We live in a low-trust environment. This means unless we have no other choice, we prefer to buy things up front, in full and in cash. This might work for that new iPhone or even a car, but houses are an entirely different matter. Even in developed countries, it takes years to buy a house or a piece of land on which to build your own. With multidimensional poverty affecting a staggering 63% of the population, renting becomes the most viable option for middle and low-income earners in Nigeria seeking housing.

For the average Nigerian tenant, rent payment isn’t quite the affordable alternative it is purported to be. It costs tenants anything from 40% to 60% of their annual income to keep a roof over their heads. To navigate these steep rent costs and save more, Nigerians have to live frugally by creating strict budgets, working more jobs or hours, or even living in remote locations that require a lengthy commute to work.

Stagnant wages and steadily rising housing and living costs only add to the financial strain on Nigerian tenants, making it more challenging to meet their annual rent obligations. In this article, we will explore the realities and challenges of renting a home in Nigeria, while sharing strategies Nigerian tenants can employ to make rent payment easier.

What are the obstacles that stand between you and your dream rental home in Nigeria?

In the Nigerian househunting world, anything goes. Poor amenities, insecurity, tribal prejudice, landlords seeking two-year upfront rent, vague or strict tenancy agreements, and complacent agents are constants in the Nigerian rental market. Getting a decent apartment at a preferred location and within your budget is nearly impossible — something always gives.

These are some common challenges faced by Nigerian tenants:

- Location

Have you ever trekked an abominable distance with an agent on your way to view an apartment while being reassured that “We don almost reach?” Only to find yourself looking at a decrepit house with no motorable roads, on the outskirts of town, simply because it’s all your budget can afford.

It’s no secret that prime locations in any city cost more, so low-income earners often have to forfeit living in high-demand urban areas and opt for remote locations requiring much more commuting.

- Affordability

Despite their best efforts, some tenants may find it hard to keep up with the escalating cost of rent and have to downsize after a few years or move to more affordable neighbourhoods.

Even house seekers are not left out of this struggle. Ama, a content marketer who had been narrating his househunting escapades on X for a few months, posted about finally finding a suitable apartment. He commented, “Wincing about how much it’ll cost me as I will now drink garri for the next couple of weeks.”

How To Set Financial Goals For A New Year: 7 Tips To Save Better In 2026

- Increasing living costs

2024 has been an interesting year for the Naira. And Nigerians in general. While food inflation has been the greatest marker of the country’s fast-rising cost of living, other sectors, like housing, have also been affected in some way. The economic volatility has made it impossible to create financial plans or stick to a budget, and this has been a source of anxiety for Nigerian tenants.

- Lack of amenities:

Nigerian (especially Lagos) developers and landlords are infamous for trying to pressure renters into settling for mediocre apartments because “Na wetin your money reach.” If you’ve never been taken to view a pocket-sized house in a suspicious location with bad water, poor security, and terrible power supply, count yourself lucky.

Joshua*, a front-end developer, told PiggyVest about his experience living in subpar conditions in Lagos, “I once rented a house that was like a zoo. Rats, roaches, termites, ants — any kind of rodent you can think of, lived with me in that home. Every day was a battle, to say the least. The area did not even have light and the plumbing was just tragic. I will forever blame the agent for setting me up like that. I lasted two years at that apartment because I couldn’t stomach all those agency fees twice in a row.”

How much are Nigerians spending on rent?

According to the 2023 Piggyvest savings report, 36% of Nigerians are saving towards rent, placing rent/housing as the top priority for Nigerian savers. To further understand why, we asked a few Nigerians how much rent they have spent in the last few years and how they have navigated saving for rent.

“We started paying rent in 2017, a few years after we got married.” Tega*, a writer and small business owner, shared this with PiggyVest. “Our first house was a 2-bedroom in Surulere for ₦250k. We spent three years there before we moved to a different location in Surulere. This time, it was a 3-bedroom apartment for ₦1 million. In 2022, we moved to Sangotedo area to a 3-bedroom that cost ₦1.2 million.”

