You’ve probably seen headlines like “MPC Dropped MPR at 27%!” They’re typically packed with financial terms and acronyms, like MPR, CRR, LR, and BPS. It sounds important (and it is — since MPR affects how much you earn on savings or pay for loans), but what does it all actually mean, and how can you make sense of it?

The Monetary Policy Committee (MPC) is a group of economic experts within the Central Bank of Nigeria (CBN) responsible for making key decisions about the country’s money supply and interest rates, particularly the crucial Monetary Policy Rate (MPR). After their regular meetings, they release official reports (called communiqués) that explain their decisions and provide important signals about the economy’s direction.

This article is your guide to understanding and interpreting these MPC decisions. We’ll start by breaking down what the MPR is, dive into the MPC and what their tools mean, then jump into how to actually read their official report, and finally explore how their decisions directly impact the economy and your personal finances. Let’s begin!

What is the Monetary Policy Rate (MPR)?

Simply put, the MPR is a country’s benchmark interest rate. Set by the Central Bank of Nigeria (CBN), it’s the benchmark interest rate the country’s apex financial institution uses to determine the rates at which it lends money to or borrows from banks.

Lending happens because the CBN acts as the “banker’s bank.” Banks may sometimes face temporary cash shortfalls for various reasons — including lending out more funds than their immediate liquidity can cover, experiencing a high volume of customer withdrawals, or needing to meet their reserve requirements.

If (and when) this happens, the CBN steps in to provide short-term loans (often overnight) to help them cover these gaps and keep the banking system running smoothly.

On the other hand, banks sometimes have surplus cash that they cannot immediately invest elsewhere at a more attractive rate than what the CBN is offering. This can happen if deposits are higher than expected, loan demand is lower than anticipated, or they receive large loan repayments.

In this situation, they can deposit this excess cash safely with the CBN to earn a risk-free interest, which is typically a better option than holding non-earning funds overnight.

How does the MPR work?

The MPR is also the primary tool the CBN uses to signal the direction of its monetary policy — essentially, whether it wants to slow or speed up economic activity. As of the last announcement in September 2025, this benchmark rate stands at 27.00%.

Think of the MPR like the official benchmark/wholesale price for petrol that the old NNPC used to set for distribution companies in Nigeria. In this analogy, the old NNPC acts as the Regulator (like the CBN). This wholesale price is the fundamental rate that influences how much all filling stations (Banks) must charge.

When the old NNPC increases the wholesale petrol price (the MPR), the base cost of fuel for the filling stations immediately goes up, forcing them to raise their pump prices (interest rates on loans) to cover their costs. Conversely, when the Regulator lowers the wholesale petrol price, the base price drops, allowing filling stations to lower their pump prices, making borrowing cheaper for consumers and businesses.

So, why does the CBN adjust this key rate?

- To control inflation: When prices are rising too quickly, the CBN raises the MPR to make borrowing costlier, discouraging excessive spending and cooling the economy (a contractionary move).

- To stimulate growth: When economic activity slows down, growth is weak, or there’s a risk of recession (perhaps unemployment is high or businesses aren’t expanding), the CBN lowers the MPR. This move makes borrowing cheaper, encouraging businesses and individuals to spend and invest more, thus boosting activity (an expansionary move).

These adjustments are crucial decisions for the economy. But who exactly makes these calls?

Meet the MPR decision-makers — The CBN Monetary Policy Committee (MPC)

The Monetary Policy Committee (MPC) comprises experts within the CBN who decide whether to hit the brakes or the accelerator. Think of them as the “market union leaders” or the “elders” for the Nigerian economy. So, who exactly sits on this committee?

