Knowledge is power — especially when money is involved. Whether you’re an entrepreneur hoping to build the next billion-dollar business, a salary earner pining for the end of the month or a student dependent on a fixed allowance, you’ll be much better off being financially literate. But exactly what is financial literacy?

Financial literacy encompasses a range of knowledge and abilities — including budgeting, investing and debt management — that empowers individuals to make informed decisions about their financial well-being.

With a deep knowledge of financial literacy, you can navigate the complex world of personal finance confidently. In this comprehensive guide, we’ll explore the concept of financial literacy, its components, why it matters, steps to improve it and its impact on your finances. Let’s begin!

An overview of the concept of financial literacy

Financial literacy is the ability to understand and apply financial concepts effectively. It involves acquiring knowledge and skills to make informed financial decisions, manage money efficiently and achieve financial goals.

Ultimately, being financially literate empowers you to take control of your financial life.

Still, financial literacy isn’t limited to understanding complex financial jargon (like the concept of compound interest) or mastering complicated mathematical formulas (although knowing stuff like how taxes work can be super beneficial). Instead, it’s about having a practical understanding of how money works and applying that knowledge to real-life situations.

What are the components of financial literacy?

Financial literacy is built on several key financial concepts. In this section, we’ll examine some of the most important.

The following are the components of financial literacy:

- Budgeting

- Saving

- Investing

- Retirement planning

- Debt management

These concepts are certainly not new; you’d have encountered them if you’ve explored topics like financial intelligence and financial management. Now, let’s explore them in relation to financial literacy.

Budgeting

Budgeting is a fundamental aspect of financial literacy. It involves creating a plan for income allocation, accurately tracking expenses and setting aside money for future goals. By understanding budgeting principles, you can effectively manage your finances, avoid debt, save for emergencies and achieve your long-term objectives.

We wrote a handy guide on how to easily create a budget. You should check it out!

How to Fully Recover from a Financial Setback in Nigeria

Saving

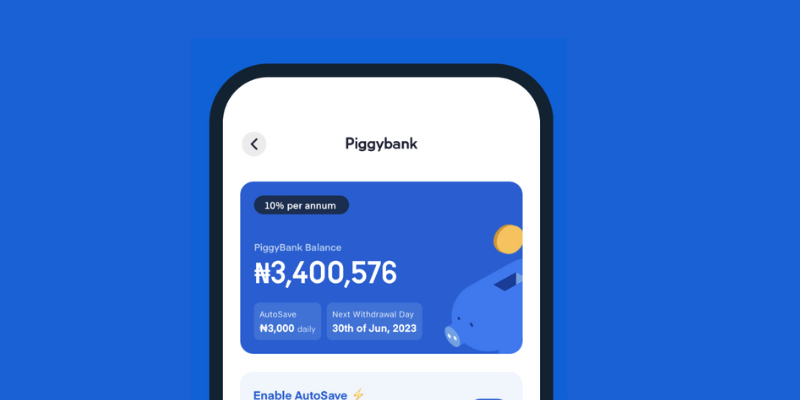

When it comes to saving, financial literacy teaches the importance of setting aside a portion of your income for future needs and goals — preferably using a safe and secure platform like PiggyVest.

It also emphasises the significance of building an emergency fund (which should contain at least three to six months of living costs) to cover unexpected expenses and creating a savings plan for long-term objectives — such as buying a house or funding education.

You can learn more about the art of saving by checking out our comprehensive guide.

