Being an adult in Nigeria should come with a handbook or some kind of operating manual. You have to juggle a ton of responsibilities all at once while trying to beat inflation, starting or raising a family and planning for retirement. For some of us, growing up in a multi-generational family offers a cushion of privilege where you can lean on others for emotional, social and financial support.

But not everyone is that lucky. The term sandwich generation is used to describe adults who provide some sort of financial support to their ageing parents — and sometimes grandparents — and their children. In the Nigerian context, the sandwich generation may also be obligated to care for extended family, non-biological dependents, and peers (if you are from certain ethnicities). Having to shoulder the responsibility of providing for the generation(s) before and after you can lead to undue pressure and alter many of your life plans if you don’t acknowledge it head-on and plan appropriately.

Here’s a comprehensive guide to help you identify if you fall into this category and our recommendations for navigating your sandwich years with financial savvy.

Keep reading!

Characteristics of the Nigerian sandwich generation

“I’ve been my father’s main caregiver since my mother passed in 2018,” Sola, a 34-year-old banker, told PiggyVest. “We’re just two: me and my younger sister. After my mum died, my father developed a partial stroke, and I’ve been taking care of him ever since. I also got married in 2020, and my wife and I have two children now. I have to pay the salary of the boy who lives with my dad, as well as care for my wife and children. Luckily, my sister was able to relocate last year to Canada, so she has been pitching in here and there. I can’t lie, it’s hard o, but I will continue to do it with a smile on my face because my father sacrificed a lot for us.”

You’re a member of the Nigerian sandwich generation if your situation rings similar to Sola’s. Typically, the sandwich generation consists of middle-aged adults, mainly Gen X and a handful of millennials and boomers. But underemployment, poverty and other social dynamics mean Nigerian millennials are forced to start financially supporting their parents and extended family long before they enter middle age.

For clarity, you’re in the sandwich generation if you:

How Babajide Duroshola Built a Career by Following the Money

- are the primary caregiver for your elderly parents or children.

- also have to deal with the financial, emotional, and physical needs of other generations, like grandparents or grandchildren.

- are the most financially stable individual in your extended family or social group.

The PiggyVest Savings Report revealed that over 80% of Nigerians pay black tax. That means 4 out of 5 Nigerians have to support nuclear or extended family members with gifts and stipends, frequently or occasionally. Being a breadwinner of multiple homes can severely impact a young Nigerian’s capacity to prepare for retirement, let alone build generational wealth. This could explain the emerging trend of members of the sandwich generation choosing to deviate from the status quo.

PiggyVest spoke to Marie*, whose husband falls into this category. The stay-at-home mum in her late 40s recounted, “I’ve lost both parents now, but before my father died, my siblings and I would always pitch in to send money home occasionally. Now, I just focus all my resources on my children. My husband, on the other hand, comes from a pretty well-to-do family. His mother retired as a hospital matron, and all of his siblings lived abroad before we finally moved this year. By the way, he is also the last born. So everyone on his end is very independent.”

But Marie also highlighted the subtle yet persistent requests from his mother and other extended family members to send money or pick up responsibilities even though they don’t need their help. According to her, her husband, whom she fondly nicknamed “my stubborn young man,” insists that unless there is an urgent need to raise major funds, he would not be putting anybody, except her and their kids, on an allowance. “Everyone else is comfortable enough to care for themselves financially,” she explained. “He has told me that he would never do anything to jeopardise our family’s finances or comfort; his priority is me and our children. He believes that it will only open the door to generational trauma and billings. What if something happens to us? Will that mean our children will inherit those responsibilities? Abeg, they can take care of themselves.”

Angel Anosike, on The True Cost of Nollywood Glamour

How to financially navigate your sandwich years

It’s impossible to stay young forever; as one sandwich generation grows older, the succeeding generation assumes this responsibility. However, if Marie’s story should teach you one thing, it is that making your children your retirement plan is a gamble you cannot afford. Your expectations will not pay the bills when your income dries up, so ensure to get your ducks in a row now that you’re in your most productive years.

Here are 6 tips that can help you financially navigate your sandwich years.

Habib Olawale Is Making Self-Expression Profitable with Smileys

1. Financial planning

A financial plan is a money roadmap. It is comparable to a budget, except that a financial plan is more extensive and long-term, as it accounts for your goals, economic projections, and even assets. Even if you’re financially stable now, a good financial plan will give you a clear overview of your finances and enable you to incorporate and plan for your financial responsibilities as a caregiver. It is the best way to ensure your financial security.

