Women & Money is a monthly PiggyVest series that explores the relationship between real Nigerian women and money. This series sheds light on money, career and business from a female perspective.

For this month’s episode of Women & Money, we spoke to Regina Richards, a 28-year-old project and event manager. In this conversation, she talks about carving a career path despite a touch-and-go beginning, starting her event planning business, Events By Tulip, overcoming depression and improving her saving habits with the help of PiggyVest.

So, what was your relationship with money growing up?

I was born into a middle-class family, so we had everything we needed. I remember we were very comfortable, but I also didn’t personally interact with money growing up. Aside from going on errands, I didn’t handle money. But I knew there was money, and we knew when it was payday for my dad; we knew when to ask him for stuff and when not to.

Then, I became a teenager and went to boarding school. But even then, I still did not handle my money myself; it was given to the hostel master, who kept and disbursed my pocket money when I needed it.

Did that change as you entered the university?

University was a continuation of the same thing, I had a weekly stipend of ₦10,000, and I was also able to manage my allowance pretty well. I just had to ask if I needed money for other things like textbooks, and my parents would provide it. I also have older siblings that would come through if I was in dire need. I was very free with my resources; whenever people came to me for assistance, I was always down to help.

What year was this?

I was in the 100 level in 2014. So around that time.

₦10,000 weekly in 2014? Wow. That’s wealth.

[Laughs]. The economy was pretty good at the time, but I realised how different the world was after I graduated.

With all of this, were you able to save money?

I didn’t save in school. I just didn’t need to. Every Friday, I would get my allowance, and I knew I could get help from my family if I ever got stranded.

And after university? Did the financial support from your family remain consistent?

Before NYSC, I was still fully supported by my parents. But all that changed when the allawee started coming in. Then I was told that sending money home had become part of my responsibilities. I was shocked. My mum would ask me to send a little cash to her or my younger brother. But I believe it was just a way to teach me to handle financial responsibilities and put me in an independent headspace.

On the plus side, I was able to save towards and complete catering school during this time. Out of my ₦19,500, I would set aside small amounts like ₦5,000 until the ₦15,000 was complete. Apart from the stress of saving from my small earnings, it also took a lot of commitment to follow through for the three-month duration of the training.

Had you decided on a career path at this point?

I started catering school as a backup plan so I would not have to sit idle at home if I didn’t get a job immediately. I also didn’t want to be a burden on my parents or find myself asking for money for small things.

But I sort of already knew my career direction from school. I studied theatre arts, and one day in my first year, I raised my hand to ask a lecturer a question and before I knew it, I was given the responsibility to lead the class for the entire year. It was a recurring class that ended with a big production at the end of every semester, and my job was to coordinate all aspects of the production until the presentation day. I had to put everything into it because it was my name on the banner as stage manager.

That’s how I held the production/stage manager role for most of my stay in school. I also helped manage personal projects for individuals, and my friends would recommend me to anyone who needed a production manager. This experience shaped what I am today — learning people management, teamwork, and collaboration while still in school, equipped me for my current career path.

How has the journey been so far?

Coming out of school, things were entirely different from my expectations. It felt like being thrown into the deep end. I guess I wasn’t exposed enough to the theatre community, so I found it extremely hard to continue on the same path.

I stumbled upon a customer service role in 2019 for a fintech; it was the easiest start for me, and I was really good at it. However, it was not what I wanted for my life. I stayed at the job for six months until the company started to do a lot of organisational restructuring. Then, it quickly became toxic and stopped feeling like home, so I knew it was time to leave.

Women & Money: Jesimiel Damina Wants To See More Women Filmmakers In Technical Roles

Did you have a plan?

Not quite. But I tend to be pretty spontaneous, so I made up my mind pretty quickly. Not long after that, I moved on to another company, an online lending company, as a customer service executive. I had lived with my family in Lagos up to this point, and now they had to move to Abeokuta, which posed another big challenge for me.

I was earning ₦50,000 at the time, which wasn’t enough to get my own apartment. So I had to put up with some family friends for a while, and that experience was one for the books. Luckily in September 2020, I found a job in Abeokuta, and I was glad to leave.

What was Abeokuta like?

