As we’ve mentioned many, many, many times, saving money is the first step to financial freedom and the cornerstone of your financial health. But are you making your savings work hard enough for you? Probably not. Don’t worry, there’s a perfect solution: high-yield savings accounts!

High-yield savings accounts (or HYSAs) are simply savings accounts that offer higher interest rates compared to traditional savings accounts (up to 20 times in some countries). They can elevate your savings game since they offer higher rates and allow you to tap into the power of compound interest.

If you’re a young professional, a student starting your savings journey, or anyone in Nigeria looking to get more out of your savings, you need to understand how HYSAs work and get in on them ASAP! This article will break down what HYSAs are, how they function in Nigeria, their benefits and drawbacks, and how platforms like Piggyvest offer compelling high-yield options to supercharge your finances. Ready? Let’s jump in!

How do high-yield savings accounts work in Nigeria?

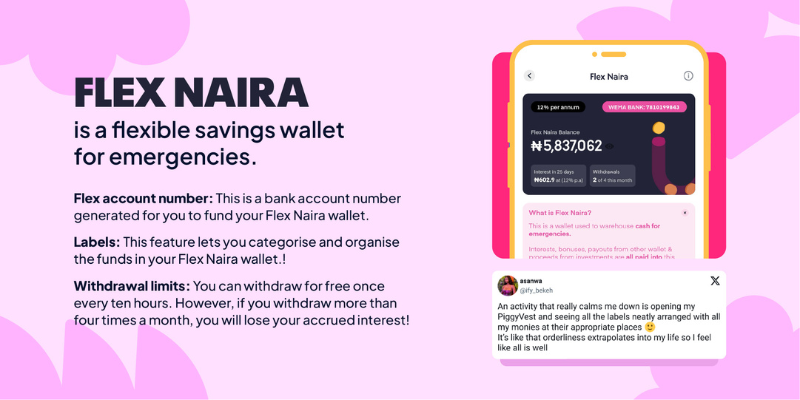

At its core, a HYSA is simply a type of savings account that offers a significantly higher interest rate compared to the national average for standard or traditional savings accounts. So, while traditional savings accounts in Nigeria might offer minimal interest (say, 8% per year), HYSAs provided by banks and financial technology (fintech) companies aim to give savers a better return (up to 12% if you use Piggyvest’s Flex Naira).

But regardless of the provider, the fundamental way HYSAs work remains the same:

- You deposit funds into the HYSA. HYSAs are easy to open, and you can even create one in less than five minutes on Piggyvest.

- The institution pays you interest at a higher rate than standard accounts typically offer. This payment typically comes monthly right into the high-yield savings account and influences your APY (annual percentage yield — the actual interest you earn on your funds after accounting for compounding).

- Your interest compounds (meaning you earn interest on your capital and interest). This then helps your money grow faster over time.

- You can withdraw your funds at any time, but with some rules. For example, you can withdraw up to four times monthly on Piggyvest’s Flex Naira before you lose your accrued interest for that month. However, some HYSAs might have other rules, like tiered interest rates and minimum operating balance.

Many platforms (including Piggyvest) provide transparency by showing daily interest accrual within their apps. Additionally, many HYSAs pay you monthly, meaning you get even more returns thanks to compound interest, even if you do not save consistently.

What separates HYSAs from traditional savings?

According to data from the Central Bank of Nigeria (CBN), the average savings deposit interest rate across banks was approximately 7.96% as of February 21, 2025 — a far cry from the 12% that you can receive with Flex Naira, Piggyvest’s version of a HYSA.

This difference often leads to the question: how come Piggyvest — as well as some banks (especially digital ones) and financial technology (fintech) companies — are able to pay higher interest rates via HYSAs?

The secret is in how institutions that offer HYSAs work, specifically the features that separate them from traditional savings.

- They enjoy lower overhead costs. Many HYSAs, particularly those from fintechs and online-only banks, don’t have the expense of maintaining extensive physical branch networks. Savings from rent, staffing, and utilities for branches can be passed on to customers as higher interest rates.

- They leverage technological efficiency. Platforms that offer HYSAs leverage technology for automation and streamlined processes. Digital account opening, automated transfers (such as Piggyvest’s Autosave), and app-based management reduce operational friction and costs compared to traditional banking systems.

