According to recent studies, around 51% to 80% of Nigerians pay rent. It’s an essential cost that constitutes a substantial portion of their expenses — often ranging from 40% to 60% of an average Nigerian’s salary. That’s a lot of money. So, what’s the optimal amount you should spend on rent?

You should spend at most 30% of your annual income on rent. In fact, according to industry standards, your total housing costs shouldn’t exceed three months’ worth of income — regardless of how much you earn. This way, you can easily pay your rent and have enough money for savings and other expenses.

But let’s face it: deciding what percentage of your income should go to rent can be tricky — especially if you live in an expensive state like Lagos. In this article, we’ll help you navigate this problem by presenting the 30% rule and other optimal rent-planning alternatives. Then, we’ll show you how to save for your house rent with PiggyVest’s HouseMoney™ and share some timeless ways to reduce your rent-related expenses. Let’s go!

What is the 30% rule?

The 30% rule is a financial guide that states that you should allocate a maximum of 30% of your annual income to your yearly rent. This rule — sometimes called the Golden Rule in Affordable Housing — isn’t a hard law but a suggestion for budgeting rent proposed by the United States Department of Housing and Urban Development (HUD) in 1966.

So, how does the 30% rule work?

Let’s say you earn a gross monthly salary of ₦300,000 in Lagos. That means your annual pay accumulates to ₦3,600,000 — an impressive sum, as you make more than 71% of Nigerians (per the PiggyVest 2023 Savings Report).

According to the rule, you should pay no more than ₦1,080,000 (or ₦90,000 monthly) as house rent to ensure you have more than enough money to spend on your wants, needs, savings and emergencies. Therefore, while that ₦1,500,000 studio apartment in Lekki might be tempting, the smart (and financially savvy) decision will be to go for a ₦900,000 two-bedroom rental in Yaba.

Now, you might ask, “A US agency suggested the 30% rule; why should I use or even care about it as a Nigerian?”

The simple answer is that the 30% rule works — especially if you’re not unbelievably liquid like PayStack’s Ezra Olubi. In fact, the rule is so effective that it’s the standard for practically every country in the world, including Nigeria. And as we mentioned, it’s a great rule to follow if you’re concerned about having money left over to live and enjoy life after paying house rent.

Should you always stick to the 30% rule?

You don’t always have to stick to the 30% rule, even if it’s a practical approach to budgeting rent. In fact, you can go well above or below the recommended percentage depending on your financial plans and overall income. After all, it’s supposed to be a guideline to keep renters financially healthy in the long run.

Therefore, there might be situations where deviating from the rule might be better for your finances than following it.

For example, let’s say you earn a yearly salary of ₦3,600,000 in Lagos but work in Victoria Island. While going for a ₦900,000 two-bedroom rental in Yaba (25% of your income) might seem like a great idea, you might be better off renting a ₦1,500,000 studio apartment in Lekki (41% of your income) to save on transport costs.

Why? Let’s do the math.

Say it costs about ₦10,000 monthly (₦120,000 yearly) to commute to work from Lekki and ₦100,000 monthly (or ₦1,200,000 yearly) to commute to work from Yaba. That means you’ll be spending up to ₦480,000 extra on transport fees alone if you rent a house in Yaba compared to renting in Lekki.

The Cost Of Renting A Home In Lagos

While this example is a bit of a stretch, it shows that it’s always a good idea to consider all the factors that can influence your spending and saving habits before deciding to stick with a number or percentage.

However, in most cases, paying 30% or less of your annual income on rent will mean more overall savings.

Does the 50/30/20 rule apply to house rent?

The 50/30/20 rule applies to house rent, and you can also use it as an alternative approach to determining the optimal amount or percentage for rent.

We already explored the 50/30/20 rule as a great way to get into budgeting, but here’s a recap: The rule states that you can transform your finances and embrace wealth by breaking down your income into three categories: wants, needs, and savings. Then, you should allocate 50% of your income to your needs, 30% to your wants and 20% to your savings.

How to apply the 50/30/20 rule to house rent in Nigeria

The simple approach is to allocate 30% of your income to rent, spend 20% on other needs, put 30% aside for wants and then save the remaining 20%. In other words, your rent takes a large chunk of the percentage allocated to your needs. This way, you combine two tested and trusted rules for navigating your finances.