I’m just going to be honest and say that returning to Abeokuta felt like a major regression. Like I had just taken ten steps backwards. The job itself was great with many benefits; for someone who found it hard to gain weight, I had started putting on some weight.

Unfortunately, three months later, the company shut down. Mismanagement of funds. I entered a very terrible depression, and to make things worse, my father suffered a stroke.

I’m so sorry about that.

There was no financial succour coming from anywhere at that point. My mother had just started running her school, and her finances hadn’t picked up either. I was just at home, contemplating my life.

For the whole of 2021, I was home, applying for jobs and getting rejections. Every day, I would go on social media and see people living their best lives and starting new positions. It felt like I had so much to give, but nobody was willing to give me an opportunity. I just gave up on applying at some point.

Luckily, in 2022, I got temporary relief. I got a freelance gig paying in dollars. It was a data entry position for a company in the US, and it felt like I had arrived. After conversion, my take-home was about ₦500,000, so I was balling.

Women & Money: Ore Eni-Ibukun Is Prioritising Work-Rest Balance

Nice! Did you save money this time around?

I wish. When you’ve been broke for a while and start earning money, there’s a long list of things you need to do. Things to buy and places to go. For a change of scenery, I moved to Benin to live with my younger brother, who was still a student. Then with the new job, which lasted a few months by the way, things started looking up.

After my contract ended, I returned home, back to square one. But even though I had no job, I had been filled with faith and inspiration. My brother was a big contributor to my hopeful state of mind. It was inspiring to watch his entrepreneurial drive; he was a graphics designer and doing amazing things even as a student. If he could do it, I knew something good was in the future for me.

What happened next?

Last year, I finally got an actual customer success job. The pay wasn’t the best, but I had a direction and a sense of purpose. I took some courses and worked on myself, and in mid-2023, I got a gig as a project manager for a startup. It was a new team of product owners, developers, scrum masters, and me, the project manager. It was more of an opportunity to build my portfolio, as I knew my calling was in project and event management. It had always flowed naturally; I’m a great leader and can coordinate projects in my sleep, so I jumped on the opportunity.

The joy of seeing things come to life, stage by stage, fills me with joy. It’s why I chose project management in the first place. It’s why I’ve stuck with this team as well. Even when the company I worked at as a customer success executive started having funding issues and was unable to pay salaries, I didn’t feel stuck. Eventually, I had to move on from that company, but I only felt sad momentarily, because I got a new project manager role that kept me busy and fulfilled.

What about your event management business? When did that take off?

I started my business, Events By Tulip, at the end of last year officially. Prior to that, I had planned many events for family and friends, but I hadn’t outrightly branded myself as an event planner. Then I told myself that the only way people would take me seriously was if I took myself seriously. So I started telling everyone in my immediate circle about my new business.

Everyone was excited to learn that I had finally decided to become an event planner full-time. I even took a course to update myself on industry standards. In less than two months, I got my first gig which earned me over ₦100,000. I also got a gig for Valentine’s Day. Getting gigs back-to-back has been a little slow, but I didn’t expect anything different. I envision getting bigger clients in the future, so taking the course, focusing on branding my business, and getting a graphic designer are the next steps I’ve taken in my journey. I’m quite pleased with my progress, and I’m looking forward to what the future holds.

Women & Money: Why Oluchukwu Chiadika Launched Your Personal Finance Girl

Congratulations on all your present and future success! So what does growth look like for you in your career paths?

For project management, I already have plans to get my scrum certification this year. And for event management, I want to expand my business beyond event planning alone. I want to build an in-house team that handles every aspect of an event, including decorators, designers, caterers, and other vendors. I also want to have a training school to teach people event planning and catering as well.

What’s your favourite career milestone?

Finally starting my event planning business. It was a dream come true.

What about a low point in your life?

When the company I worked with in Abeokuta shut down. It was an investment company, and many customers invested through me. After the crash, my phone would not stop ringing. I slipped into depression, crying myself to sleep every night.

I’m glad that phase is over, but I still have some residual trauma from that time. My phone has been on silent since then. I turned off my read receipts on WhatsApp and never looked back. I get more calls now since I started my business, but sometimes I let the phone ring and call back instead. I prefer texts or emails over phone calls. I don’t know when I’ll fully recover, but I know it’s all behind me now.

