In our article on saving, we covered how the simple act of setting money aside for future use can help you make big purchases and build wealth. Now, we will introduce you to the big guns — investing. But first, what is investing?

Investing is the act of putting your money into assets or ventures (like stocks, real estate, and businesses) to generate a profit. It’s an excellent way to secure your financial future and grow your long-term wealth — regardless of how much you earn.

This article is a comprehensive explainer for beginners. In it, we’ll answer all your investment-related questions — from how investing works to how much you need to start investing in Nigeria. Then, we’ll show you how to use Investify by PiggyVest to make your first investment today.

How does investing work?

You invest money by putting your funds into different investment vehicles (like stocks, bonds, real estate and mutual funds). By purchasing these assets, you become a partial owner or contributor to the investment. The value of your investment will then fluctuate based on market conditions and the performance of the underlying assets.

That’s a lot of words. Let’s simplify things with an example.

Let’s say you earn ₦800,000 monthly and — as a money-smart Nigerian who understands the power of the 50/30/20 rule of budgeting — you’ve been keeping 20% (or ₦160,000) aside for savings and investment.

Your savings have been growing steadily, and — since you love the ease of automation and up to 10% annual interest — you’ve been using the PiggyBank feature on PiggyVest for months now. But you’ve heard amazing stories about investing and have decided it’s time to diversify your portfolio.

So, you decide to split the 20% meant for savings into two — 10% of your income now goes into regular savings, and the remaining 10% is for investments. To start, you decide to invest in stocks — carefully buying ₦80,000 worth of shares in a profitable company every month.

When investing in stocks, the shares you buy represent ownership in that particular company. Different factors can influence stock prices, including company performance, economic conditions, and market sentiment.

So, how do you make money?

Investing allows you to benefit from the growth or success of the investment, which can result in capital gains, dividends or interest payments.

Shares can result in dividends (profits) from the company if it distributes a portion of its profits to shareholders. So, as a shareholder, you can enjoy (somewhat) free money at the end of a business year if the company makes excellent gains.

And that’s not the only way to make money from this type of investment. As a company becomes more profitable, their stock prices can soar. Therefore, the shares you bought for ₦80,000 today can be worth twice that in a year — given the right circumstances — and you can sell them for a tidy profit.

Of course, there’s also the flip side. All investments have some level of risk. You could lose your capital completely if your investment company does badly or records losses. But that’s investing!

Now, let’s talk risk!

What is risk in investing?

Risk in investing refers to the possibility of losing money on your investment. Every investment carries some level of risk (even that one your friend promised you is “sure die”). So, it’s essential to understand and assess the risk associated with different investment options before committing your funds.

Usually, the higher the returns attached to an investment, the greater the risk. Therefore, you must balance risk and potential reward that aligns with your investment goals and risk tolerance.

What is diversification in investing?

In our example above, we mentioned you “diversifying your portfolio.” What does that mean, exactly?

Diversification is a risk management strategy that involves spreading your investments across different asset types, industries and geographic locations. For example, you could split your ₦80,000 monthly investment fund into three pools — ₦40,000 for stocks, ₦20,000 for real estate and ₦20,000 for crypto assets.

How Do The Real Estate Investment Opportunities On Piggyvest Work?

By diversifying your portfolio this way, you can reduce the impact of potential losses on your overall investment and lower your overall risk without sacrificing returns since another investment can help offset losses if one investment underperforms.

Diversification is an integral part of investment education, and we recommend checking out our article on diversification strategies in investment to ensure you understand the concept in detail.

What is volatility in investing?

Volatility refers to the degree of variation in the price of an investment over time. It’s another important concept to consider when evaluating risk in investing and a core part of your education as a beginner investor.

Generally, investments with higher volatility tend to have a greater risk of large price swings — which can lead to both significant gains and significant losses. Understanding the volatility of an investment can help you assess the level of risk you are comfortable with and make informed investment decisions.

Is investing like gambling?

You’ve probably heard people refer to investing as “gambling for rich people.” Well, while both involve risks and the potential to gain or lose money, the key difference lies in the approach and strategy.

Gambling relies purely on chance, where the outcome is unpredictable and largely uncontrollable. It often involves games of luck (like Slots) where the odds are stacked against you.

On the other hand, investing requires a thorough understanding of more technical concepts, including the financial markets, company performance and economic trends.

As an investor, you must analyse and evaluate potential investments based on their fundamentals and prevailing market conditions. You also need to carefully research companies, assess their growth potential and consider factors like industry trends and competitive landscape before deciding to drop a Naira.

Why should you invest?

By now, you should already have a solid understanding of the basics of investing. But before introducing you to your first investment, let’s answer some key questions. To start, why exactly should you invest?

The following are some top reasons you should invest money:

How To Keep Your Piggyvest Account Safe: 4 Security Tips From Our Cybersecurity Team

- You should invest to put your money to work and allow it to grow over time.

- Investing offers the potential for higher returns compared to keeping your money in a savings account or, worse, under your bed.