2. Empowering your children:

Strive to provide your children with quality education if you can afford it. Encourage them to be independent thinkers, help them hone their social skills, and start teaching them responsibility early. As your children enter adulthood, encourage them to pursue autonomy to avoid dealing with boomerang kids who return home like the scriptural prodigal son after a failed stint at adulting. Having financially independent children will help you alleviate your stress early enough, allowing you more time and resources to enjoy in your old age.

3. Growing your savings and investment portfolio:

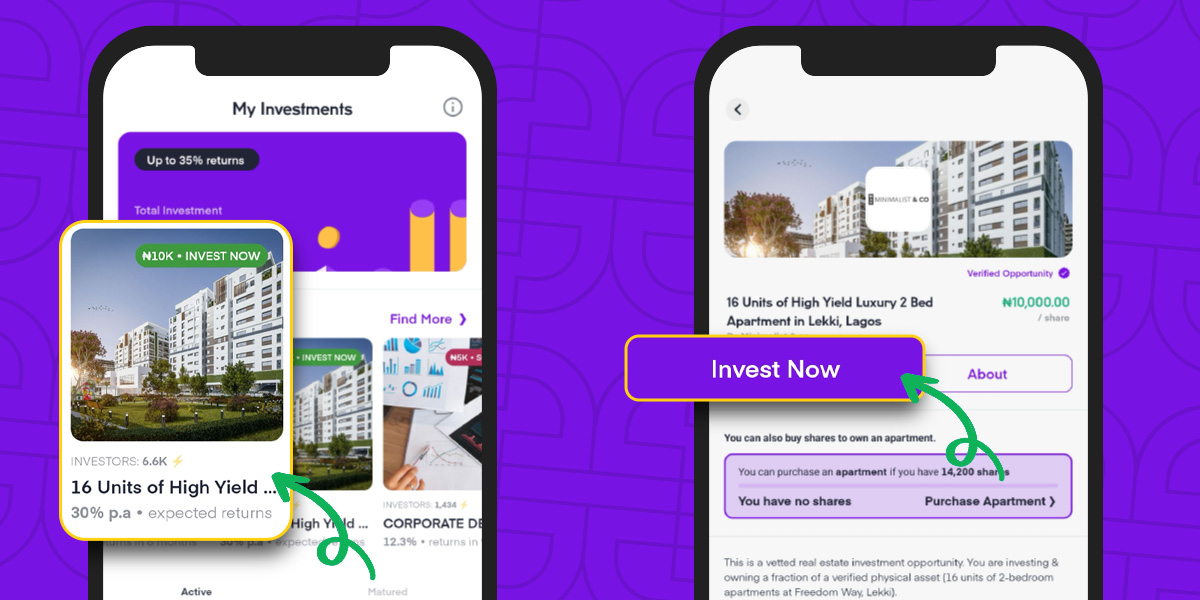

Savings and investments are major elements of a financial plan. And being in the sandwich generation, having a solid financial backup is very crucial. Fortunately, you can join millions of Nigerians in saving and investing with ease and earning interest using PiggyVest.

By using Investify, you can access pre-vetted low-to medium-risk investment opportunities. Safelock is a feature that works as a fixed deposit, and you can even Autosave on PiggyBank. There’s also the Flex Dollar option if you want to grow your portfolio in dollars, and you can save towards a unique goal, like your kid’s school fees, on Target savings.

4. Contributing to a pension fund:

This is another element of a financial plan that involves planning for life after retirement. According to the PiggyVest Savings Report, only 22% of Nigerians set money aside towards retirement. One of your primary concerns should be securing financial stability in your later years. Whether or not your organisation pays a specific amount towards your pension, still assess your finances to determine how much you can spare towards your retirement, and create a Safelock for this purpose.

5. Buying a good health insurance plan:

A good HMO will save your life and save you money at the same time. A good hack for ensuring adequate health coverage for your family is purchasing a comprehensive healthcare plan for the whole family. A good plan will, first of all, fit your budget, as well as cover multiple specialist visits, routine check-ups, medication, and a choice of facilities. Having a health insurance plan will save you from having to continuously dip into your emergency funds.

6. Seeking help from extended family:

The challenges of being a primary caregiver for multiple generations will often be too much for one person to handle. Whether in your nuclear or extended family, each member has unique strengths and can contribute time or other resources to ease the burden. So, please ask for help at every opportunity.

You and your siblings can create a Group Target to contribute towards your parents’ welfare. You can do the same with your spouse to save towards household expenses.