Stop us if we’re wrong: you’re a budding investor looking to learn all you can about investing in Nigeria. You’ve probably checked out our beginners’ guide to investing, and now you want to know the types of investments you can access as a Nigerian. Well, you’re in the right place!

The types of investments available to Nigerians include stocks, derivatives, annuities, high-yield savings accounts (like PiggyVest) and exchange-traded funds (ETFs). You can also invest in retirement plans, commodities, bonds, mutual funds, real estate and certificates of deposit (CDs).

In this article, we’ll help you understand how these investment types work by exploring their associated risks, characteristics and potential returns. This way, you can make informed decisions about where and how to invest your money — whether you’re putting down ₦5,000, ₦50,000 or ₦5,000,000.

What are the categories of investments?

Before we dive into the types of investments in Nigeria, let’s discuss the categories (or asset classes) under which these investment vehicles fall. Understanding these investment categories can help you create a truly diversified portfolio, regardless of your risk appetite or financial goal.

The categories of investments are:

- Equity. Equity investments (like stocks) involve buying shares of ownership in a company, allowing investors to enjoy potential returns through capital appreciation and dividends. You can get them on the Nigerian Stock Exchange (NSE) or by directly investing in private companies. They typically have higher potential returns but involve higher risk due to market volatility.

- Fixed-income investments. This investment category offers investors a steady stream of income at predetermined rates. They’re generally lower risk compared to equities but provide lower potential returns — with bonds (issued by the government or corporations) and treasury bills being common options in Nigeria.

- Cash investments. Cash investments like high-yield savings accounts (HYSAs), money market funds and short-term certificates of deposit (CDs) provide high liquidity and stability. They offer a safe place to park funds and are super accessible but typically offer lower returns compared to other investment options.

- Investment funds. Investment funds (like mutual funds and ETFs) pool money from multiple investors to invest in diversified portfolios. They allow you to access various asset classes simultaneously (including stocks, bonds and real estate) with relatively small capital to enjoy diversification and professional management.

- Alternative investments. Alternative investments — like real estate, commodities, cryptocurrencies and private equity — go beyond traditional assets. They offer unique risk-return profiles (the higher the risk, the higher the returns), potential for higher returns, and portfolio diversification. However, they also come with additional complexities and may require specialised knowledge and due diligence.

In the next section, we’ll discuss 11 types of investments available in Nigeria.

11 types of investments in Nigeria

Investing can feel overwhelming, especially if you’re a beginner — and with good reason. Unlike saving, there’s so much you must learn, know and understand to ensure you get returns from a venture. Still, the best place to start is knowing the major types of investments in the country.

The 11 types of investments in Nigeria are:

- High-yield savings accounts (HYSA)

- Annuities

- Bonds

- Certificates of Deposit (CDs)

- Commodities

- Derivatives

- Exchange-traded funds (ETFs)

- Mutual funds

- Real estate

- Retirement plans

- Stocks

Now, let’s see just how these investments work.