Discussing the effect that paying rent has had on her family’s finances, she added, “Renting has really taken a toll on our finances because we could have used that money to relocate out of Nigeria or have more kids. But it helps that my husband and I contribute towards rent, though he pays a larger chunk, making it more bearable. We just ensure that we live within our means and work extra hard so that we don’t sink into poverty. Lord knows I was born for the soft life.”

How to Fully Recover from a Financial Setback in Nigeria

For some other Nigerian tenants in smaller cities, saving up for rent does not do as much damage to their finances, “I’ve been paying rent since I left home and moved to Owerri for work in 2019 – five years now. My first apartment was a bedsitter in Aladinma, it was what I could afford, and it cost ₦180k per year.” Chidi*, a banker told us. “After staying in that house for two years, I needed to expand, so I moved to a one-bedroom apartment in Amakohia. My annual rent here has been ₦450k for three years running. That’s because my rent is considered expensive in my area, so my landlord has not been able to raise our rent like his counterparts have been doing recently. I don’t have a rent-saving strategy, to be honest. My rent doesn’t take a significant chunk of my earnings, about a month and a half’s salary. Call it the perks of living in a small town. I always have the money when the time comes.”

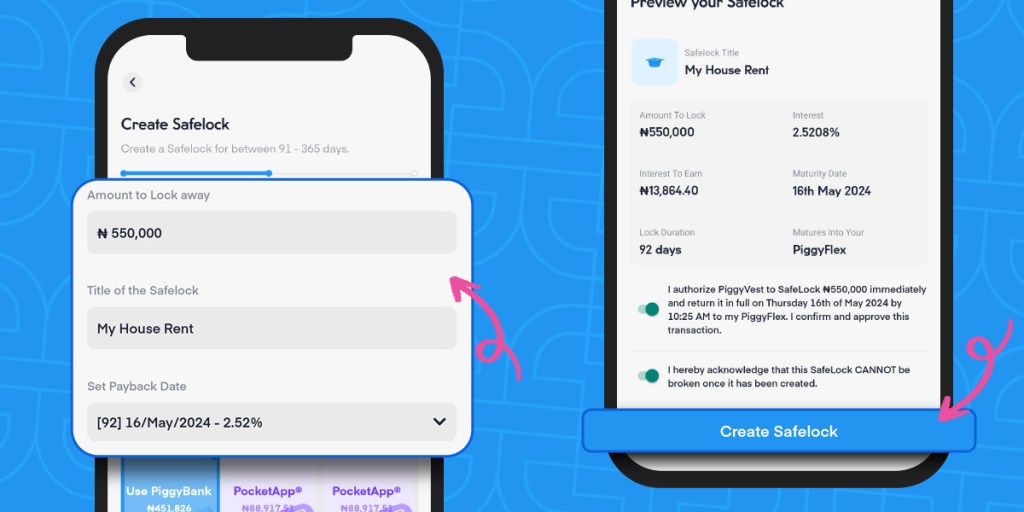

Port Harcourt resident Abby*, told PiggyVest, “I started renting in 2021, and I’ve stayed in the same self-contained apartment in Oroazi for three years now. My rent has gone from ₦250k to ₦350k in this time. I run a small business and have a 9-5, so I’m able to save for rent quite easily using PiggyVest’s Safelock.”

How To Stop Gambling: 8 Practical Tips For Regaining Control And Saving Money

Joshua, who has moved houses three times in five years in the same location, went from paying ₦300k for a shared 3-bedroom apartment to paying ₦650k for a one-bedroom and now spends ₦1.5 million for a 3-bedroom apartment. “I would have spent longer in the second place, but I was just tired of sharing my bed with cockroaches and ants,” he joked. I’m also planning on getting married, hence the choice to move to a much larger space.”