However, this approach might not always be optimal — especially if you have certain needs (like if you spend a considerable amount on medication). So, what can you do?

Here’s an alternative approach to applying the 50/30/20 rule to house rent in Nigeria:

- Take out a calculator — or use the Label feature on PiggyVest.

- Pay yourself first (by keeping an amount aside for savings — 20%).

- Analyse your needs by sorting them into high-priority or low-priority expenses.

- Leave the rest for rent and wants.

Let’s illustrate with an example.

Imagine you earn ₦100,000 monthly, and you want to apply the 50/30/20 rule to your house rent. First, save ₦20,000 (20%). Then, let’s say you spend ₦35,000 on food and other non-negotiable needs — allocate this 35% as appropriate.

How To Set Financial Goals For A New Year: 7 Tips To Save Better In 2026

Now, you have 45% of your income left over — 15% for house rent and 30% for your needs. You have two options: stick to this 15% and find a house that fits your budget, or cut into your want allocation and free up more cash for rent — the choice is yours.

Just remember: your rent doesn’t have to be precisely 30%. Simply work with a number that suits you.

Which factors should affect what percentage of your income should go to rent?

We’ve repeatedly mentioned how certain factors can (and should) affect the amount you spend on rent, even with the 30% and 50/30/20 rules serving as guidelines. What are these factors, and how do they affect rent?

You should keep the following factors in mind when deciding the exact amount to spend on your house rent:

How to Fully Recover from a Financial Setback in Nigeria

- Your yearly income.

- The location you plan on living.

- Housing market trends.

- The type and size of the accommodation you want.

- Utilities and other maintenance costs (like electricity bills and garbage disposal fees).

- Future financial stability.

Always consider the factors above before deciding on a particular percentage to ensure you’re not spending too much or too little on your rent payments.

How much is too much rent?

Most standards say spending more than 40% of your income on house rent is bad practice — for obvious reasons. After all, this high percentage usually means you’re spending too little on your needs or not saving enough money.

However, as we discussed earlier, there might be situations where it might be an excellent idea to go beyond this 40% with little to no impact on your overall financial health. The trick to determining “too much rent” is to analyse your income and specific situation before setting a number.

Remember: your house rent is an expense — albeit a crucial one. Therefore, you must approach it with your financial health in mind and not just a need to live somewhere fancy.

How to save for your house rent with PiggyVest’s HouseMoney™

Most landlords in Nigeria prefer to collect annual rent, with some even insisting on up to two years in advance for new tenants. Therefore, paying huge amounts of money yearly can be overwhelming — even if your rent is less than 30% of your income.

