In many parts of the world, money is a leading cause of stress among adults. With the whip of inflation cracking down harshly on Nigerians, our basic needs become harder to meet, and our financial anxieties compound. Most adults will worry about money at some point in their lives, whether they are struggling financially or not. In the words of our African Giant, Damini Ogulu, even ‘Dangote still dey find money’.

However, worrying solves very little. A healthier approach to managing overwhelming financial stress is finding ways to boost your financial security by actively employing innovative financial strategies like budgeting, rent planning, emergency fund building and setting money goals, all while prioritising self-care.

Recognising the telltale signs of financial stress is the first step to turning this tide. In this piece, we will be peeling back the layers of financial stress — causes and symptoms — and sharing strategies for Nigerians trying to navigate these financially draining times.

5 Nigerians On How They Are Responding To Nigeria’s Tax Reforms

Causes of financial stress

Whether short or long-term, financial stress is a rite of passage for every adult. Here are some of the many life events that can lead you to be stressed out about money:

- Debts.

- Sudden job loss or salary cut.

- Unexpected family responsibilities like the loss of a loved one.

- Poor lifestyle habits like gambling, alcoholism and impulsive spending.

- Financial abuse.

- Medical emergencies.

- Economic factors (e.g., inflation, recession).

Some of the reasons for your financial stress might be outside your control. Even so, by acknowledging the circumstances giving rise to your stress, you can begin your journey to financial stability.

How can financial stress manifest?

No matter the cause, prolonged financial stress should be managed as its effects can burgeon into unfathomable despair. Financial stress can adversely affect your overall well-being, and being consumed by financial anxieties will make daily living harder to navigate.

Here are some signs that you may be dealing with financial stress:

How To Read And Understand The CBN’s MPC Reports

- Depression: A prolonged feeling of sadness and hopelessness about the state of your finances. It can also lead to social withdrawal.

- Substance abuse: Money problems can cause you to turn to the bottle or other harmful drugs or substances.

- Money arguments: Constantly disagreeing with your partner, roommate, parents or children about money (splitting and paying bills, wants vs needs, expenses, budgets). This can result in strained relationships among the parties involved.

- Insomnia: When the thoughts of unpaid bills and debts keep you from getting some shut-eye at night.

- Anxiety: Unease and worry about the future and your financial capability could lead to a situation where you constantly agonise about taking the smallest of decisions. Anxiety could also manifest as a fear of responding to calls, texts, or even running into friends and acquaintances.

- Physical ailments: Like other kinds of stress, financial stress can also manifest physically. Some health problems like gut and digestive issues, migraines, skin problems, high blood pressure, low energy levels and weight gain/loss, can be symptoms of financial stress.

10 strategies to help Nigerians cope with financial stress

Just because financial stress is common, doesn’t mean it’s normal. A healthy relationship with money will bring you peace of mind and a better quality of life. So, as soon as you discover symptoms of financial stress, you should do everything possible to remedy it.

These are some tips that can help:

Women & Money: Adesope “Oyinademii” Ademola Is Hustling Her Way To A Cocktail Empire

- Financial planning:

A financial plan helps you draw a line from where you are now to where you want to be, financially. By creating a financial roadmap, you can take stock of your personal finances: income, expenses, goals and the strategies to achieve them. Financial plans are useful because they give you a healthy metric by which to assess your efforts to growth and help you set realistic timelines for your goals.

- Budgeting:

