In our article on taxes, we explained that they’re compulsory fees that serve as a significant source of revenue for a nation’s operations — allowing governments to distribute wealth and stimulate the economy. But have you ever heard of a tax refund?

A tax refund is an amount of money a government returns to an individual or a business when they pay more than their required tax liability (the amount they’re legally supposed to pay as taxes for a year). In other words, it’s a repayment of excess tax that you have paid.

In this article, we’ll show you how tax refunds work and answer any questions you might have about the subject. But first, let’s answer the most important question: Does Nigeria do tax refunds?

Does Nigeria do tax refunds?

Nigeria does tax refunds. In fact, the Federal Inland Revenue Service (FIRS), the agency responsible for administering taxation in the country, has an act that stipulates that refunds can be made to taxpayers for overpayment of tax.

This act is the Federal Inland Revenue Service Establishment Act, 2007 (or FIRSEA, if you like acronyms) and highlights that Nigerians are eligible for tax refunds after the agency has conducted a proper audit.

However, other tax laws — like the Companies Income Tax Act (or CITA) — also make provision for tax refunds, subject to the taxpayer meeting specific conditions. In the case of CITA, businesses can request a repayment of overpaid taxes and get a refund from the FIRS within 90 days.

How do tax refunds work in Nigeria?

As you can see, tax refunds are 100% legal and backed by law in Nigeria. So, suppose you’ve overpaid your taxes or are eligible for certain tax credits. In that case, you can claim a refund by filling out a tax refund application form and providing the necessary documentation to support your claim.

After you submit this form, the relevant tax body — the FIRS or State Internal Revenue Service (SIRS) — will review the claim and decide whether you’re eligible for a refund. If you are, you’ll get a credit or direct deposit into your bank account for the amount owed.

It’s a pretty straightforward affair, in theory. However, obtaining a tax refund in Nigeria can sometimes be complex and time-consuming. Therefore, refunds are not as common here as in other countries, like Europe and North America.

But remember: it is possible to get a refund. We advise keeping detailed records of your income, expenses and tax payments to ensure a smooth refund process.

What Is The Difference Between Tax Evasion And Tax Avoidance?

Why do people get tax refunds in Nigeria?

You can’t request a tax refund if you’re not eligible. Fortunately, Nigerian tax laws give a breakdown of what counts as tax refund eligibility.

Here are the most common reasons an individual or business might be eligible for a tax refund in Nigeria:

- If they make tax remittances with mistaken Tax Identification numbers (TIN).

- When there’s an overpayment of taxes due to errors in withholding or estimated tax payments.

- When input VAT exceeds output VAT.

- When there are computation or payment errors.

- If tax credits or other deductions reduce the amount of tax owed.

- When the government provides companies with refundable tax incentives for specific purposes.

Taxpayers may also receive tax refunds in Nigeria if there are changes in tax laws or regulations that retroactively affect their tax liability. These changes can result in the Nigerian government owing taxpayers a refund if they have already paid taxes based on the previous laws or rates.

As a Nigerian, you must stay informed about any updates to tax laws to ensure you’re taking advantage of all available refunds and credits.

What do you need for a tax refund?

Before we explore the exact process of filing a tax refund in Nigeria, let’s dive into the documentation requirements.

You’ll need the following to file for a tax refund in Nigeria:

How To Set Financial Goals For A New Year: 7 Tips To Save Better In 2026

- A completed tax refund form like the FIRS Refund Application Form.

- Evidence of overpaid taxes or eligibility for tax credits.

- Supporting documents such as pay slips, bank statements or receipts.

The tax agency may ask for more documents to support your claim, so it’s essential to keep accurate records and provide all required documents when due.

Beyond that, the FIRS may also conduct thorough reviews of your documents (and refund claims) to verify their accuracy and legitimacy. They do this to prevent fraudulent refund requests and ensure that taxpayers receive the correct amount they’re entitled to.

How to file a tax refund in Nigeria

You must be a taxpayer to file a tax refund in Nigeria. To ensure Nigerians understand what happens behind the scenes, the FIRS has a tax refund mechanism detailing the agency’s process to refund taxpayers’ money. In this section, we’ll focus on the steps you need to take to effect this refund.