1. High-yield savings accounts (HYSA)

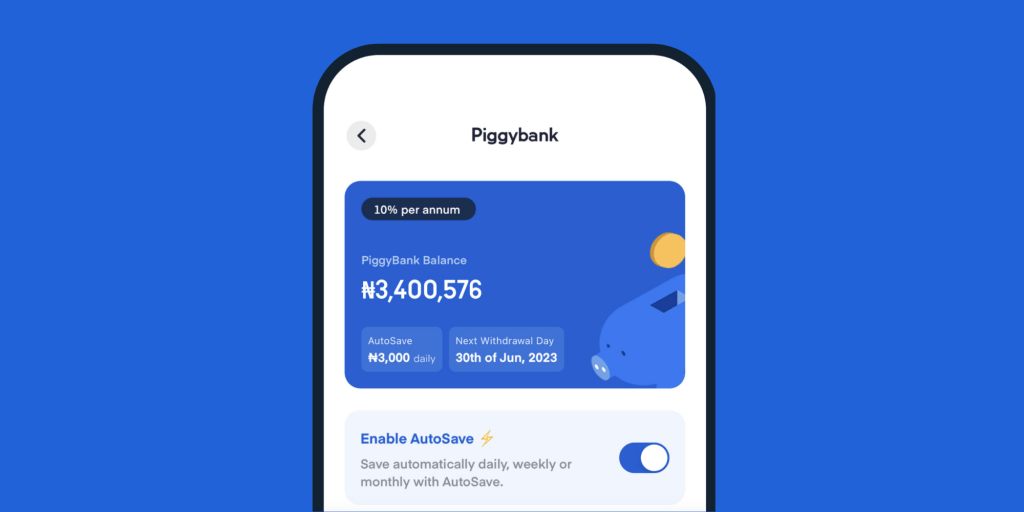

A high-yield savings account (or HYSA) is one of the safest investment options in Nigeria. Banks and financial institutions (including PiggyVest) typically offer these accounts, offering investors a higher interest rate than their regular savings accounts. And just like a regular bank account, a HYSA allows easy access to your funds.

So, how exactly do they work? And how do they differ from regular bank accounts?

HYSAs are pretty much the same as regular savings accounts in every way — except in their interest rates, required initial deposit, fees and deposit options. Where most banks typically offer about 6% interest per annum on regular savings accounts, you can get up to 30% or more if you use a HYSA.

Their required initial deposits are also usually higher than that of a savings account, and you might need to pay monthly maintenance fees or charges for exceeding a certain number of withdrawals per month.

Still, some HYSAs only allow you to deposit and withdraw money using a smartphone app or website — which can be pretty convenient if you love to invest in bits and on the go.

An excellent example of HYSAs you can access today in Nigeria are the plans on PiggyVest — from PiggyBank to HouseMoney™ — which allow you to earn up to 35% interest per annum using a nifty app on your smartphone.

High-yield savings accounts are perfect for beginner investors because of the peace of mind they offer. Plus, knowing that your funds are secure and earning a competitive interest rate can encourage you to keep confidently pursuing your financial goals.

2. Annuities

Annuities are investment products provided by insurance companies that offer you a reliable source of income during your retirement years. These financial instruments are perfect if you want to secure a steady stream of income post-retirement or are looking for economic stability and peace of mind in your golden years.

They come in two types.

- Immediate, which start payouts right after investment

- Deferred, which accumulate funds before payouts begin.

Here’s a simple overview of how annuities work:

- Purchase: You give money to an insurance company to start your annuity. This first payment is called the premium.

- Accumulation phase: Your money grows over time without you having to pay taxes on it. The insurance company might give you a set amount of interest, or it could change based on how well the market is doing.

- Annuitization: You can start getting money from your annuity after a set time. This money can be for a particular time or the rest of your life — or for both you and your partner, depending on your annuity plan.

- Distribution phase: Once you start getting paid, you’ll keep getting regular payments based on your payout option. These payments can go on for a certain number of years, for your whole life, or for both you and your partner’s lives.

Annuities are great for many reasons, but their customizability means you can tailor them according to your specific requirements and risk tolerance levels.

However, annuities can also have associated fees and charges — including sales commissions, administrative fees and investment management fees. These fees can significantly impact the overall returns and suitability of the investment — alongside market fluctuations, interest rate changes, inflation, lack of liquidity, longevity and credit risk.

The truth is that annuities can be pretty complicated if you’re new to them. Therefore, we recommend consulting with a financial advisor to help you select an annuity product that best aligns with your long-term financial goals.

3. Bonds

Bonds (not the fictional British secret agent, James Bond!) offer investors like you a stable avenue for wealth accumulation through fixed-income securities. They’re similar to annuities and provide a reliable source of income — making them an essential component of a truly diversified investment portfolio.

Bonds come in various forms in Nigeria, including:

- Government bonds. These bonds are issued by the federal government to finance its budget deficits and infrastructure projects. They are considered low-risk investments by many finance professionals because the full faith and credit of the government backs them.

- Corporate bonds. True to their name, corporate bonds are issued by businesses to raise capital for expansion or operational needs. And while they usually offer higher yields than government bonds, these carry higher risk due to the creditworthiness of the issuing company.

- Infrastructure bonds. These are specialised bonds issued to finance specific infrastructure projects like roads, bridges and even power plants. They provide investors with the opportunity to participate in the development of critical infrastructure while earning a fixed return on their investment.

Similar to annuities, investing in bonds involves an initial purchase, where investors lend money to the bond issuer in exchange for periodic interest payments. Then comes an accumulation phase where investors can watch their capital grow over time.