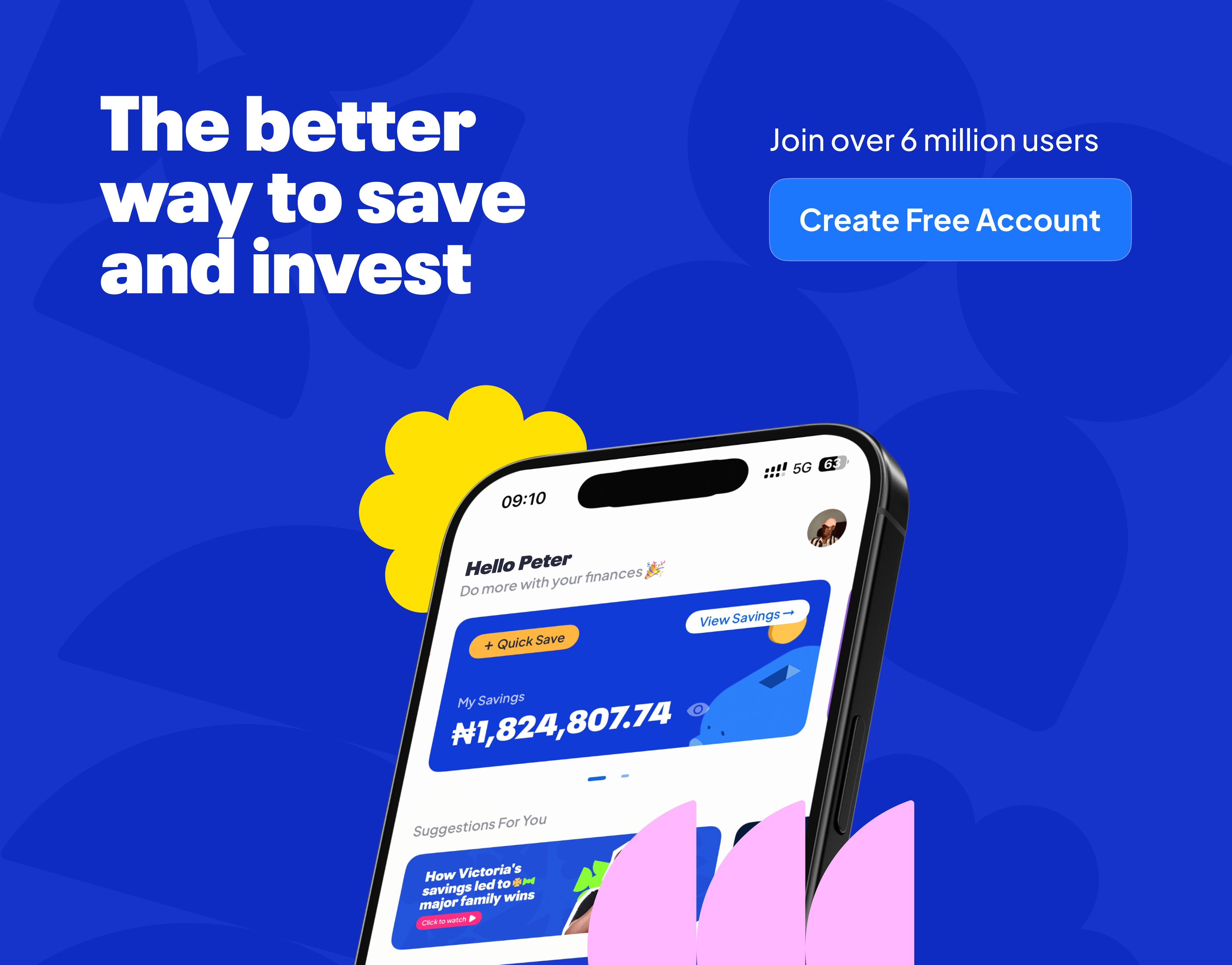

A budget is a feature of your financial plan that guides your day-to-day money decisions. Budgets can help you plan your savings, spending, and debt repayment. Note that a budget has to be realistic and reasonable, as a too-strict budget will only lead to more financial stress. You can use PiggyVest’s Labels to allocate funds for spending according to your budget to keep yourself accountable.

- Tracking your spending:

Knowing where all your money goes will help you create a solid budget and eliminate excesses. Keeping track of all your bill payments and daily expenses can be hard, but PocketApp by PiggyVest makes this easier. With PocketApp, you can pay bills, get debit cards, make super fast bank transfers, and manage your expenses in groups, too.