- It allows you to beat inflation and preserves the purchasing power of your hard-earned money.

- Investing allows you to diversify your portfolio and spread risk across different assets.

Still, the best part of investing is that it allows you to enjoy the power of compound interest. When you reinvest your earnings, you earn returns on your original investment and the profit your capital has generated.

Over time, this compounding effect can significantly boost your wealth and accelerate your journey towards generational wealth.

What is the best age to start investing?

As with saving money, the best age to start investing is as early as possible. By investing early, you can quickly make the most of the exponential effect of compound interest and grow your income to Dangote-like levels.

However, there is always time to start investing. Even if you are in your 30s, 40s or beyond retirement age, you can still benefit from investing and secure your financial future.

How do you know if an investment is good?

From wasted school fees to lost savings, we all know at least one example of someone investing money in an unsavoury venture. In fact, we even wrote an article where Nigerians shared their investment misadventures and the lessons they learnt.

How can you tell if an opportunity is any good?

When considering the quality of an investment, it’s crucial to explore its historical performance. By examining how an investment has fared in the past, you can gain valuable insights into its potential for future growth or decline.

There’s also fundamental analysis — an assessment of factors like the company’s financial health, market position, competitive advantages, and growth prospects. By conducting a thorough fundamental analysis, you can determine whether an investment is undervalued or overvalued and whether it aligns with your overall financial strategy.

Risk Management 101: How To Build A Balanced Portfolio As A Beginner Investor

Evaluating the risks and potential returns of an investment is also critical. You should consider factors like market volatility, economic conditions, regulatory changes and company-specific risks when assessing the risk-return profile of an investment.

For example, it’s a glaring red flag if a venture promises you returns much higher than Nigeria’s monetary policy rate (or MPR) — which was 22.75% as of March 2024. This type of investment is overvalued and risky. Therefore, there’s a high chance you won’t get your promised returns (and you may even lose your capital).

By carefully weighing the factors we shared, you can make more informed decisions and build a well-rounded investment portfolio.

Can you start investing with little money?

You can start investing with little money. In fact, many investment platforms offer low-cost options that allow individuals (including Nigerians) to start investing with small amounts of capital.

