Have you ever wanted to make money from Nigeria’s $2.61 trillion real estate market? What if we told you that there are several beginner-friendly ways to invest in real estate right now, beyond owning a house or buying a piece of land?

You can make money on real estate in Nigeria by investing in real estate opportunities on Investify, building rental properties, or backing Real Estate Investment Trusts (REITs). Other beginner-friendly options include Real Estate Investment Groups (REIGs), land flipping, and property development.

We wrote this article for beginner investors and real estate enthusiasts seeking guidance on how to invest in real estate in Nigeria, particularly low-income earners who want a slice of the pie. It covers all the basics and shows you exactly how you can get started using five investing methods.

How does real estate investment work in Nigeria?

So, you’re thinking about diving into Nigerian real estate? Fantastic! Essentially, investing here means you’re looking to acquire, own, manage, rent out, or sell a property in Nigeria to make a profit.

It’s a path many Nigerians have used to build wealth, primarily because most properties can appreciate in value over time (that’s capital appreciation!) and also bring in a steady income if you rent them out.

Now, the Nigerian real estate scene has its own unique systems, compared to places like the US or Europe. You’ll hear terms like “Certificate of Occupancy” (C of O), “Governor’s Consent,” or “Deed of Assignment“, crucial documents related to land and property ownership.

You may also encounter Omo Onile (traditional landowners who may ask for additional fees) and various levels of community development. This means that doing your homework (due diligence) is super important in real estate, especially here in Nigeria.

Therefore, you’ll want to double-check real estate requirements, confirm property titles, and team up with trusted lawyers and surveyors.

But is real estate a good investment in Nigeria, considering the challenges?

Oh yes! Even with its unique twists and turns, property in Nigeria has a solid reputation for being a resilient and profitable long-term investment. It often shields your money from things like inflation and generally holds its value well, especially if you invest in highbrow areas of cities like Kano or conurbations like Lagos.

How to start investing in real estate in Nigeria

Beginning your real estate journey truly depends on what you’re comfortable with financially, how much risk you’re up for, and what your long-term goals are. If you’re starting with a modest income, the trick is to find those opportunities that allow you start small, learn the ropes, and grow your investments gradually.

Here are 5 ways to start investing in real estate in Nigeria as a beginner:

- Invest in real estate opportunities on Investify by Piggyvest

- Build rental properties

- Invest in Real Estate Investment Trusts (REITs)

- Join Real Estate Investment Groups (REIGs)

- Flip lands and houses for a profit

Let’s see how they work!

1. Invest in real estate opportunities on Investify by Piggyvest

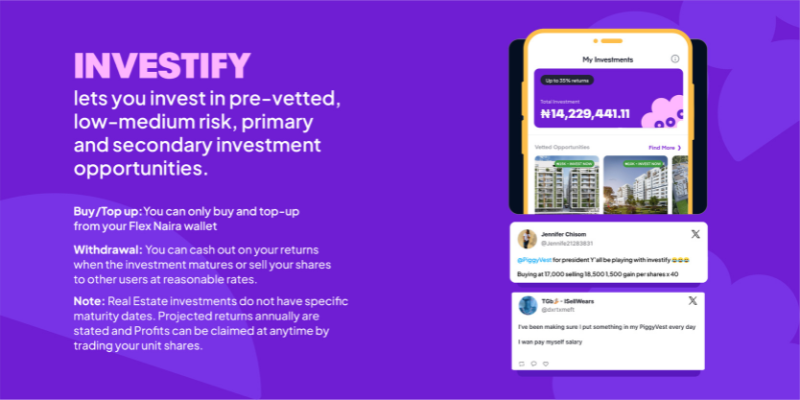

Piggyvest created Investify to make investing easier for every Nigerian. It’s a feature in our app where you can find various pre-vetted investment options, including opportunities in real estate.

With Investify, you can invest in various real estate options for as low as ₦5,000 alongside thousands of other investors and earn up to 35% per annum.

This is amazing because it means you don’t need a massive amount of money to get started; you invest what’s comfortable for you and then you can earn returns based on how well that property does, perhaps through rental income paid out or when the property’s value goes up.

You can even make money by selling your real estate shares on the Piggyvest app whenever you want.

What Is Diversification In Investing? Tips For Building A Lasting Portfolio In Nigeria

Here’s how to invest in real estate opportunities on Investify:

- Log into your Piggyvest app.

- Go to “Invest” and choose an investment opportunity.

- Click on “Invest Now.”

- Type in the number of units you want to buy and click on “Next Step.”

- Confirm your Investment.

- Click on “Invest Now.”

Remember to look at the details of each project before investing (including the minimum investment, projected returns, and tenor) since the opportunities we offer on Investify have different terms.

2. Build rental properties

Ever dreamt of having tenants and earning a steady income? That’s what building rental properties is all about! You could buy land and build on it, or buy an existing property and then rent it out to people or businesses.

Location is super important here if you want to attract tenants easily.

You’ll also want to think about the type of property, who your ideal tenants are, how you’ll manage it (or if you’ll get someone to help you manage it), and the agreements you’ll have in place. It’s like running a business where your property is your main product, and your tenants are your customers.