At the end of the bond’s maturity period, investors can receive the return of their principal amount. This distribution phase ensures a steady stream of income, making bonds an attractive option for income-oriented individuals.

How Do The Real Estate Investment Opportunities On Piggyvest Work?

Now, we must point out that, like annuities (and every investment vehicle in this article), bonds also come with their risks and considerations.

These may include market fluctuations, interest rate changes, inflation, lack of liquidity and credit risk. Additionally, you may incur fees and charges associated with bond investments, which can impact your overall returns.

4. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are a straightforward yet effective way to grow wealth through time deposits offered by banks in Nigeria. Functioning as fixed-term investments, these vehicles offer investors higher interest rates than traditional savings accounts.

When you opt for a CD, you commit to leaving your funds with a bank for a predetermined period, often ranging from a few months to several years. During this time, the bank provides a fixed interest rate — ensuring you know precisely how much you will earn when the investment matures.

One of the primary advantages of CDs is their low-risk nature. In Nigeria, CDs are typically insured by the Nigerian Deposit Insurance Corporation (NDIC), which means you have a safety net against potential bank insolvency or default.

This assurance also makes CDs attractive for investors prioritising capital preservation and modest interest rates.

Still, it’s essential to note that CDs lack the liquidity of regular savings accounts. Once you deposit funds into a CD, you generally cannot access them until it matures — at least, without incurring penalties. This feature makes this type of investment better suited for individuals with a stable financial outlook and a willingness to commit funds for the specified duration.

Still, there are drawbacks. While CDs offer a fixed interest rate, they may not always outpace inflation, which means you might see a reduction in the purchasing power of your capital and profits over the investment period.

5. Commodities

Investing in commodities involves buying and selling physical goods like gold, silver, crude oil, agricultural products and even art. The Nigerian commodities market is vast, with opportunities in areas like agriculture, energy and metals for newbies and veterans to explore.

Consider agriculture, which is a significant sector in the country. This commodity is an excellent example of a venture you can dive into as a Nigerian. As an investor, you can engage in farming activities (like crop cultivation, livestock rearing and fisheries), sell production materials (like farm equipment and seeds) or sell farm produce and get juicy returns for your efforts.

Agriculture is popular in Nigeria today as there’s an increasing trend towards agricultural technology and agribusiness in the country, allowing people to profit from mechanised farming, food processing and even agrarian logistics.

Plus, unlike art and other commodities, agriculture investments can contribute to the country’s economic growth while providing long-term returns.

Still, most commodities provide diversification and hedging benefits to an investment portfolio, making them an excellent option if you understand how they work and their associated risks.

My Money Mistake: I Invested All My Profits In One Platform And Lost Everything

Yep, commodities aren’t without risks. They can be subject to price volatility and require careful monitoring and analysis to ensure you don’t lose your profit or your capital.

6. Derivatives

Derivatives are sophisticated financial tools that derive value from an underlying asset or benchmark. In Nigeria, these investment vehicles include a range of instruments, each serving a distinct purpose in the financial landscape.

The main types of derivatives are:

- Futures contracts. These enable investors to speculate on the future price movements of assets like commodities, currencies or stock indices. By entering into a futures contract, you commit to buying or selling the underlying asset at a predetermined price on a specified future date. This ability to capitalise on anticipated price fluctuations without owning the actual asset presents both opportunities for profit and heightened risk.

- Options contracts. Options grant investors the right (but not the obligation) to buy or sell an underlying asset at a predetermined price within a specified time frame. This flexibility means you can hedge against potential losses or speculate on price movements with limited upfront capital. However, trading successfully requires a nuanced understanding of market dynamics.

- Swaps. These are agreements between two parties to exchange cash flows or other financial instruments based on predetermined terms. The most common types are interest rate swaps, currency swaps and commodity swaps — each serving to mitigate risk or optimise financial positions for participating parties. While they offer opportunities for customisation, swaps also involve counterparty risk and require meticulous contract negotiation and monitoring.

Derivatives offer unique opportunities for investors to manage risk, enhance returns and speculate on market movements. However, they also carry inherent complexities and heightened levels of risk compared to traditional investment options.

We recommend you only approach this type of investment if you understand its mechanics, intricacies and associated risks.

