a realistic savings goal. Start with small amounts to build a savings habit, and you can increase it over time as your income grows and your financial stress eases.

- Adhere to your budget. Creating a thorough budget allows you to monitor your income and expenses. Having a financial roadmap to guide you can provide clarity on your daily spending and alleviate persistent financial worries..

- Cut down exorbitant expenses. Reduce unnecessary expenses, and redirect the money you save into your emergency fund.

- Automate your savings. Set up a recurring transfer to your Piggybank so you’re saving consistently without having to think about it.

- Replenish after withdrawals. Whenever you use money from your emergency fund, be sure to pay it back to avoid depleting your savings.

- Assess and adjust. Regularly review your budget and savings goals, adjusting as needed to match your current expenses or ability to save more.

7. Seek Avenues to Earn More and Spend Less

Enjoying life on a budget in Nigeria doesn’t mean you have to sacrifice fun. There are many ways to stretch your cash, and a combination of cutting costs and increasing income is often the best way to go.

When it comes to spending less, you can start by cancelling or downgrading subscriptions, batch-cooking your meals, eating a packed lunch, and even bulk buying.

Your Guide To Disposable Income: Budgeting, Spending and Saving Smart in Nigeria

To boost your income, consider offering your skills as a freelancer on platforms like Upwork or Fiverr. You can also monetise a skill you already have, whether it’s baking, sewing, tutoring, or copywriting. You can explore other side hustle options, like signing up for ride-hailing platforms and selling digital products.

8. Build Emotional Resilience

Money and emotions are deeply linked, and financial stress can take a toll on your mental health. If you’re working to recover from a financial setback, building mental and emotional resilience is just as essential as all the other strategies we’ve shared.

If you’re recovering from a financial setback, ensure that you:

- Talk to someone. Confide in somebody. It could be a trusted friend, a close-knit community or group, a mentor or even a financial expert.

- Avoid comparisons. Don’t worry about what others are doing. Everyone’s journey is different, and our financial timelines vary widely. Nobody knows your story but you.

- Celebrate tiny wins. Just paid off ₦20,000 from your debt? Or did you save ₦5,000 this month? Applaud yourself for those milestones. That’s progress.

9. Set Realistic Goals

Big goals are great, but they can feel impossible to reach. So, instead of trying to save ₦10,000 once a month, you can choose to save ₦500 daily. Focus on paying off one small debt first, before tackling the others. Track your expenses and stay within budget for a day, and repeat this process every day for a week.

The thing about small, realistic goals is that they are easily achievable, a huge confidence boost, and yield significant results over time.

Final Notes:

It’s easy to feel like you’re behind because others seem to be thriving. But remember that learning how to fully recover from a financial setback is a gradual process that requires patience, self-compassion and strategic planning/execution.

Don’t be afraid to ask for help or use financial tools that make the journey easier. Budgets, trackers, saving plans and tools like Piggyvest aren’t meant to deprive you of simple joys; they’re there to help you build discipline and financial stability. And with time, intention and the right tools, you can not only recover from a financial setback, but also create a stronger, more resilient financial future.