As this article by Zikoko shows, this path can require a substantial amount of money upfront (millions of Naira, in fact) — for the land, construction, any fix-ups, and routine maintenance. But hey, you could also start with something smaller, like a single flat or a small building with a few units in an area that’s still developing.

Fortunately, Piggyvest can also help here.

You can use Target Savings to build up the funds you need for that initial investment or down payment (while earning up to 12% per annum). The reward? You could enjoy regular rental income and watch your property hopefully grow in value over many years.

3. Invest in Real Estate Investment Trusts (REITs)

A real estate investment trust (REIT) is a publicly traded company that owns, manages, or funds properties that generate income and whose shares are available for purchase. They’re traded on the Nigerian Exchange (just like regular stocks) and formed by investors who pool their capital together.

In other words, you can buy or sell shares in REIT through a shareholder listed on the Nigerian Exchange Group (NGX). And while REITs might sound complicated, they’re actually a pretty neat and safe way to get into real estate.

How Do The Real Estate Investment Opportunities On Piggyvest Work?

Imagine a company that owns or manages a whole bunch of properties that make money — like shopping malls, office buildings, or apartments. With a REIT, you can buy shares in this company (just like you’d buy shares in any other business on the stock market) and make money through dividends from the property income and potentially when the share values increase.

So, you become a part-owner of all the properties that REIT holds!

Now, important advice: we recommend checking out the REIT’s collection of properties, who’s managing it, how it has performed in the past, and how much it usually pays out to investors before investing. This way, you can stay safe and keep your capital secure!

4. Join Real Estate Investment Groups (REIGs)

REIGs (sometimes called real estate syndications) are very similar to REITs, with one small exception — REIGs are private investment groups that operate as limited partnerships.

Essentially, a group of people like you pool their money together to invest in bigger real estate projects — the kind that might be too expensive or complicated for one person to handle alone. There’s usually a main person or company (the sponsor) who finds the deal, manages the project, and handles the day-to-day stuff.

Besides money, members sometimes contribute their skills to tackle larger opportunities.

The amount you need to invest in a REIG can vary a lot. Some smaller, more informal groups might let you join with a sum that’s quite manageable for a beginner (as little as ₦100,000), while others look for larger investments (up to ₦5,000,000). However, your returns are based on your agreement — usually from rental income or profits when a property is sold.

But here’s the truth: while REIGs can be great if you’re investing with little capital, they can also be incredibly risky.

How To Invest In REITs In Nigeria: A Deep Dive Into Real Estate Investment Trusts

Therefore, it’s really important to do your homework on the group’s sponsor or management team. You’ll want to understand what their investment plan is, what fees are involved, what kind of returns you might expect, and how long your money will be tied up.

Another important thing to keep in mind is that it may not be easy to get your money out quickly if you need it (this is called illiquidity), and your success depends a lot on how well the managers do.

The flip side is that REIGs can also be a great way to go if you want to invest with friends or family.

5. Flip land and houses for a profit

Property flipping can be quite thrilling and very profitable! It involves buying a property – maybe a piece of land (often called “land banking” if you hold it for a bit while it appreciates) or a house — with the main goal of selling it fairly quickly for a profit.

This is different from holding it for years to collect rent. Sometimes, if it’s a house, you might do some renovations or improvements to make it more attractive and valuable before you sell it.

To do this well, you need a good eye for spotting properties that are undervalued or are in areas that are about to become popular. You’ll also need to understand market trends, how much renovations might cost (if you’re doing them), and how quickly properties usually sell in that area.

And yes, PiggyBank can definitely help you save up for that initial purchase, whether you’re saving for a piece of land or a house to flip! Plus, you get to start making money before you even buy your first property (thanks to the 18% annual interest you get when saving in PiggyBank!)

While property flipping can be quite good, it does take skill and careful planning. You’ll need to make sure all the paperwork (like titles and survey plans) is in order when you buy and deal with Omo Oniles and other Nigeria-specific factors.

There are also risks, like the market suddenly going down (making it hard to sell at a profit) or underestimating how much those renovations will really cost. Additionally, you’ll need at least a few millions of Naira for land in developing areas, and go up from there.

Which real estate investment method pays the most?

“Most profitable” depends on what you mean — are you looking for the highest percentage return on a small amount of money you put in or the biggest overall Naira profit from a larger project?

Generally, if you successfully develop properties or flip high-value ones, you could see the biggest profits because you’re creating a lot of new value. But these also come with the biggest price tags to get started and the highest risks.

If you’re looking for more of a steady, consistent income, then rental properties and carefully chosen REITs can be highly effective, even if the returns are a bit more modest.

And those fractional investments we offer on Investify? They strike a nice balance, giving you a way in that’s both accessible and offers competitive returns.

The bottom line

The good news is that you don’t have to wait till you have millions to make that dream a reality. With Piggyvest, you can invest in bits and pieces of properties via Investify or save towards your goal using any of our savings products.

Ready to start investing? Download the Piggyest app and start using Investify!

The articles on the PiggyVest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.

- IGI Global Scientific Publishing: What is Omo-Onile

- LSBU: A strategic approach to real estate financing: challenges & opportunities in real estate financing in Nigeria

- Emerald Insight: Evolution of REITs in the Nigerian real estate market

- Piggyvest Savings Report 2024