- Having emergency funds:

Cultivating a good saving culture will help you build a financial security net in no time; three to six months of income in a savings wallet will help ease your financial anxieties. But don’t be pressed to conjure up a portfolio in a hurry, because building an emergency fund takes time, planning and discipline. PiggyVest has many cool features, like Flex Dollar, Piggybank and Safelock, to help you save automatically and seamlessly and reach your money goals faster.

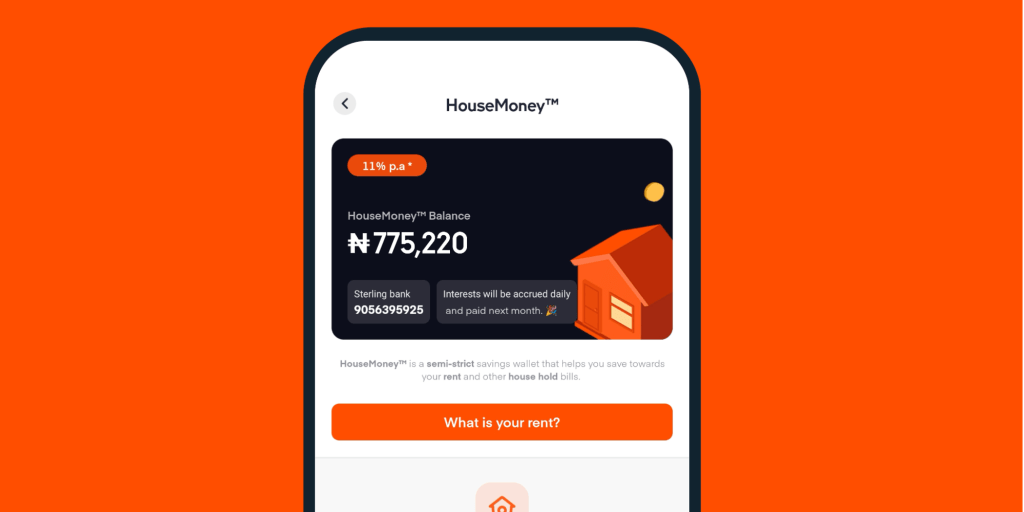

- Rent planning

Renting a home in Lagos or other parts of the country is not cheap by any means, this is why deciding on where to live can either make or break your finances. Rent planning involves deciding how much of your income should be spent on rent and then making a plan on how to pay this bill when due. You accomplish this by saving up your rent in smaller chunks every month using PiggyVest’s HouseMoney™, and earning up to 11% per annum interest while at it.

- Investing:

One of the best ways to ensure financial freedom in the future is by having an investment portfolio and making compound interest your best buddy. Whether you’re an investing newbie or a pro, our prevetted investments on Investify are simple, secure and give you up to 35% returns.

- Seeking financial support:

Do not hesitate to seek financial assistance when needed. Your ego will not pay the bills when you’re in a bind, so explore and accept any available financial support, like work benefits, salary advances, cash gifts, and zero-interest loans from loved ones.

- Stretch your budget:

Take advantage of the many incentives offered by retailers in order to get the most out of your budget. Apply smart spending principles while shopping: buy in bulk, bargain, use coupons, chase deals and discounts, and resist the urge to impulse buy. You can even make money from saving, by cashing out your upfront interest when you Safelock your funds.

- Self-care:

There’s no better time to indulge in self-care than when everything seems to be falling apart. Self-care is important for stress management as it puts you in a better physical and mental state. Some self-care activities include taking breaks from work, meditating, exercising, spending time with loved ones, and even simply taking walks. Instead of completely spiralling, you want to focus on the things you can control. Rather than coping using substances or harmful habits, pick up a hobby like reading, watching films, solving puzzles, or a fun new skill like crocheting.

- Talking to a professional:

If you can afford it, consider seeking professional help if you find yourself struggling with your mental health. A financial advisor will also review your finances to help you draw a feasible financial plan and diversify your savings and investment portfolio. If these options are inaccessible to you at the time, you can start by subscribing to PiggyVest’s Money Matters newsletter and asking PiggyVest’s COO, Odunayo Eweniyi, your finance-related questions, to get valuable financial advice.