The concept of riba extends beyond monetary transactions — encompassing any form of excess or unjust gain — and is forbidden under Islam. But what exactly is it, and why does the Quran ask that Muslims shun it?

Riba (usury or interest) is an Islamic concept that refers to charging or accepting interest on loans or debts. The term comes from an Arabic word meaning “increase” or “excess,” and the practice is strictly prohibited and considered haram (forbidden) in Islamic finance.

In this article, we’ll explore the basics of riba, discover why it’s forbidden, and find out if there are methods you can use to earn interest under Islam. Then, we’ll show you how to save money with PiggyVest — the halal (lawful) way. Let’s begin!

Why does Islam prohibit riba?

Riba has its roots in pre-Islamic Arabian society, where the practice of charging excessive interest on loans was prevalent — often leading to exploitation and economic hardship for borrowers. Islam views riba as unjust and exploitative since it creates an imbalance in wealth distribution and encourages social inequality.

Still, it has been a topic of ethical and religious debate for centuries — with many having conflicting views about practising it in modern times. Nevertheless, many Muslims view riba as exploitative and unjust because it allows lenders to profit from a borrower’s financial difficulties — perpetuating a cycle of debt and inequality.

According to them, riba goes against the principles of fairness and equality Islam promotes, especially since the religion emphasises the importance of mutual respect and compassion in all financial transactions — whether you’re saving, investing or trading goods.

But what does the Quran say about riba?

In addition to its economic implications, riba is considered a major sin in Islam — with severe consequences both in this life and the hereafter. The Prophet Muhammad (PBUH) warned against riba’s dangers, highlighting its detrimental effects on individuals and society as a whole.

In fact, verses such as those found in Surah Al-Baqarah (2:275-279) explicitly forbid the practice of riba and caution against its allure. These teachings serve as a reminder of the importance of ethical conduct and social justice in all aspects of life — including (and especially) financial transactions.

What are the types of riba?

According to the Quran, there are two types of riba — each focusing on different financial transactions. Nevertheless, Islam prohibits both kinds and encourages Muslims to embrace Quran-approved (halal) practices when dealing with money.

The following are the two types of riba:

10 Of The Best Books About Money For Nigerians To Learn About Saving, Investing, And Wealth Building

- Riba al-Fadl (Riba of exchange): This riba refers to the prohibition of unequal exchanges or transactions involving goods of the same kind, where one party benefits unfairly.

- Riba al-Nasi’ah (Riba of debt): This type of riba refers to the prohibition of lending money with a predetermined interest increase.

But what does riba look like in real life?

What are some common examples of riba?

Riba can take many forms, depending on the type of transaction you’re involved in. However, there are some common examples in modern society.

Here are some common examples of riba:

- Charging interest on loans or credit. This involves charging an additional amount on top of the principal loan amount, increasing the total repayment amount.

- Earning interest from savings accounts or fixed deposit accounts. Receiving interest on funds deposited in conventional banking products is considered riba as it involves earning money on capital without engaging in productive economic activities.

- Engaging in financial contracts that involve predetermined interest payments. Any financial agreement that includes fixed interest payments — regardless of the economic performance of the underlying assets — falls under the category of riba.

Now, let’s see how these examples differ from the halal (or acceptable) options that Islam promotes.

What is the difference between riba and halal financial practices?

Halal financial practices — such as profit-sharing partnerships (Mudarabah) and leasing arrangements (Ijarah) (more on these later in the article) — involve a fair distribution of profits and losses between the parties involved.

In contrast, riba involves a guaranteed return for the lender — regardless of the borrower’s financial success or hardship. This situation creates an unfair advantage for the lender and places an undue burden on the borrower.

Women & Money: Jesimiel Damina Wants To See More Women Filmmakers In Technical Roles

All Islamic financial practices are based on justice, cooperation and risk-sharing principles. Therefore, the Quran encourages ethical and responsible financial behaviour that benefits individuals and society. Islamic banking and finance also emphasise that Muslims avoid excessive risk and speculation in socially irresponsible activities (like gambling).