How To Stop Gambling: 8 Practical Tips For Regaining Control And Saving Money

Investing

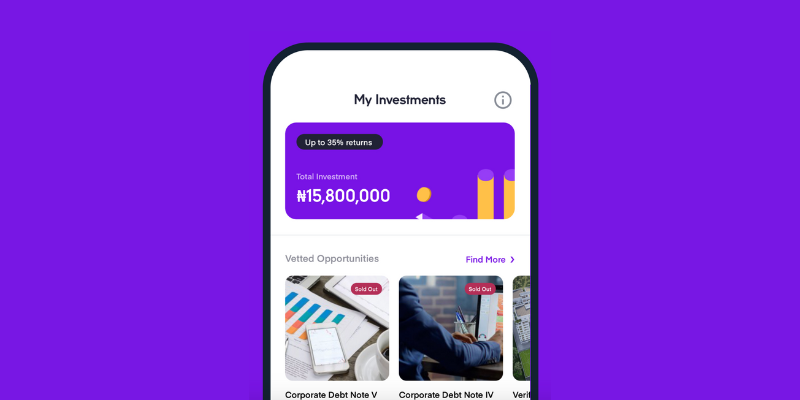

Understanding the various investment options — such as stocks, bonds, and mutual funds — will help you grow your wealth over time. Beyond this core knowledge, financial literacy also equips you with the ability to assess investment risks, diversify your portfolios (including investing in PiggyVest’s Investify opportunities that offer up to 35% returns) and make informed decisions based on your risk tolerance and financial goals.

Retirement planning

Knowledge of retirement planning allows individuals to make informed decisions regarding pension plans and other retirement savings vehicles. Being financially literate will also ensure you understand the importance of starting early, contributing regularly and taking advantage of employer matching contributions.

It will also ensure you know the significance of calculating your retirement needs, estimating future expenses and planning for a comfortable retirement lifestyle.

Debt management

Financial literacy ensures you understand debt management strategies, such as debt consolidation, negotiating with creditors and creating a repayment plan. It also empowers individuals to take control of their debt, reduce financial stress and work towards becoming debt-free.

Why is financial literacy important?

Financial literacy is a critical skill that enables individuals at all stages of life to take control of their financial lives. In this section, we’ll see why it’s so crucial for you to be financially literate today.

Financial literacy is important for the following reasons:

How To Budget On A Fluctuating Income

- It can help young adults avoid common financial pitfalls and develop good habits early on, ensuring a secure and prosperous future.

- It can enable individuals approaching retirement to make informed decisions about pension plans and other savings to ensure a comfortable retirement.

- It promotes independence, reduces vulnerability to scams and contributes to overall financial well-being — extending beyond personal benefits and positively impacting the economy.

How can financial literacy impact your personal finances?

It’s pretty simple, really. Financial literacy can help you make informed decisions about your money. After all, by understanding key concepts like interest rates, investment options and debt management, you can make intelligent choices that align with your goals and values.

Whether it’s purchasing a home, starting a business or saving for higher education, being financially literate maximises your chances of making sound financial decisions on your first try.

Having strong financial literacy skills will also help you avoid common financial pitfalls. This includes falling into excessive debt, becoming a victim of scams or making impulsive purchases. By being aware of potential risks, understanding the consequences of financial decisions and having the ability to evaluate financial products critically, you can protect yourself from financial disasters and keep your money secure.

How can you improve your financial literacy?

Like many things in life, knowing about financial literacy is not enough — you must continuously improve the skill. Fortunately, it’s pretty easy to become even more financially literate as a Nigerian — regardless of who you are or how much you earn.

Here are a few steps you can take to improve your financial literacy:

- Educate yourself on financial topics. Read books, attend money-focused seminars and keep up with reputable financial websites (like the PiggyVest blog) to gain valuable insights and knowledge. Develop a habit of continuously learning about personal finance to ensure you make informed decisions and adapt to the changing economic landscape.

- Use financial literacy resources. Try out online resources and interactive tools like the PiggyVest interest calculator to understand how small choices can yield significant profits with little time. Government agencies, non-profit organisations and other financial institutions also provide resources such as workshops, webinars and free counselling services that promote financial knowledge and skills.

- Practice financial management. Creating a budget, tracking expenses and setting financial goals are essential steps towards gaining control over your finances. Developing healthy financial habits and consistently monitoring progress can reinforce your financial literacy and achieve long-term financial stability.

There you go!

Final Thoughts

Financial literacy is a fundamental skill that is vital in our daily lives. It refers to the ability to understand and utilise all kinds of financial information effectively — even niche concepts like how the Central Bank of Nigeria works. By acquiring knowledge and skills in this area, you can make smart financial decisions, manage your money efficiently and achieve your financial goals.

The articles on the PiggyVest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.

- SSRN: The Impact of Financial Literacy Education on Subsequent Financial Behavior

- Cambridge University Press: Financial literacy around the world: an overview