7. Exchange-traded funds (ETFs)

Exchange-traded funds (or ETFs) are dynamic investment vehicles traded on stock exchanges. They offer investors a convenient and efficient way to access diversified portfolios of assets.

In Nigeria, ETFs provide exposure to various asset classes (including stocks, bonds, commodities and even real estate), allowing investors to tailor their investment strategies to fit their financial goals.

One of the key advantages of ETFs is their ability to offer instant diversification across multiple securities within a single investment. So, by investing in them, you can spread risk and minimise the impact of individual stock or bond performance on your overall investment portfolio.

Transparency is another hallmark feature of ETFs, as they disclose their holdings regularly — typically on a daily basis. This transparency allows investors to understand the composition of the ETF’s portfolio, assess its risk profile and make informed investment decisions.

Before investing in ETFs, we recommend thoroughly researching their various factors, including the fund’s expense ratio, tracking error, liquidity, and the underlying assets. This way, you can select ETFs that align with your financial goals.

Still, these investments are not without risks. Market fluctuations, geopolitical events and changes in interest rates can impact ETF performance.

8. Mutual funds

Mutual funds are collective investment vehicles where numerous investors pool funds to create a diversified portfolio of securities. They are managed by experienced professionals known as fund managers and offer a convenient and accessible way to access a broad range of asset classes and investment strategies.

Mutual funds attract investors primarily because of the fund managers’ expertise in overseeing investment decisions. These professionals conduct research, analyse market trends and allocate assets to maximise returns while managing risk.

How To Set Financial Goals For A New Year: 7 Tips To Save Better In 2026

This hands-on management appeals to investors who may need more time, expertise or resources to manage their investments independently and successfully.

Plus, there are so many types of mutual funds in Nigeria today. So, whether you want capital appreciation, income generation or capital preservation — there is likely a mutual fund suited to your needs.

Unsurprisingly, mutual funds also carry risks. Therefore, you need to analyse various factors before sinking your money into one. These factors may include the fund’s historical performance, fees and expenses, investment objectives and risk tolerance.

You may also need to consider the fund’s track record, consistency in achieving its stated objectives, and alignment with your investment goals.

9. Real estate

Real estate is one of Nigeria’s most tangible and versatile investment opportunities. Whether you invest in residential, commercial or industrial properties, you can enjoy rental income, capital gains and portfolio diversification.

Let’s quickly discuss the classes of real estate you can invest in in Nigeria:

- Residential properties. These are perfect for investors who want steady rental income streams and long-term capital appreciation. From single-family homes to multi-unit apartment complexes, residential real estate provides a stable investment option — especially if they’re in urban centres with high demand for housing.

- Commercial properties. Office buildings, retail spaces and warehouses offer investors the potential for higher rental yields and capital appreciation. These properties primarily cater to businesses, offering opportunities for stable cash flows and long-term growth potential.

- Industrial properties. They include assets like manufacturing facilities, distribution centres and logistics hubs, which serve as critical infrastructure for economic activities. Investing in industrial real estate is typically expensive. Still, it can provide you with impressive returns since the value of these properties is driven by the growth of industries and logistics sectors.

Besides direct property ownership, you can also make money from real estate through Real Estate Investment Trusts (REITs). REITs pool funds from multiple investors to invest in a diversified portfolio of properties, allowing individuals to participate in real estate markets through publicly traded shares.

REITs also provide liquidity, diversification and professional management, making them an attractive option for investors who want to enjoy the proceeds of the sector without the challenges of direct ownership.