Is it haram to earn interest on savings?

Earning interest on savings is generally considered haram in Islam. Therefore, Muslims must explore alternative financial instruments that comply with Islamic principles (like Islamic savings accounts, profit-sharing investments or Islamic bonds).

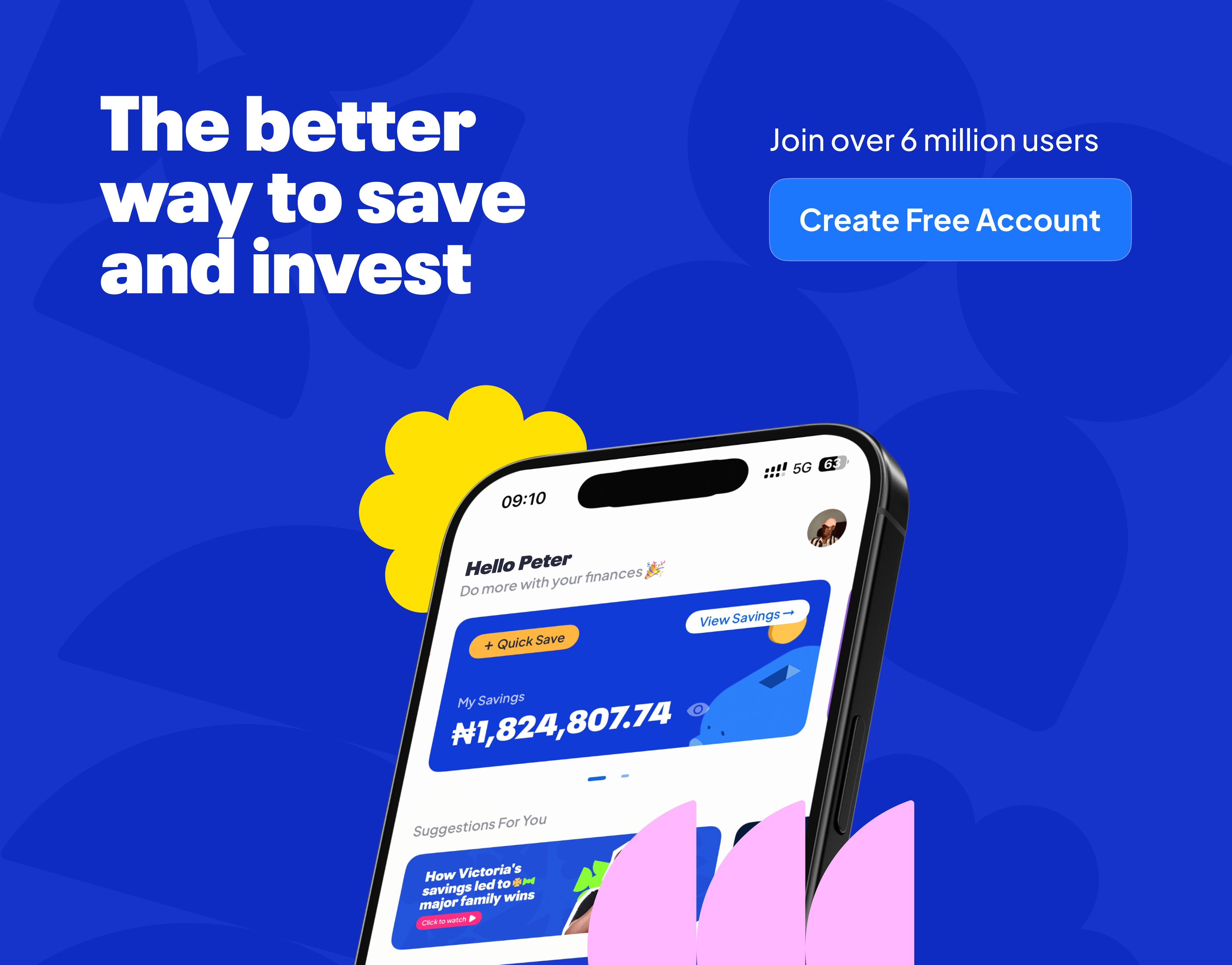

Still, it’s perfectly fine for Muslims to save money — even on safe and secure platforms like PiggyVest — as long as they’re not earning interest on their funds. But can you save on PiggyVest without incurring riba?

