Shows like Netflix’s Ozark and movies like The Accountant are fictionalised explorations of how (among other things) big, bad criminal masterminds use money laundering to “clean” their illicit funds and grow their businesses. While these stories usually include quick explainers or some kind of illustrated breakdown, money laundering in practice can be somewhat confusing, even for victims of financial crimes and finance bros.

So, what is money laundering exactly?

Money laundering is the process of making illegitimate funds appear legal by disguising their true origin. It’s a serious offence, and many countries consider it illegal because it facilitates criminal activities and undermines the integrity of their financial system.

In this article, we’ll tell you all you need to know about money laundering — from how it works to what it means for you and your finances. Then, we’ll show you how we secure your PiggyVest account against all forms of fraud to ensure your funds are always safe. Let’s go!

How does money laundering work?

Money laundering might be illegal, but it requires much work and a high level of expertise. In fact, to successfully launder money in any country, you’ll need the services of a financial professional — typically an accountant. Regardless of the amount involved, your accountant must go through three stages to clean your illicit cash.

The three stages of money laundering are:

- Placement

- Layering

- Integration

Each stage serves a specific purpose in disguising the illicit origins of funds and making them appear legitimate. Explaining these three stages might be confusing, so we’ll illustrate with a fictional character, “Ifeoluwa.”

Let’s assume Ifeoluwa is a “businessman” who has recently acquired some funds (say, ₦500,000,000,000) through less-than-legal means (Ifeoluwa is a drug dealer!). He wants his business to keep booming, so he has decided to avoid any action that might incur the attention of law enforcement agencies — including tax evasion.

Of course, he still wants to spend his money on cool stuff like the Tesla Cybertruck.

Unfortunately, there’s one small problem. Spending this money might draw the attention of financial agencies like the Federal Inland Revenue Service (FIRS) or the Economic and Financial Crimes Commission (EFCC). After all, he can’t pay taxes on drug trafficking (that’s illegal!).

Plus, it’d be suspicious if he just buys a super-expensive car out of nowhere. What will he tell his neighbours he does for work?

So, his only option (besides pivoting to a legitimate career) is to launder his money.

How would that work?

1. Placement

Ifeoluwa’s accountant must start by physically placing or depositing the illegally obtained cash into financial institutions or businesses without attracting suspicion. This first step is the placement stage of money laundering and is sometimes referred to as the “mixing” stage since the aim is to “mix” illegitimate funds with legal ones.

In this stage, his accountant must minimise detection and suspicion by law enforcement authorities and financial institutions.

They can use any of the following techniques during the placement stage of money laundering:

- Structure deposits: This technique involves breaking down huge sums of cash (say, ₦300,000,000) into smaller amounts to avoid triggering reporting requirements by financial institutions. For example, they can deposit ₦500,000 every weekend into a legal bank account instead of, say, ₦100,000,000 all at once.

- Smuggle the cash: Transporting cash across borders or through various channels to deposit into foreign or offshore bank accounts is another excellent method. Launderers typically use this technique when dealing with foreign currencies like the United States Dollar (USD).

- Use cash-intensive businesses: Casinos, hotels, restaurants and retail stores are some of the most popular ways to combine illicit cash with legitimate revenues.

- Recruit money mules: Ifeoluwa can also recruit individuals to deposit cash on behalf of his organisation. Of course, they’ll need to use false identities or shell companies — to safeguard themselves and protect Ifeoluwa’s illegal business.

The placement stage is critical as one wrong move means Ifeoluwa’s operation is compromised.

2. Layering

Next comes layering — an attempt to obscure the trail of illicit funds by creating complex layers of financial transactions. For this stage to work, Ifeoluwa’s accountant must move the placed funds electronically and begin a series of transfers and transactions across multiple accounts, jurisdictions and financial instruments.

The point of this stage is to create a web of transactions and financial complexities that make it difficult for law enforcement authorities and financial institutions to trace the illicit funds back to their criminal origins — or any origins, really.

What Is Anti-Money Laundering (AML)? How Compliance Protects Your Piggyvest Funds

This stage is where Ifeoluwa’s accountant will prove his expertise, as layering requires a deep understanding of financial systems.

The techniques used during the layering stage may include:

- Wire transfers: This involves moving funds electronically between domestic and international bank accounts to conceal their origin and destination.

- Offshore accounts: They may transfer funds to offshore jurisdictions with strict banking secrecy laws to create additional layers of anonymity.

- Shell companies: This technique involves establishing shell companies or front companies to disguise the true ownership of assets and facilitate complex financial transactions.

- Investment vehicles: They may invest the illicit funds in stocks, real estate and other assets to further obfuscate their origins and integrate them into the legitimate economy.

Think of layering as the “disappearing phase” of money laundering since the placed funds “disappear” into the financial system so no one can discover their origins.

3. Integration

The final stage is integration, where the accountant reintroduces the laundered funds into the economy as seemingly legitimate assets or investments. During this stage, the accountant integrates Ifeoluwa’s funds into the financial system to conceal their illicit origins and allow them to enjoy the proceeds of his criminal activities without raising suspicion.