5 Strategies to help Nigerian tenants navigate rent payments

With the many obstacles tenants must surmount to meet up with their rent payments, Nigerians have to employ a combination of strategies in order to remain housed. Despite systemic or other issues, you can make saving for and paying rent a lighter burden by making certain financially wise choices.

Here are a few:

1. Try budgeting

How much of your income should you be spending on rent? According to the 30% rule, your annual rent should not exceed 30% of your yearly income. You do not want to live way above your means, so you must assess your financial situation thoroughly to figure out what you can afford to spare towards rent.

Start by creating a proper budget to help you track your income and expenses. Not only will budgeting help you meet your rent obligations, but you can work on building your emergency funds while investing on the side. Talk about a financial guru!

2. Have routine savings

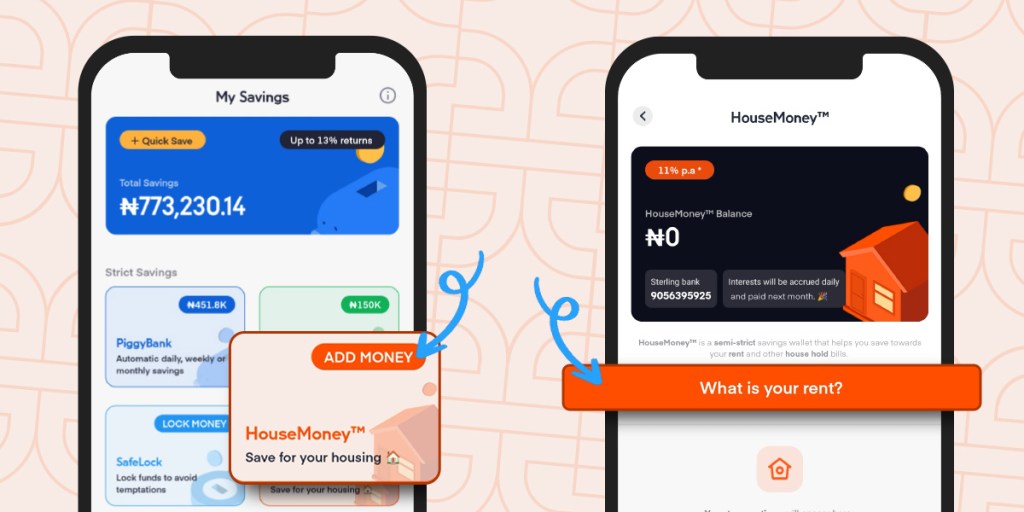

One of the most effective ways to ensure your rent is ready by the time the next year rolls around is by saving consistently towards it. This is why PiggyVest has introduced HouseMoney, a semi-strict savings wallet for your house rent and other household bills.

HouseMoney allows you to break your rent into smaller, pocket-friendly proportions and save year-round without stress. All of this while earning up to 11% interest per-annum. It’s like being rewarded for saving your rent!

3. Look for cheaper housing options

Are you a true Nigerian if you don’t “price” your rent? You do not want to settle for the first figure you’re given; make a counteroffer instead. Most of the time, you can shave off a good amount and save some money for other household expenses.

Another way to get cheaper accommodation is by ditching agents entirely and directly renting from landlords. You can also take over the lease of another tenant looking to leave their apartment. Renewing an existing rent agreement is far cheaper than paying outrageous agency fees. If your rent becomes too expensive, consider moving to a smaller or more affordable apartment.

4. Get a flatmate/roommate

If you’re open to living with people, then having a roommate or flatmate is a great option if you’re looking to make the most of your money and save on rent. Shared living arrangements can drastically lower your yearly rent expenses and free you up financially.

5. Avoid lifestyle inflation

It’s tempting to upgrade your lifestyle once you get a pay bump or land your dream job. But in most cases, this is a poor financial choice. It is better to keep your expenses, and rent, as low as possible. You’ll have more financial resources to put towards your future goals, invest, save, and plan for retirement. Let’s not forget the peace of mind that comes with always having some spare cash for emergencies.