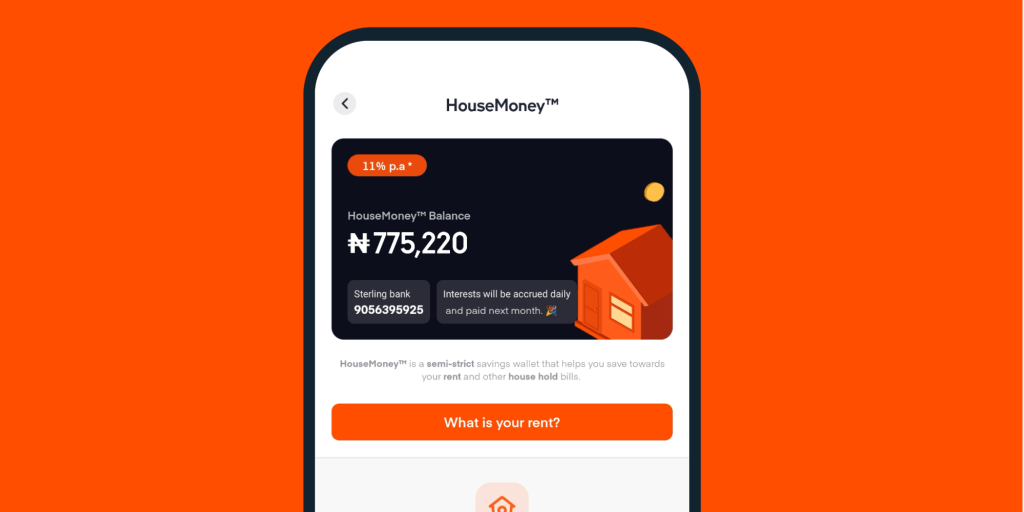

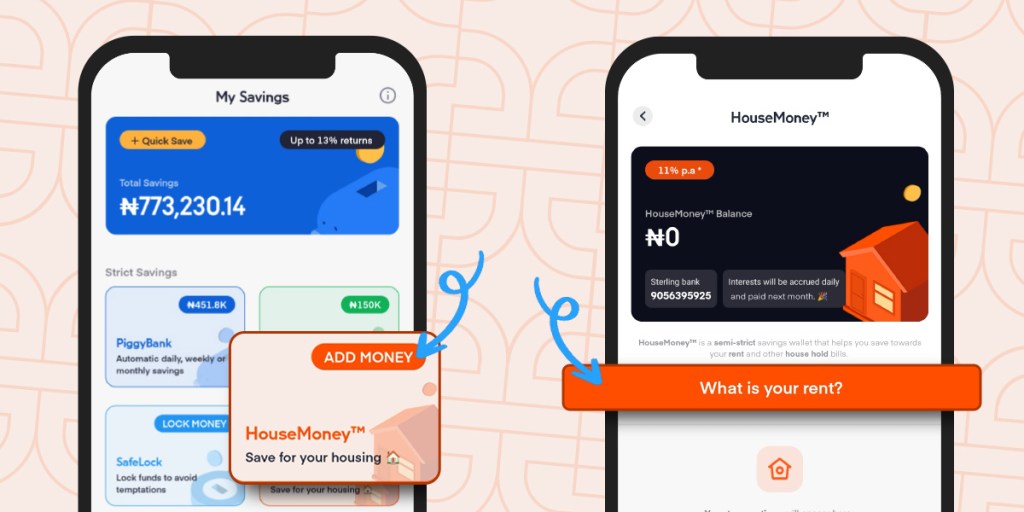

An excellent way to prevent this wahala is to split your rent into monthly chunks and save all year round. The best way to do this in Nigeria? HouseMoney™ by PiggyVest!

Here’s how to save for your house rent using HouseMoney™:

- Log in to your PiggyVest account.

- Click on “Savings.”

- Scroll down and select “HouseMoney™.”

- Fill in the required fields.

Now, you can easily save your house rent in advance — all while enjoying 11% annual interest. What a sweet deal!

How to save money on rent

While 30% is an excellent number to stick to, we at PiggyVest recommend you employ all the strategies in your arsenal to keep your house rent as low as possible. This way, you can save the excess funds with Flex Dollar — our Dollar savings feature — or spend the cash on cool stuff like a new car.

Here’s how to save money on rent in Nigeria:

- Consider less expensive neighbourhoods and smaller houses.

- Negotiate for less rent.

- Look for special deals and discounts on house rent.

- Consider ditching agents and renting directly from landlords.

- Opt for unfurnished apartments instead of serviced properties.

- Get a roommate or housemate.

- Use rent-saving platforms like HouseMoney™ to automate rent savings and enjoy interest.

Remember to protect your house rent by all means necessary, even while figuring out ways to save on rent. Be careful and stay away from opportunities you don’t understand to avoid rent-related scams and Ponzi schemes.

Conclusion: How much should you spend on rent?

The optimal amount to spend on rent in Nigeria is at most 30% of your yearly income or about three months’ salary. However, depending on your income and specific situation, you can spend more or less. A handy guide is to ensure you don’t exceed 40% to have enough money left over for savings and other expenses.

And remember: you can use HouseMoney™ by PiggyVest to save your rent without wahala and enjoy up to 11% annual interest.

The articles on the PiggyVest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.

- Estate Intel: Nigeria & Home Ownership: 51% Live in Rented Accommodation

- Business Day: Why Nigerians rent despite homeownership opportunities

- International Centre For Investigative Reporting: Nigerians spend 40% of annual income on housing – Property Pro COO

- Daily Trust: ‘Why Nigerians Spend 60% Of Income On Rent’

- HUD User: Defining Housing Affordability

- The PiggyVest Savings Report ‘23

- Crunchbase: Ezra Olubi

- Estate Intel: 4 Reasons Why Landlords Prefer Collecting Annual Rents Over Monthly Rents in Nigeria