Here are a few ways they could integrate the money:

- Investing in legitimate businesses: They could acquire or invest in legitimate businesses, real estate ventures or other income-generating assets.

- Purchase of luxury assets: Ifeoluwa could buy luxury goods such as high-end real estate, vehicles, jewellery or artwork to store value or demonstrate wealth.

- Loan repayment: He could repay loans or debts to legitimise the source of the money and avoid scrutiny from financial institutions.

- Financial transactions: This technique involves conducting legitimate financial transactions — like opening bank accounts, obtaining loans or engaging in investment activities.

Finally, it’s done. Ifeoluwa’s dirty money has gone through many stages, but he can finally spend his funds as he deems fit — without worrying about getting arrested. It’s time to order his Tesla.

In reality, the three stages of money laundering are interconnected, and it might be hard for an untrained eye to understand if any crime is happening. That’s why law enforcement authorities and financial institutions usually have entire departments and professionals dedicated to identifying money laundering and developing strategies to investigate and prevent laundering activities effectively.

Why do people launder money?

Money laundering is bad, that’s for sure. But why do people do it? Why can’t they just spend the money small, small to avoid the scrutiny of law enforcement agencies?

People launder money for the following reasons:

How to Fully Recover from a Financial Setback in Nigeria

- They do it to conceal the proceeds of illegal activities like drug trafficking, fraud or corruption. By making the money appear legitimate, money launderers can enjoy their ill-gotten profits without drawing suspicion.

- Money laundering allows individuals and organisations to evade taxes and other financial regulations. Through complex transactions, launderers can obscure all information around the money they’re laundering — including the actual total amount involved — allowing for tax evasion and other financial crimes.

- Another reason why people launder money is to integrate illicit funds into the legitimate economy. Once the money has been successfully laundered, they can buy real estate, luxury goods, or businesses. This process not only helps criminals enjoy their wealth but also allows them to further invest in legal enterprises, creating a cycle of illicit financial gain.

This list isn’t exhaustive, of course. However, it highlights the primary reasons an individual or organisation might engage in laundering.

Why is money laundering so bad?

As we mentioned, money laundering poses a challenge to the integrity of the international banking system and requires constant vigilance from regulatory authorities. But why is it so bad? Surely, people deciding to move their money around cannot be dangerous, right?

The truth is that money laundering has far-reaching negative consequences for societies and economies.

Here are some of the effects of money laundering:

- It undermines the integrity of a country’s financial system by allowing illegal funds to enter and circulate undetected. Money laundering can lead to a loss of public trust in financial institutions and damage the overall stability of the economy.

- Money laundering also has detrimental effects on legitimate businesses. It creates an uneven playing field, enabling criminals to compete unfairly in the market. Legitimate businesses may suffer as they cannot compete with those with access to illicit funds.

- It can also lead to severe social consequences. Laundering enables criminal organisations to thrive — perpetuating violence, corruption and other illegal activities. The funds generated through money laundering can be used to fuel organised crime and terrorism, exacerbating the overall insecurity in society.

- Money laundering also impacts government revenue. Most money launderers evade taxation, depriving governments of crucial income for public services and infrastructure development. This loss of income can hinder a country’s ability to provide essential services like healthcare, education and social welfare programs — ultimately affecting the well-being of its citizens.

- Money laundering can also distort economic decision-making and hinder economic development. When introduced into the financial system, illegal funds can artificially inflate asset prices, create bubbles in specific sectors and distort market competition. This can lead to economic instability, reduced investor confidence, and hinder the country’s long-term growth prospects.

As you can see, money laundering isn’t a victimless crime. It can seriously impact the global economy, affect financial markets, undermine the integrity of the financial system and facilitate other criminal activities such as drug trafficking and terrorism.

Who might launder money?

If you’ve been following the gist, you should have an idea of the calibre of individuals that might engage in money laundering. Still, let’s highlight them.

The following are the categories of individuals that may launder money:

- Individuals involved in organised crime.

- Drug cartels.

- Corrupt politicians.

- Legitimate businesses acting as fronts for illicit activities.

These individuals often rely on a network of facilitators to help move their illicit funds across borders and through various accounts. Therefore, money laundering usually involves professionals like lawyers, accountants, and bankers who assist in disguising the origin of funds.

What are the signs of money laundering?

When done correctly, it might be hard for ordinary citizens to recognise that money is being laundered. Therefore, you might have interacted with businesses or individuals involved in the crime. Don’t worry. This doesn’t necessarily make you an accessory.

Some signs of money laundering include:

How To Stop Gambling: 8 Practical Tips For Regaining Control And Saving Money

- Unusually large cash deposits or withdrawals.

- Frequent transfers of funds between different accounts or countries.

- Inconsistencies in the transactions, such as round-figure amounts or unusual patterns.

- Clients who are reluctant to provide necessary identification documents or details.

If you notice any of the above, you should report your suspicions to your financial institution or the closest law enforcement agency.

What is electronic money laundering?