What type of interest is halal in Islam?

In Islamic finance, only profit-sharing arrangements or investments that adhere to the principles of fairness, risk-sharing and ethical conduct are halal. Profit-sharing is considered halal because both parties share the risks and rewards of a venture.

Some halal options in Islamic finance include:

How To Budget On A Fluctuating Income

- Ijarah (leasing). This involves leasing or renting out an asset (such as property or equipment) for a predetermined period in exchange for rental payments. The lessor retains ownership while the lessee enjoys the asset’s benefits. This structure aligns with halal principles as it involves a tangible asset and a transparent value exchange.

- Mudarabah (profit-sharing partnership). This is a halal partnership where one party provides capital (rabb-ul-Maal), and the other contributes expertise and effort (mudarib) to manage a business venture. Partners share profits according to a pre-agreed ratio, while the capital provider solely bears all losses. This arrangement promotes collaboration and risk-sharing.

- Murabaha (cost-plus financing). In Murabaha, the financier purchases an asset and sells it at a marked-up price with deferred payment terms. This allows the buyer to acquire the asset without incurring interest while the financier earns a profit margin.

- Musharakah (joint venture). Musharakah involves two or more parties pooling their resources and expertise to undertake a business venture. They share profits and losses according to a pre-determined ratio. This model fosters collaboration and aligns the interests of all participants.

- Sukuk (Islamic bonds). Sukuk represents ownership certificates in an underlying asset or project and offers investors participation in the actual performance of the underlying venture. Holders can enjoy a share of the returns the asset generates, separating from conventional bonds offering fixed interest payments.

All five examples align with the principles of halal finance, as they promote risk-sharing and asset-backed transactions.

How to save on PiggyVest the halal way

PiggyVest is the better way to save and invest money in Nigeria, allowing users to earn up to 35% interest on their funds. However, there’s a way to use the platform in a halal manner if you’re avoiding riba.

Here’s how to save on PiggyVest the halal way:

- Log in to your PiggyVest app.

- Click on the “Account” tab.

- Disable the “Interest Enabled on Savings (Riba)” option.

- Save as much as you like.

Now, you can enjoy all the benefits of using PiggyVest and explore our platform’s many options — from emergency savings with Flex Naira to rent-focused wallets with HouseMoney™.

Happy saving (and welcome to a halal PiggyVest)!

Tips for maximising your savings without riba

You can still be on the path to financial freedom — even without riba. In fact, there are some handy strategies that you can apply to ensure your money goes a long way — especially if you’re not earning interest.

Here are some tips for maximising your savings even without riba:

- Create a budget and carefully track your expenses to identify areas to cut back.

- Invest in halal investment opportunities like ethical funds or Islamic stocks.

- Practice delayed gratification by avoiding unnecessary purchases and focusing on long-term financial goals.

- Engage in charitable giving, as it is a spiritual obligation and a means of purifying your wealth.

Want to learn more? We recommend checking out our conversation with seven Nigerians on life hacks that help them save money.

Final thoughts

Saving and investing in a halal way is not only possible but can also be financially and spiritually rewarding. By choosing halal-compliant options and following the principles of Islamic finance, you can achieve your financial goals while staying true to your faith.

PiggyVest allows you to access halal-compliant savings options, making it an excellent choice for Muslims looking to grow their wealth responsibly and ethically.