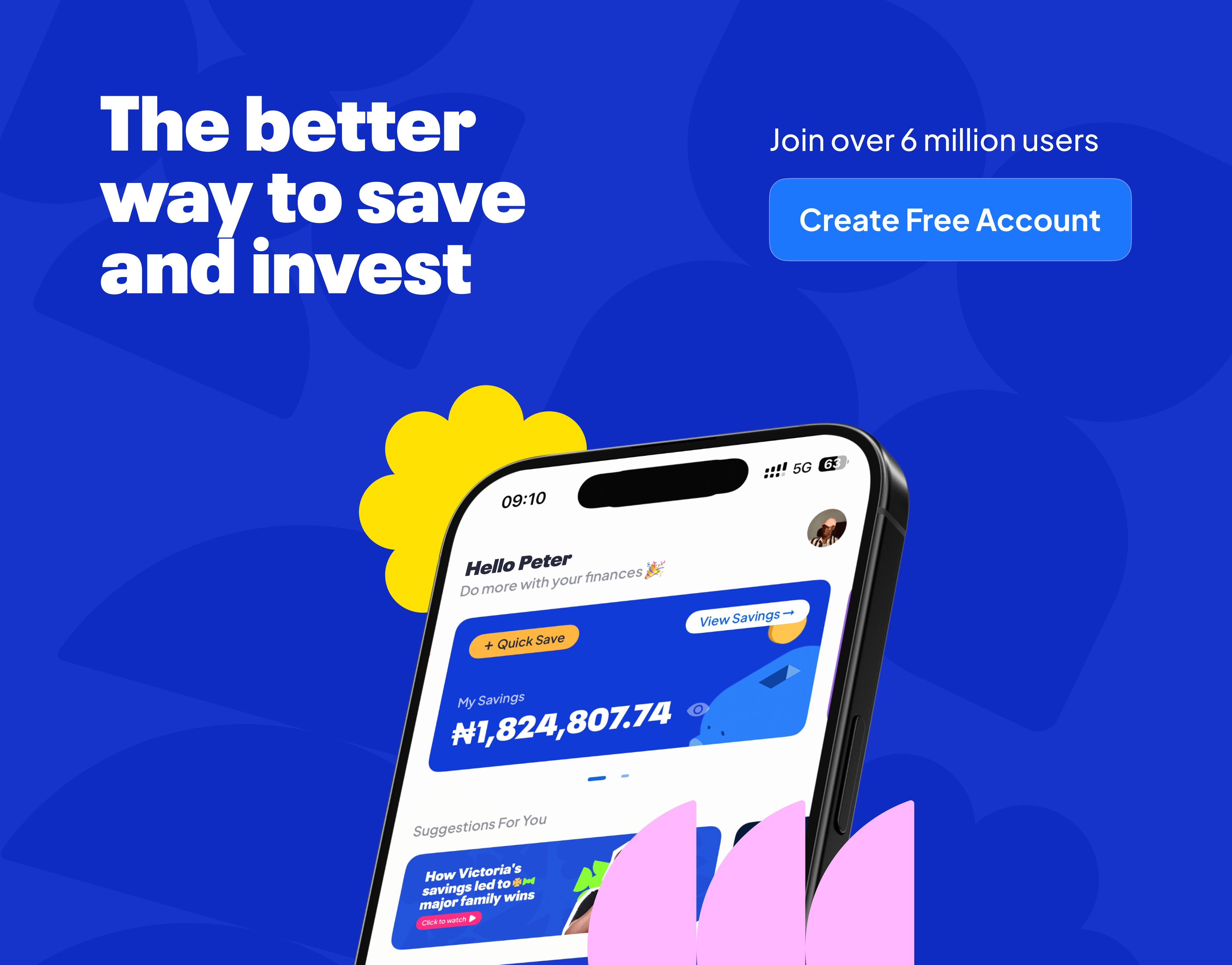

A great example is PiggyVest — the largest online savings and investment platform in Nigeria — that allows you to invest in low-risk opportunities on Investify with as little as ₦5,000.

Regardless of how much you’re investing, the key is to start as early as possible — even with small contributions — and gradually increase your investment amount over time.

How do you find investment opportunities?

Finding investment opportunities involves conducting research and staying informed about the financial markets.

However, you can explore these sources to find excellent investments:

- Financial news websites

- Investment newsletters

- Reputable investment platforms

Beyond these methods, we recommend consulting with financial advisors or professionals who can provide valuable insights and guidance when searching for investment opportunities.

Suppose you’re unsure of where to find one. In that case, you can subscribe to the Money Matters by PiggyVest newsletter and talk to Odunayo Eweniyi — COO and co-founder of PiggyTech — via the “Ask Odun” column.

How to make your first investment with Investify by PiggyVest

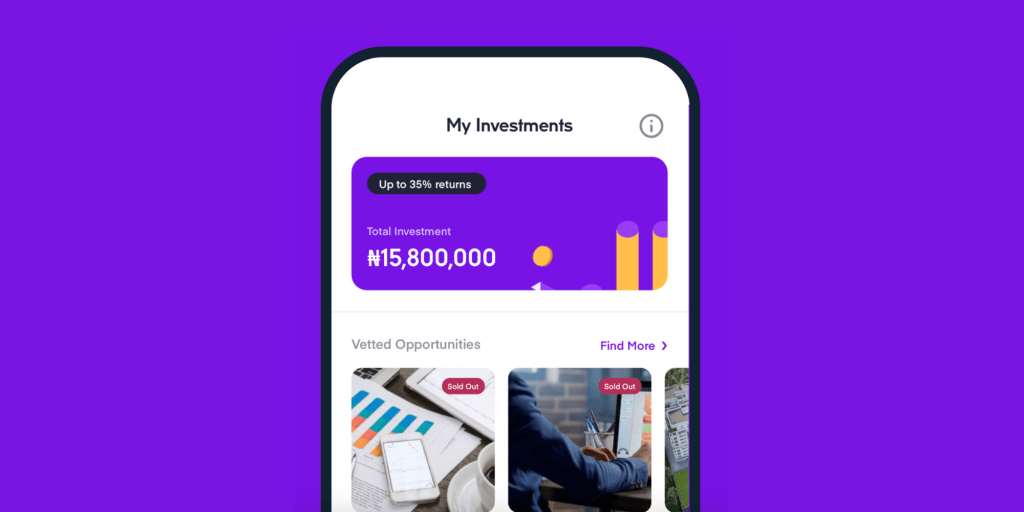

If you’ve made it this far, you should now have a practical understanding of investing. Now, it’s time to put your knowledge into practice by making your first investment with PiggyVest. With Investify, you can invest in bits and on the go with as low as ₦5,000 and get returns of up to 35% per annum.

Below is a step-by-step guide to making your first investment with Investify by PiggyVest:

- Log in to your PiggyVest app.

- Go to “Invest” and choose an investment opportunity.

- Click on “Invest Now.”

- Type in the number of units you want to buy and click on “Next Step.”

- Confirm your Investment.

- Click on “Invest Now.”

You can learn more about how Investify works by reading our article on how the real estate investment opportunities on PiggyVest work.

Final thoughts

The world of investing can seem confusing and treacherous if you’ve never backed a venture or sunk money into an asset. And that’s okay. Even the greatest investors in history — from George Soros to Bill Gates — had their “first day of school” moments. Thanks to this article, you now have a solid understanding of the fundamentals of investing.

Congratulations!

Now, before you embrace your inner Warren Buffet and become the “Oracle of Kaduna,” remember these words: investing is a journey, not a sprint. Educate yourself, be patient, and deal with only the financial risks you can handle.

The articles on the PiggyVest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.

- Springer Link: The Physician’s Guide To Investing

- Springer Link: The Ethics Of Investing

- Taylor & Francis Group: The Psychology of Investing