- They compete for deposits: Digital banks and fintechs are often aggressively competing to attract customers and their deposits. Offering higher interest rates through HYSAs is a primary strategy to stand out and capture market share.

- They focus on innovation: Fintechs and digital banks often focus on specific niches or customer segments (like young professionals and millennials) and design products specifically for their needs (for example, mobile apps instead of websites). Some may also employ different strategies for managing the deposited funds, potentially generating higher returns that they can share with savers.

Essentially, HYSAs leverage efficiency, technology, and competitive strategy to offer savers a better return on their money compared to traditional savings routes.

Why do HYSAs exist, and who do they benefit?

HYSAs exist primarily because financial institutions (especially online banks and fintechs with lower overhead costs than traditional brick-and-mortar banks) compete for customer deposits by offering better returns.

These high-yield savings accounts benefit the following people:

What Is Diversification In Investing? Tips For Building A Lasting Portfolio In Nigeria

- Savers seeking growth: Anyone looking to grow their savings faster than inflation without taking on significant investment risk.

- Emergency fund holders: HYSAs are ideal for parking emergency funds. The money is relatively safe, accessible, and grows faster than in a basic account.

- Goal-oriented savers: Perfect for short-to-medium term goals like saving for a down payment, vacation, new car, or education.

- Young professionals and new savers: An excellent starting point for building wealth and developing saving habits.

- Risk-averse individuals: Offers growth potential without the volatility associated with stock market investments.

Do you fall into one or more of these categories? Then, you should definitely be thinking about saving in a HYSA!

Why should you open a high-yield savings account?

We’ve talked about what they are, how they work and even who they can benefit. Now it’s time to ask: “why exactly should you open a HYSA?”

Here are a few of the top reasons you should open a high-yield savings account today:

- It can help you earn more money. This is the primary advantage. Significantly higher interest rates mean your savings generate more income over time if you have sufficient capital and discipline. For example, depending on how much you save, you could earn ₦100k+ in interest each month using Piggyvest.

- They are usually pretty safe. In Nigeria, deposits in licensed institutions are protected by the Nigeria Deposit Insurance Corporation (NDIC) up to certain limits. Piggyvest uses bank-level security and hold funds with licensed partners, offering a degree of safety.

- They could (potentially) help beat inflation. While not always guaranteed, the higher rates offered by HYSAs stand a better chance of keeping pace with or even exceeding inflation compared to traditional accounts.

- They’re accessible. Your money isn’t locked away completely like in some long-term investments. You can typically access it when needed, though some restrictions might apply.

- HYSAs encourage saving. Seeing your money grow faster can be a great motivator to save more consistently.

So, are you convinced yet?

What are the limitations of a high-yield savings account?

HYSAs aren’t financial silver bullets — they can’t solve all your financial issues. Therefore, it’s important to know exactly what their limitations are.

The following are some of the limitations of HYSAs:

How To Build A ₦100,000 Emergency Fund During NYSC

- They have variable rates. Interest rates on HYSAs are often variable. This means that they can change in response to market conditions or the institution’s decisions. For example, Piggyvest increased interest rates across the board in February 2025 (allowing users to earn up to 20% yearly returns on some products) due to CBN’s Monetary Policy Rate’s (MPR) changes.

- Some HYSAs have withdrawal limits. Some accounts may limit the number of free withdrawals per month or impose fees if limits are exceeded, to encourage long-term saving.

- Most HYSAs have minimum balance requirements: Some HYSAs might require a minimum deposit to open or a minimum balance to earn the advertised high rate or avoid fees.

- They offer lower returns than investing. While safer, HYSAs generally offer lower potential returns compared to long-term investments, such as stocks or mutual funds, which also carry higher risk.

- Some HYSAs have fees. Watch out for potential monthly maintenance fees, transaction fees, or inactivity fees, although many modern HYSAs (especially online/Fintech) have minimal or no fees.

But can you lose funds to HYSAs?

Are high-yield savings accounts risky?

Compared to investing (or keeping money under your bed), HYSAs are considered very low-risk. In fact, they basically carry almost the same risks as keeping money in a traditional savings account. In other words, your money is as safe as the institution you decide to save with.