The CBN Act of 2007 specifies the 12 members of the MPC:

- The Governor of the CBN (who serves as the Chairman)

- The four Deputy Governors of the CBN

- Two members from the CBN’s Board of Directors

- Three members appointed by the President of Nigeria

- Two members appointed by the CBN Governor

They meet regularly (usually every two months) to assess the health of the Nigerian economy and analyse key indicators such as inflation, growth, and the value of the Naira. Based on this evaluation, they vote on adjustments to the MPR and other monetary tools primarily to maintain monetary and price stability, while also considering the implications for overall economic growth.

In simple terms, their biggest fight is against rising inflation, making sure the Naira you earn today can buy roughly the same amount of goods tomorrow. And while they also aim to support the government’s broader economic goals (like growth and employment), controlling inflation is usually priority number one.

How Babajide Duroshola Built a Career by Following the Money

Now, before we keep going. You’ll notice that changes to the MPR are often announced using a specific term: basis points. What exactly does that mean?

What are Basis Points (BPS)?

Basis Points, often shortened to BPS, are a standard unit used in finance to measure minimal changes in percentages, like interest rates. Think of it as a more precise way to talk about fractions of a per cent. Just like 100 Kobo makes 1 Naira, 100 basis points make one percentage point (1%).

Here’s the simple math:

- 100 basis points (BPS) = 1.00%

- 50 basis points (BPS) = 0.50%

- 25 basis points (BPS) = 0.25%

- 75 basis points (BPS) = 0.75%

- 150 basis points (BPS) = 1.50%

So, when the news said the MPC “cut the rate by 50 basis points” in September 2025, it simply meant they reduced it by 0.50%. The previous rate was 27.50%, so the new MPR became 27.50% – 0.50% = 27.00%.

It’s just a more straightforward, standard way for finance folks to talk about percentage changes instead of saying “zero point five per cent.”

The MPC’s toolkit: It’s more than just the MPR

While the MPR gets most of the headlines, it’s not the only lever the MPC pulls to manage Nigeria’s economy. To effectively control the amount of money circulating, influence bank lending, and ultimately keep inflation in check, the Committee relies on a set of complementary tools. Understanding these gives you a fuller picture of how the CBN guides the financial system.

Here are the main ones you’ll see mentioned in their reports:

Cash Reserve Requirement (CRR)

This is the percentage of total customer deposits that commercial banks must keep with the CBN and are not allowed to lend out. Currently, it’s 45.0% for commercial banks and 16.0% for merchant banks. Commercial banks serve most people and businesses for everyday financial activities like saving money, getting loans, or transferring funds, while merchant banks are financial institutions that primarily serve businesses and institutions with corporate finance, investments, and advisory services.

Essentially, at a Cash Reserve Ratio of 45%, the CBN is telling commercial banks, “If you receive ₦10,000 in deposits, you must park ₦4,500 with me, where it earns 0% interest. You can only lend out or invest the remaining ₦5,500.” By setting this ratio, the CBN directly influences how much money banks have available to create new loans.

MPR dropped to 27%: Here’s what that means for your money

When the CBN wants less money circulating (to fight inflation), it might increase the CRR, leaving banks with even less cash to lend.

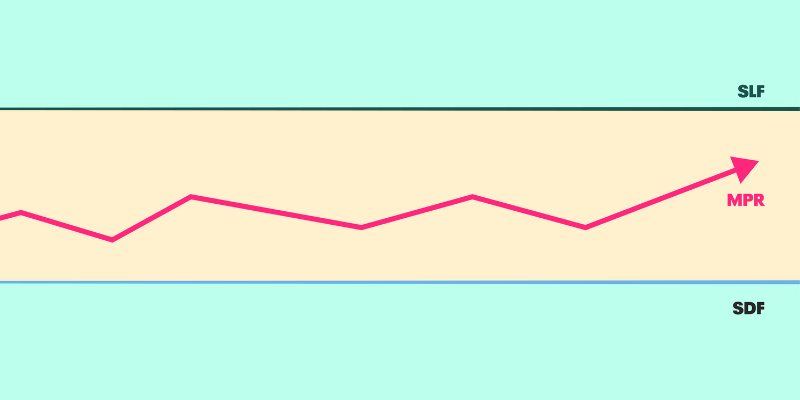

The Standing Facilities Corridor

This creates a “band” or “corridor” around the MPR. It sets the ceiling (highest rate) and floor (lowest rate) for banks dealing directly with the CBN for overnight funds. The September 2025 meeting adjusted this to a corridor of +250/-250 basis points around the 27.00% MPR.

