Nigerian universities are…stressful. It’s almost like there’s so much to do — from classes and assignments to parties and conferences. And let’s not even mention the money you have to spend! How can one save in the middle of so much spending, sapa and wahala?

You can save money as a student by applying the 50 30 20 budgeting rule, using student discounts, planning your meals, using free software for your schoolwork and thrifting everything you can. We also recommend bulk shopping, protecting your belongings and saving money with PiggyVest.

We already mentioned some methods in our guide to saving money in Nigeria, but that article doesn’t cover the nuances of being a broke uni student. Here, we’ll share 11 real and practical tips on how to save money as a student in Nigeria. You can try them out if you’re looking to have more money at the end of the day or better enjoy the funds you receive as pocket money.

1. Use the 50 30 20 rule to create a budget that works

We’ll be honest: creating a budget is one of the best things you can do for your finances — even if you aren’t a student. In fact, a good budget can help you take control of your money in ways you never thought possible. And when done right, budgeting can help you enjoy every kobo you earn — no matter how much that is.

Still, finding a budgeting technique that works for you can be daunting — especially if you’re a uni student fighting the neverending forces of sapa! That’s why we recommend the 50 30 20 rule.

This easy-to-use technique simplifies and divides your money into three sections — savings, needs and wants. All you have to do is put aside 50% of your income for your needs, 30% for wants and 20% for savings.

You can learn more about how the rule works as well as its effectiveness by checking out our guide to budgeting using the 50 30 20 method.

2. Find and use student discounts and campus services

Most people don’t know this, but you can use your studentship to unlock a world of value, especially for online services and subscription-based products. Many platforms offer massive deals (and even free subscriptions) to Nigerian students — as long as you have a student ID or school email address.

These deals might be small (like Spotify’s 50% student discount for Premium), but you can also unlock free services that you can use for schoolwork (like Notion for Education or the GitHub Student Developer Pack). There’s also stuff like subsidised movie tickets and free conference access if you look in the right places.

These freebies and halfsies can help you save tons of money in school and open you up to opportunities you might not find in the real world. So use them well! You and your friends can even make a game out of finding and using these discounts to ensure everyone saves money!

Still, you don’t need to use the internet to maximise your student status. Being in a Nigerian university means you can access perks like free Wi-Fi, subsidised health insurance and free library access as long as you’re a student.

3. Plan your meals and cook your own food

Eating in uni is a big deal. In fact, a good meal (and lots of studying) can help you pass your hardest exams and put you in the right headspace to overcome the most challenging semester. However, food can also be pretty expensive.

Our advice? Eat well.

The trick to eating well in a Nigerian uni? Meal planning and cooking your food.

Planning your meals well in advance can help you save time and ensure you buy what you need, want and enjoy. It’s sort of like budgeting — but with food! You can plan your meals weekly, bi-weekly or even monthly — depending on your preferences and available time.

However, you’ll need to pair meal planning with some Hilda Baci vibes if you actually want to save money. In other words, you’ll need to buy the ingredients necessary to make these meals and cook them.

This tip might seem like a lot of work, but you can easily save up to half your food budget (and eat healthier meals) if you do it right.

4. Try jogging or running instead of the gym

Going to the gym is a healthy habit to build as a student, but it can be pretty expensive. Fortunately, there are cheaper and equally effective alternatives. Try jogging, skipping or running instead and eliminate gym fees.

All you need to get started is a pair of good running shoes (that you can thrift for as low as ₦2,000) and maybe some old tees and shorts. By exercising this way, you can also enjoy the outdoors and touch some grass.

How To Earn ₦90,000 Passive Income Monthly

You can use apps like Adidas Runtastic or Zombies, Run! to make your exercises more immersive and super fun.

5. Use e-books and free software for your schoolwork

We recommend getting e-books from upper-level students, lecturers or online platforms like Bookboon and Scribd to save money. Most of these options are free, and the rest come with student discounts.

This way, you can avoid paying exorbitant fees for new textbooks. Plus, you get to take your studies on the go! You can also invest in a dedicated e-book reader like a Kindle to ensure you access your e-books quickly and without hassle.

But that’s not all you can do to save money! Free software like Google Docs and WPS Office are perfect for students who don’t have thousands of naira to spend on pricier options.

You can also use your phone’s calendar app or free student planners like My Study Life to keep track of your classes and assignments.

When in doubt, google it! There’s almost always a free option for any software you need for schoolwork.

6. Share expenses and bills with your friends

The 4+ years you’ll spend in uni will probably be some of the best days of your life, thanks to friends and the many experiences you’ll share. In fact, there’s a chance the relationships you forge in school will become a part of your life for a long time.

These relationships can also help you save money while you’re in school. For example, you can share expenses like rent and data subscriptions with your friends or opt for family plans of subscription services to save loads of cash.

Fortunately, you don’t necessarily need a big friend group to save money this way. For example, you can save money and share expenses with just one best bud and still get significant savings from expenses like rent.

And it’s not just big bills! You can also split travel expenses, dinner costs and ticket prices to save cash by collaborating with your friends.

If you’re doing this, we recommend using the Groups feature on Pocket by PiggyVest. It’s especially perfect for when you want to ensure everyone pitches in when you’re spending as a group.

Building Wealth in Your 20s: Practical Money-Saving Strategies for Young Nigerians

Here’s how Groups work on Pocket to split bills and expenses with your friends:

- Log into your PocketApp and click on the “Groups” option.

- Click on the “Create New” button.

- Tap the “For My friends & I” option (or any joint account that works for you).