How to choose the right high-yield savings account in Nigeria

There are dozens, probably thousands, of HYSAs in Nigeria marketed under different names and offering variable returns. So, how can you pick the right one?

Here’s how to choose the right high-yield savings account in Nigeria:

- Start by comparing interest rates ( specifically APY). Look for the highest annual percentage yield (APY), which includes compounding. Check if rates are fixed or variable, and if they are tiered based on balance.

- Check if the HYSA has fees. Opt for accounts with zero or minimal fees (maintenance, withdrawal, transfer). Always read the fine print.

- Understand withdrawal rules. How easily and how often can you access your money without penalty? Does it align with your needs (for example, if you want to use a HYSA for your emergency fund)?

- Confirm minimum deposit and operating balance. Can you meet the initial deposit requirement and ongoing balance requirements (if any)? This step is important, so take time to review the HYSA you have in mind.

- Check if the HYSA has features and tools you need. Does the provider offer helpful tools like automated savings, goal tracking, or a user-friendly mobile app (like Piggyvest)? Choose features that fit your needs and that will make your life easier.

- Review the security and reputation of the HYSA. Is the institution reputable? Are deposits insured (NDIC for banks) or held securely with licensed partners (common for Fintechs)? Check reviews and regulatory status. Your money is your life — so perform the necessary due diligence.

- Check for customer service. How responsive and helpful is their customer support? You might need to speak to the institution during emergencies or if you have questions so ensure you pick one that has stellar customer service.

Piggyvest’s Flex Naira is the best choice if you want the perfect HYSA in Nigeria. It passes all the checks above and gives you up to 12% yearly returns (paid monthly), which means you can enjoy the benefits of compounding interest.

You can also access your funds at any time via the website or a secure mobile app. Plus, our world-class customer service executives are always available, meaning you can get quick resolutions to your issues even if you reach out in the middle of the night.

10 Of The Best Books About Money For Nigerians To Learn About Saving, Investing, And Wealth Building

How to open a high-yield savings account with Piggyvest

So, Piggyvest is the way to go with HYSAs. How can you get on the train and enjoy high returns and world-class safety?

Here’s how to open a HYSA with Piggyvest:

- Head over to the PiggyVest website or download the official app. The free app is available on the App Store and Google Play Store.

- Click on the “Create free account” button. You may see this button as “Register” if you use the app.

- Provide the required details and click “Create Account.” Ensure you double-check your details before submitting to avoid issues with your free PiggyVest account.

- Set up your withdrawal bank. This account must be your own and is where PiggyVest sends your money anytime you choose to withdraw.

- Verify your details and activate your PiggyVest account. This process shouldn’t take more than a few seconds.

- Select Flex Naira and deposit your funds. You can check out our article on how Piggyvest works to learn all you need to know about Flex Naira.

Congratulations! You are now saving and enjoying high yields alongside more than 5.5 million Nigerians!

Should you put all your money in a high-yield savings account?

While HYSAs are excellent tools, we don’t recommend putting all your money into one account. Instead, you should embrace diversification and spread your funds across other savings options (like Piggyvest’s Piggybank that pays up to 18% per year) and investment vehicles (like low-risk options on Investify that give up to 35% annual returns).

The right mix depends on your individual financial situation, goals, and risk tolerance.

Can you live off your high-yield savings account?

It’s highly unlikely, and we generally don’t advise that you live solely off the interest from a HYSA, especially in Nigeria. While the rates are better than traditional savings, they’re usually not high enough to generate sufficient passive income to cover living expenses unless you have an exceptionally large principal amount saved.

HYSAs are primarily for growing savings and preserving capital, not generating primary income.

The bottom line: Is Piggyvest’s HYSA offering right for you?

If you are looking for a secure, flexible, and high-return way to build your savings for specific goals or an emergency fund, Piggyvest Flex Naira is the right choice for your savings. We provide some of the safest and most attractive high-yield savings options available in the country, and you can join more than 5.5 million Nigerians as they meet their money goals.

Ready to save like crazy? Join the Piggyvest train!

The articles on the PiggyVest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.