I’m glad it’s all in the past. Let’s talk about financial freedom. What does it mean to you?

Financial freedom to me is being able to acquire all of life’s necessities, being debt-free, and being able to afford a few extra luxuries.

How are you working to attain this?

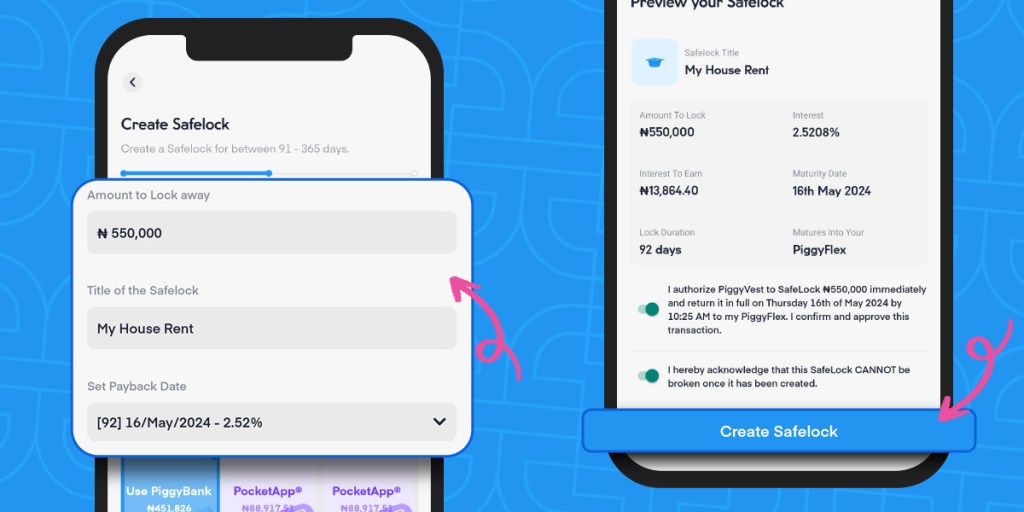

Honestly, PiggyVest has helped with my saving habits. I’ve been using the app off and on for four years now. In fact, I was one of the best students when last year’s WAEC results dropped. I use Safelock a lot, I collect my upfront interest and enjoy it, and I use Target savings whenever I’m saving towards a goal.

I’m not investment savvy, so I’m still trying to learn how to invest properly. For now, my own form of investment is giving out loans to people I trust who pay back with interest.

You can try the pre-vetted, low-to-medium-risk investment opportunities on Investify.

Sure. I’ll check it out.

What’s a piece of advice you received that changed your outlook in life and career?

My mum has always told me that I had the potential to be a boss of my own, I just needed to apply myself more. These words have been etched in my mind for as long as I can remember. In fact, she reminds me every year on my birthday. It was all the push I needed. The moment I told her about my event planning business, she told all her friends. She even keeps my flyers and shares them every chance she gets.

Nothing like a supportive parent.

She’s so supportive.

Looking back, are there things you wish you could tell younger Regina?

Yes. I would tell her to stop being scared. You can do anything you want to. I’m past being afraid or too shy to promote my business. If big companies can spend big budgets running ads, why can’t I?

Looking at your financial track record, would you say your money skills have improved?

Of course. I’m so much better with money. Nowadays, I plan my finances and don’t just spend recklessly. I also save money. I’ll say that’s a huge improvement.

Have you made any money mistakes?

I think spending without saving all those years ago counts as a money mistake. Also, spending so much money on black tax; I need to learn to say no when it counts.

What’s the coolest purchase you’ve made recently?

My balloon pump. I want to start learning how to do balloon decorations myself, so that was a good investment. Now I can practise and get better at home.

Do you have any advice for women aspiring to be project or event managers?

First of all, we need to eliminate the “I can’t do it” attitude and be prepared to take the bull by the horns. Look in the mirror every day and tell yourself that you’re good enough. I draw strength from prayers, so commit yourself to God, and keep your eyes on the prize.

It’s hard, but take things one day at a time. Don’t let people’s successes on social media make you envious or insecure, instead draw inspiration from them. If they can do it, you can too.