Having an emergency fund is a critical part of your financial well-being. Life can happen anytime: a job loss, a sudden illness, a stolen phone, a fender bender, a pandemic, a sudden crisis — all of these can set you back financially.

Many Nigerians have been saved by their savings. Having cash saved will ease your panic and prevent you from accruing debt, which saves you from the shame that comes with dealing with loan apps or creditors.

However, devoting resources to building this pool of backup funds can be a challenge in an economy where 63% of Nigerians already battle daily with multidimensional poverty. Then again, even with a high bank account balance, an emergency fund will benefit you in many ways.

A rule of thumb is that your emergency fund should consist of three to six months’ worth of income. For breadwinners of large families, you could aim to have up to a year’s pay set aside. This figure can be daunting and discouraging for many, especially if your monthly income is barely enough to sustain you. But Rome wasn’t built in a day. You must shake off the pressure to build your emergency fund overnight. It’s impossible to do so. Focus on adding little drops to your pool, which will eventually create an ocean of financial security.

Here are five tips that will make the process of building an emergency fund easier:

1. Create an airtight budget

Before creating a budget, account for every naira you earn monthly. Once this is done, the next step will be to figure out your expenses — every single one. This information will help as you create your airtight budget: you can cut out excesses and figure out how much and how often you can contribute to your emergency fund.

Note that budgets will only work if you adhere to them. Also, an airtight budget does not mean unrealistic; it should also factor in miscellaneous expenses to allow you some wiggle room till your next paycheck. If you have difficulty creating a budget, the 50 30 20 rule is a great place to start.