- Provide the name and username of the Clique™ you’re creating and tap the “Create Clique™” button.

A Group Pocket allows for easy contribution and management of cash between you and up to 100 people. So, create one and invite your peeps!

7. Thrift everything you can

As a student, you’re allowed to thrift everything! We recommend going for second-hand books (if you have to get physical books), pre-owned gadgets (in good condition), pre-loved furniture and everything in between to get deals and save money.

You can also thrift clothes, bags and shoes from Katangua or Yaba markets if you’re in Lagos and have an eye for okrika.

Besides the cost savings, you’ll likely find gems (like original pieces or rare items) when you thrift. Plus, everyone’s doing it. So don’t be shy!

8. Do your shopping in bulk and with friends

Like meal planning and cooking your food, shopping in bulk can help you save loads of cash. For example, you’ll pay far less money if you buy a bag of rice upfront than if you buy several cups over a period. This logic also applies to items like foodstuff, clothes and even water.

But let’s be honest: buying things this way can be expensive. Fortunately, you can partner with your friends! We’ll show you how.

Suppose a bag of rice costs ₦60,000. Then, you go to the market and find it costs ₦20,000 to get a quarter bag — the exact amount you need to last the semester. That’s ₦5,000 extra.

What can you do?

Easy! You can contact three friends interested in the same item and buy the bag. This way, you all save money, and everyone’s happy.

Women & Money: Why Oluchukwu Chiadika Launched Your Personal Finance Girl

Doing bulk shopping this way can also help you snag deals in the most unlikely places — such as when shopping for clothes — since you can use the volume of items you’re buying as a negotiation tool.

9. Avoid debt

Avoiding debt as a student in Nigeria is a fantastic way to save money since you’ll have control over your finances and more money to stash for rainy days. To avoid debt, try to live below your means and follow the rest of the tips we shared in this article.

You can also check out our tips on managing debt as a Nigerian if you’re looking for ways to escape debt for good.

Remember: There’s nothing shameful about debt — especially if it’s unavoidable and valuable (like borrowing money to pay your school fees). Just ensure you work to make your payments and secure your future.

10. Protect your belongings

Another way to save money as a student in Nigeria? Protect your stuff! Ensure that everything from your foodstuff and your clothes to your phone and your laptop are safe at all times.

Protect them from spills, pests, burglars and similar agents.

Some platforms even allow you to insure them.

Protecting your belongings will help them last longer and will result in you spending less money on servicing or fixing damaged items. Of course, you won’t have to worry about replacing your items and concentrate on upgrading them instead.

The biggest payoff is that you can channel more funds to stuff that matters (like your emergency savings) instead of repetitive purchases.

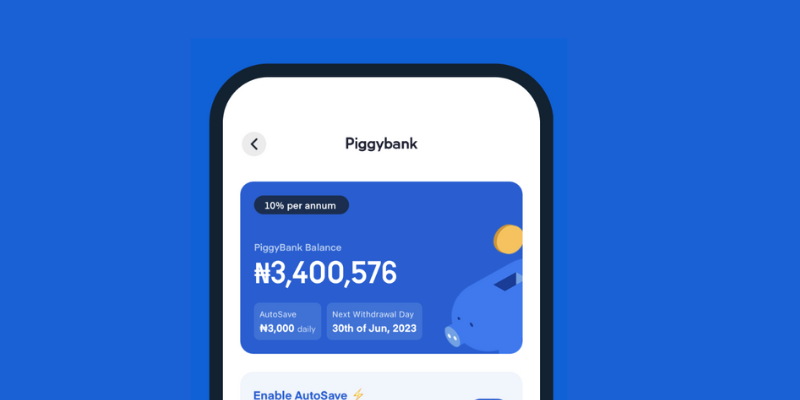

11. Automate your savings with PiggyVest

PiggyVest is the first online savings and investment app in West Africa and has been a part of many success stories since its launch in 2016. The platform is the best way to save your extra cash as a student in Nigeria, and you can enjoy interest of up to 35% per annum — depending on which plan you choose.

We recommend using the PiggyBank feature to automate your savings while you’re in school. And since there’s no limit to the amount of money you can start with, you can stash as low as ₦2,000 monthly for rainy days.

Of course, the exact amount you’ll save depends on you, your needs and your income. Just save!

Here’s a quick guide on how you can use PiggyBank to save money as a student in Nigeria:

- Login to the PiggyVest app.

- Go to “Savings.”

- Click on “PiggyBank” and “Enable AutoSave.”

- Then go to “Settings” and select “AutoSave Settings.”

- Set up your preferred AutoSave plan (for instance if you want to save ₦2,000 monthly).

- Click on “Continue” and select your source of funds, preferred time to save and when you would like to start.

- Then click on “Complete.”

You can also use Flex Dollar to save in USD or try our Safelock option if you’d rather lock cash for a specific period (and earn up to 12.5% interest annually).

Conclusion

Although making money as a student is great, it’s important you learn to save money as well. The tips we shared in this article will help you do so. You can also try tracking your spending and paying your bills on time to conserve your funds.

Of course, don’t forget to make PiggyVest your savings associate as you brave the rigours of ASUU, student loans and all the other ups and downs of university schooling in Nigeria.

The articles on the PiggyVest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.

- Digitala Vetenskapliga Arkivet: Student saving, does it exist?: A study of students' saving behavior, attitude towards saving and motivation to save

- The Republic: 'Na mumu dey go boutique': The essentials of Nigeria's okrika industry