Electronic money laundering means using electronic or digital means to launder illicit funds. With the increasing reliance on technology and the growth of online financial transactions, criminals have found new ways to exploit digital channels for money laundering.

To launder money electronically, criminals may:

- Use virtual currencies like Bitcoin.

- Use online payment platforms and wallets.

- Exploit vulnerabilities in electronic banking systems.

Authorities and financial institutions must continuously adapt and enhance measures to combat this evolving threat since electronic money laundering typically allows criminals to move their money at scale.

What does money laundering mean for you?

Money laundering isn’t just a problem for governments and financial institutions. It can also have direct consequences for individuals. First and foremost, it undermines the overall economic stability and can lead to increased taxes or reduced public services as governments allocate resources to combat crime.

Beyond that, money laundering may also increase the prices of goods and services, as businesses incur extra costs to comply with anti-money laundering regulations and compete with businesses funded with laundered money.

And that’s not all!

Activities related to money laundering can have wider social and security repercussions that can impact communities and individuals negatively.

How can money laundering affect your personal finances?

As a regular citizen, your unwitting involvement in money laundering (say, if unsavoury individuals hack your bank account and use it to launder money) can severely impact your personal finances.

You risk losing your hard-earned funds if they’re stolen by criminals or seized by law enforcement agencies in connection with illicit activities. You can even face more serious legal consequences if your finances or business is linked to a money laundering scheme, like fines and imprisonment — even if you were unaware.

Of course, there’s also the impact it could have on your reputation. After all, the Central Bank of Nigeria (CBN) mandates you link your BVN and NIN to your accounts — whether you use a traditional bank or a reliable financial platform like Pocket by PiggyVest.

Therefore, financial institutions may view you with suspicion, making it challenging to open accounts or conduct routine transactions. This could result in inconvenience and added stress as you struggle to manage your financial affairs.

This reputational damage may also hinder future financial and professional opportunities since you’ll likely face scrutiny from regulators and business partners for a long time.

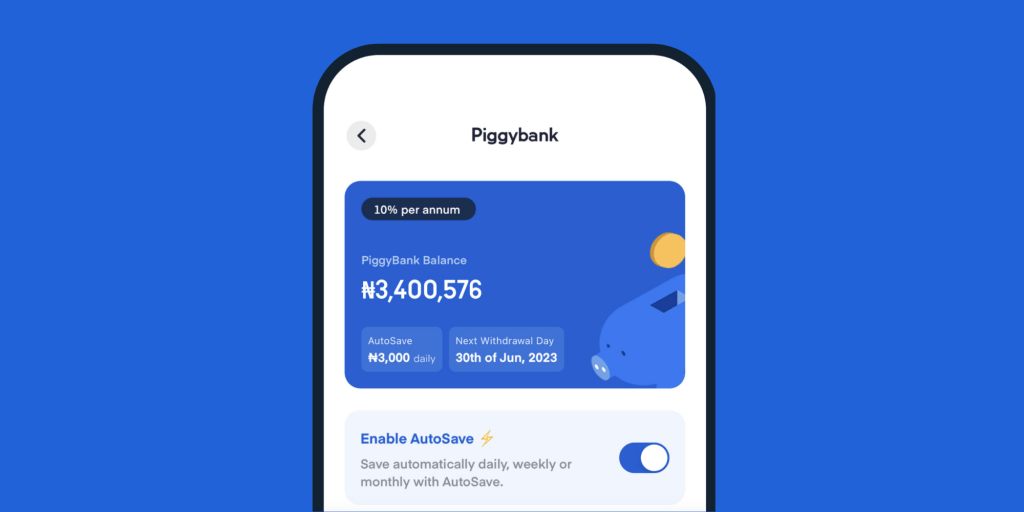

How do we protect your PiggyVest account?

PiggyVest is still the better way to save and invest money in Nigeria — allowing you to enjoy up to 35% returns on your funds. However, we understand that you might be worried about the safety and security of your funds when you download the app.

At PiggyVest, we’ve implemented various measures to safeguard your funds and protect against money laundering activities, including:

- Secure login procedures: We use strong, multi-factor authentication methods to verify your identity and prevent unauthorised access to your account.

- Transaction monitoring: Our system constantly scans for suspicious activities or transactions to identify and mitigate potential risks.

- Anti-Money Laundering (AML) compliance: We adhere to strict regulations and maintain robust internal controls to prevent illicit activities.

- Employee training: Our staff undergo regular training to stay updated on the latest trends and techniques in money laundering, ensuring we can effectively detect and prevent such activities.

Therefore, you can rest easy and focus on wealth-building when you save and invest your money with us.

Summary

Money laundering might seem fun in movies, but it’s a serious crime that can have far-reaching consequences in real life. That’s why law enforcement agencies and financial institutions like PiggyVest crack down hard on it.

In fact, at PiggyVest, we understand how dangerous all forms of fraud can be. By prioritising your security and maintaining a proactive approach to combating money laundering, we strive to provide you with a safe and trusted platform for managing your finances.