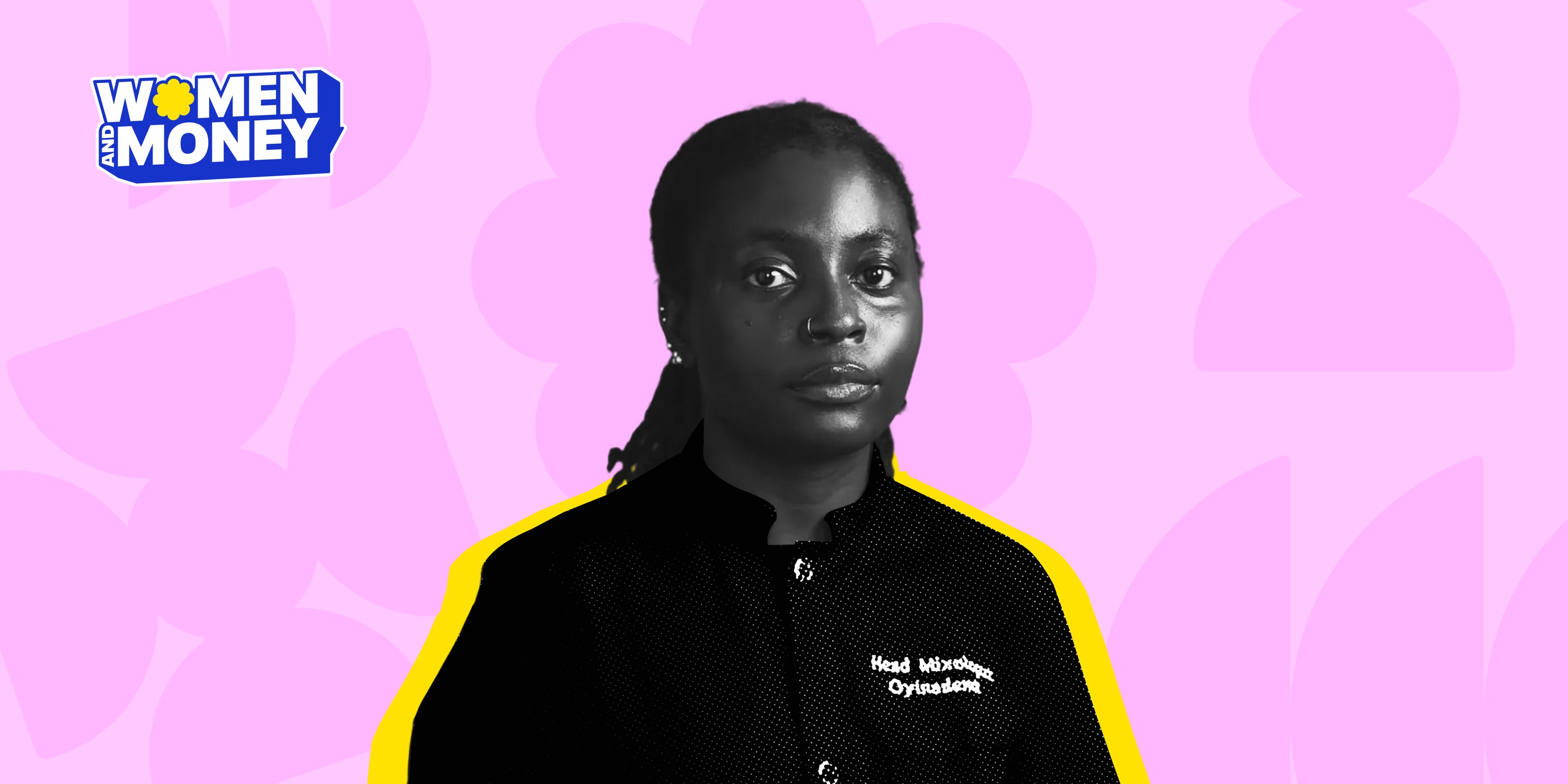

Women & Money: Adesope “Oyinademii” Ademola Is Hustling Her Way To A Cocktail Empire

Spending within budget also means that when you come into unexpected money, like gifts or bonuses, you should keep only a small percentage of it for yourself before adding the rest to your emergency fund. Think about it: You had no plans for the money and it’ll be a major boost to your savings. A win!

2. Choose your preferred PiggyVest plan

PiggyVest has made saving and investing simpler and safer for us all. With the different PiggyVest saving and low-risk investment plans, you can now get paid as you save. The different PiggyVest plans have varying levels of flexibility, depending on your goals. PiggyBank is a savings plan that lets you save automatically (daily, weekly, or monthly) when you turn on AutoSave. You can use Quick Save if you prefer to save manually. You also earn up to 10% interest per annum.

Target Savings helps you create unique saving goals, like “New Car” or “Laptop.” Your Target can be private, but you can also create a Public Target Savings, like “Vacation with the Gang.” You can invite your gang of friends and save together.

How to Fully Recover from a Financial Setback in Nigeria

If you want to keep yourself even more accountable while building your emergency fund, Safelock is the better option. You will receive your interest (of up to 12.5% annually) upfront. Your Flex naira wallet is a flexible savings wallet that holds all your interests and profits. You can also withdraw and send money into this wallet.

Whatever your saving goals are, you will find a PiggyVest plan that suits your needs. So join the millions of Nigerians using PiggyVest and start building your emergency funds today!

How To Stop Gambling: 8 Practical Tips For Regaining Control And Saving Money

3. Set small saving goals

Instead of one large, unrealistic goal, start very small. You can decide to Autosave ₦1,000 weekly if that’s all you can spare. Then, as you figure out your budget, grow your income, or come into unplanned cash, you can save more money.

4. Only withdraw during emergencies

An emergency is not that avoidable, impromptu outing you’ve been invited to over the weekend. It is not those nice shoes on that IG vendor’s page. And Detty December is certainly NOT an emergency.

Emergencies are those sudden occurrences that require your immediate attention. Medical emergencies, fixing your car or losing your income — things you need to handle to survive.

Resist the impulse to run to your PiggyVest wallets to tamper with your emergency fund at the slightest inconvenience. It defeats the purpose of having a financial safety net and shows a lack of financial discipline.

The next time you want to break your PiggyBank savings before withdrawal day, ask yourself, “Is this really an emergency?” There is a good chance it isn’t.

5. Pay yourself back

One emergency today does not cancel out the possibility of future emergencies, so you must aim to replenish your emergency fund every time you dip into it. You’re saving with a goal in mind, so make a habit of paying yourself back until you attain that milestone. When you eventually reach your goal, feel free to set a new milestone. Keep going from there.