Like in our earlier analogy, the CBN basically uses this tool to set both a “selling price” and a “buying price” for banks that need to manage their funds overnight:

- Standing Lending Facility (SLF): This is the “Selling Price” — the ceiling of the corridor (27.00% + 2.5% = 29.50%). If a bank is short on cash overnight (perhaps due to unexpectedly high customer withdrawals during the day, large payments made to other banks, or needing to meet their required reserves with the CBN) and needs to borrow from the CBN as a last resort, it repays the borrowed amount plus interest calculated at this higher SLF rate.

- Standing Deposit Facility (SDF): This is the “Buying Price” — the floor of the corridor (27.00% – 2.5% = 24.50%). If a bank has excess cash overnight, perhaps due to higher-than-expected inflows, it can park those funds with the CBN safely. This is because it’s the most secure, risk-free option, especially if suitable lending opportunities aren’t found in the interbank market before the close of business. However, it earns this lower interest rate (set lower to encourage interbank lending first).

Liquidity Ratio (LR)

This requires banks to hold a certain minimum percentage (currently 30.0%) of their assets in liquid form — meaning cash or other assets that can be quickly converted to cash (such as short-term government bills). This ensures they always have enough ready cash to meet withdrawal demands from customers like you.

How to actually read an MPC report

Now that you understand the key terms that make up the MPC report, it’s time to learn how to make sense of one. You can find these reports on the CBN’s Monetary Policy Communiqué page, but we’ll use the September 2025 Monetary Policy Communiqué to show you how to read it yourself:

1. Start with the key decisions

Right at the top of the first page, you’ll find a section often titled “Decisions of the MPC“. This is a concise, usually numbered or bulleted list summarising exactly what the committee decided to do.

For the September 2025 meeting, this included:

Level Up Your Money Game At The Zikoko x Piggyvest Naira Life Conference This August!

- Monetary Policy Rate (MPR): Reduced by 50 basis points to 27.00%.

- Standing Facilities Corridor: Adjusted to +250/-250 basis points around the MPR.

- Cash Reserve Ratio (CRR): Adjusted to 45% for commercial banks and retained at 16% for merchant banks. The MPC also introduced a 75% CRR for funds owned by government ministries, departments, and agencies (public sector deposits) held outside the federal government’s central account at the CBN (also known as the Treasury Single Account).

- Liquidity Ratio (LR): Kept unchanged at 30.00%.

This section gives you the core outcomes immediately.

2. Understand the Committee’s reasoning

Following the decisions, look for a section titled “Considerations“. This is crucial as it explains why the MPC made those choices. The committee discusses the economic factors influencing their thinking.

For September 2025, the key points were:

- Positive economic signs: They noted improvements like sustained disinflation (inflation slowing down) for five months, stable exchange rates, good output growth, and strong external reserves.

- Inflation outlook: They expected inflation to keep declining partly due to previous policies and FX stability.

- Liquidity management: Despite positive signs, they observed excess liquidity in banks, mainly from government spending, prompting the adjustment to the CRR for public sector deposits.

- Supporting Growth: Given the stability and declining inflation, they felt there was room to lower the MPR slightly to support economic recovery.

- Interbank Market: Adjusting the corridor aimed to improve how efficiently banks lend to each other.

Reading this section helps you understand the context and the MPC’s priorities.

3. Note the voting pattern (and attendance)

The MPC report usually states how many members attended the meeting. While it might not explicitly detail a vote count like “X voted for, Y voted against” unless there’s a significant split, look for phrases indicating agreement or attendance.