Here’s how to file a tax refund in Nigeria:

How to Fully Recover from a Financial Setback in Nigeria

- Confirm you’re eligible for a refund by checking if you overpaid your taxes or consulting a financial advisor.

- Complete the relevant tax refund form and include all necessary details — including your correct TIN and tax liability.

- Gather all supporting documents, like bank statements and receipts.

- Submit your completed tax refund form and supporting documents to the FIRS or whichever tax agency is involved.

- Wait for the FIRS to review your claim and process your refund.

The review process may take some time, so patience is important. Once approved, the government will issue your refund as a direct deposit into your bank account.

4 tips for getting a faster tax refund in Nigeria

Waiting is probably the most stressful part of a tax refund process. However, there are several things you can do to expedite the refund process and reduce future troubles.

Here are four tips for getting a faster tax refund in Nigeria:

- File your tax refunds early to avoid any delays caused by last-minute filings.

- Ensure that all the information on your tax refund form is accurate and up to date.

- Submit all the required supporting documents along with your tax refund form.

- Follow up with the Federal Inland Revenue Service to check the status of your refund and provide any additional information if requested.

By following these tips, you can increase your chances of receiving your tax refund on time.

What can you do with your tax refund?

A tax refund isn’t free money, but it sure can feel like it. If you’re one of the lucky few that receives a repayment, we recommend putting this windfall to good use. Thankfully, we have a few ideas.

Below are some excellent use cases for your tax refund when you receive it:

- You can use it to pay off debt.

- You can save the money in your PiggyVest Safelock wallet and get up to 12.5% annual interest, paid upfront.

- You can invest the money in safe, low-to-medium risk, primary and secondary investment opportunities on Investify and earn up to 35% yearly interest.

- You can save towards your financial goals (maybe a vacation or that new car) using PiggyVest’s Target Savings feature and get up to 9% interest annually.

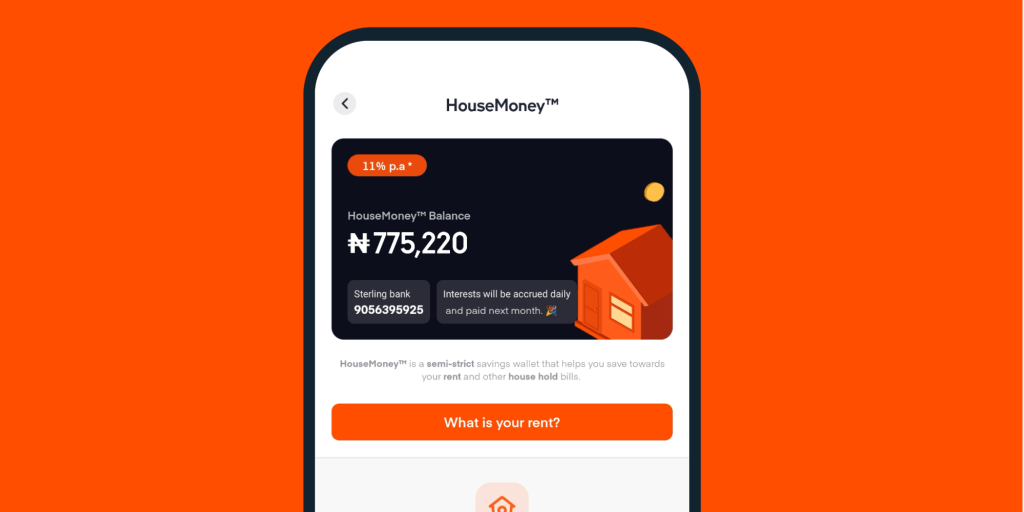

- You can contribute towards your house rent using the new PiggyVest feature, HouseMoney™, which allows you to enjoy 11% yearly interest.

- You can buy some dollars on Flex Naira to preserve the value of your money and get up to 7% interest annually.

You can also treat yourself to something special — like a truckload of suya. The choice is yours. Still, it’s essential to consider your financial priorities and make a decision that aligns with your long-term goals.

Summary

You can access tax refunds as a Nigerian if you’re eligible and file for it. While the review process might be lengthy, a tax refund can provide you with somewhat “free” money you can use for yourself or your business.

The articles on the PiggyVest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.