For example, the September 2025 meeting stated, “All twelve (12) members of the Committee were in attendance.” The report was also presented without mentioning any dissent, implying a unanimous agreement.

If future reports were to mention differing votes (something like, “Seven members voted to raise rates while five voted to hold”), it would signal more debate and potentially greater uncertainty among policymakers about the economic outlook or the best course of action.

How MPC decisions directly impact you

Okay, let’s connect the dots. How do these MPC decisions about the MPR, CRR, liquidity ratio, and the corridor around the MPR actually trickle down to affect your everyday finances and your Piggyvest account? Though it might take weeks or even months, the impact mainly depends on the direction the MPC is moving — either increasing rates (hiking) to cool down the economy or decreasing rates (cutting) to encourage growth.

Let’s examine both scenarios:

Scenario 1: When the MPR is hiked

This was the trend before the recent cut:

- Loans become more expensive. Interest rates charged by banks on business loans, personal loans, car financing, and even mortgages usually climb. Banks are essentially passing on the higher cost of borrowing from the CBN to you.

- Saving becomes more rewarding. Good news for savers! To encourage people to save rather than spend (which helps fight inflation), banks may increase the interest rates they offer on savings accounts.

- Piggyvest savings rates may rise. This is often when you might see higher interest rates announced for products like PiggyBank (which now offers up to 17% per annum) and SafeLock (offering up to 20% annual returns). Hiking cycles make it an even better time to lock your funds away and earn attractive returns.

- Fixed-income investments become attractive. Returns on investments like Government Treasury Bills and Bonds typically increase as overall interest rates go up.

Scenario 2: When the MPR is cut

This is the current situation as of the September 2025 meeting:

- Loans become cheaper. Interest rates on various loans (specifically new loans and existing loans with variable interest rates) might decrease, making it potentially a better time to borrow for business expansion, major purchases, or projects.

- Interest rates offered on traditional savings accounts could decrease. Following the September 2025 cut, the minimum rate banks must pay on savings deposits actually reduced slightly from 8.25% to 8.10% because it’s directly linked to the MPR (currently set at 30% of the MPR). So, the incentive to simply hold cash in basic savings might lessen slightly.

- Locking in rates with Piggyvest becomes strategic. When the general interest rate environment starts softening (like now), using SafeLock is a smart move. It allows you to secure the currently available high rates for a fixed period (anywhere from 10 days up to two years) before they potentially follow the MPR downwards across the market.

- The goal is to boost spending and the economy. By making money cheaper, the CBN hopes to encourage more borrowing, investment, and spending by both businesses and individuals, aiming to stimulate economic activity and job creation.

So, whether the MPR is rising or falling, the MPC’s decisions create direct consequences (and opportunities) for your borrowing costs, savings returns, and overall financial strategy.

The bottom line

See? It’s not so complicated! Just remember two crucial things: the MPR itself isn’t an investment you can buy, and the rationale behind the MPC’s decision is as important as the rate itself. For instance, an MPR cut to 27% doesn’t mean your investments will return that specific rate (or even that high); it’s primarily a signal that the CBN is trying to support the economy and encourage spending.

While the official CBN communiqué is the direct source, also check analyses from trusted sources — like the Piggyvest Blog, where we break down important topics like what MPC decisions mean for you. So, next time the MPC speaks, you’ll understand what it means for your financial strategy and your Piggyvest account.

Ready to act on this knowledge? Use SafeLock to secure great rates on your savings or check out Investify to earn up to 35% on your investments!

The articles on the PiggyVest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.

- Central Bank of Nigeria Act, 2007 (PDF)

- Central Bank of Nigeria: Monetary Policy Decisions

- Central Bank of Nigeria: Monetary Policy Communique No.159 (PDF)

- Central Bank of Nigeria: Foreign Exchange Market in Nigeria