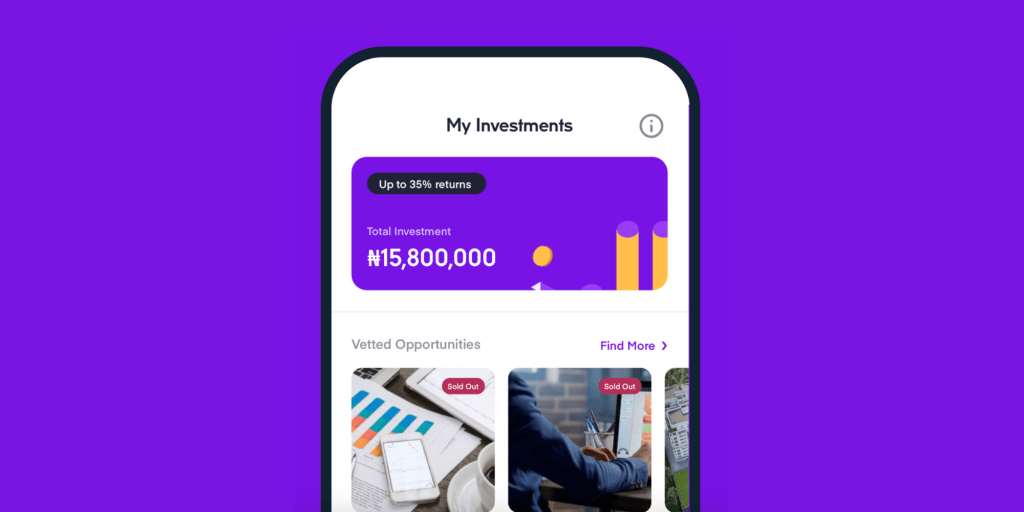

While the real estate opportunities on Investify by PiggyVest aren’t REITs, they offer a similar experience. These opportunities offer up to 35% annual returns and you can buy a share for as low as ₦5,000.

Here’s how to use Investify for real estate investments:

- Download the PiggyVest app.

- Log in to your PiggyVest app.

- Go to “Invest” and choose an investment opportunity.

- Click on “Invest Now.”

- Type in the number of units you want to buy and click on “Next Step.”

- Confirm your Investment.

- Click on “Invest Now.”

You’re all set!

While real estate investments offer numerous benefits, including potential long-term income and tax advantages, they also come with considerations and risks. Real estate investment requires significant upfront capital, ongoing maintenance and management responsibilities.

Market fluctuations, economic cycles and regulatory changes can also seriously impact investment values and rental income streams.

Although it might seem straightforward, the real estate industry can be complex. Therefore, we recommend consulting with real estate professionals and financial advisors who can provide valuable insights and guidance before investing.

10. Retirement plans

Retirement plans are designed to help individuals accumulate funds for their post-employment years. Different retirement plans offer individuals structured pathways to secure their financial well-being during retirement.

The following are the types of retirement plans available in Nigeria:

- Contributory Pension Scheme (CPS). The National Pension Commission mandates both employers and employees to contribute towards a pension fund, which is then managed by Pension Fund Administrators (PFAs). These contributions are directly from employees’ salaries, ensuring a disciplined approach to retirement savings. CPS funds are invested in diverse asset classes (including equities, bonds and real estate) to generate returns and build a retirement nest egg.

- Voluntary Pension Scheme (VPS). This scheme provides individuals with the flexibility to supplement their mandatory contributions under the CPS with additional voluntary contributions. Through the VPS, you can increase your retirement savings and take advantage of tax incentives provided by the government to encourage pension savings.

- Retirement Savings Account (RSA). This serves as the repository for individuals’ pension contributions under the CPS and VPS. It offers individuals a centralised platform to monitor their pension contributions, investment returns, and retirement savings progress over time.

By participating in retirement plans, you harness the power of compounding. Therefore, your investment returns are reinvested over time, leading to exponential growth of your retirement savings.

This compounding effect allows you to build a substantial retirement fund for your golden years.

Still, retirement plans need a lot of monitoring. In fact, you must regularly review and adjust your retirement plan based on your changing life circumstances, financial goals and economic conditions. Of course, we don’t recommend you do this without first consulting with financial advisors and pension experts.

11. Stocks

You invest in stocks by buying shares of publicly traded companies. This allows you to participate in the growth and profitability of these enterprises. The Nigerian Stock Exchange (NSE) serves as the primary platform for buying and selling shares of Nigerian companies, providing investors with access to a diverse array of investment opportunities.

Stock investments offer great returns as the value of the shares may increase over time based on the company’s growth and performance in the market. Plus, many companies distribute a portion of their profits to shareholders in the form of dividends — providing investors with a source of passive income.

Still, stocks come with inherent risks, including market volatility, economic fluctuations and company-specific factors. These may cause stock prices to fluctuate significantly. Therefore, successful stock investing requires careful analysis, research and risk management.

Summary

Regardless of your investment strategy or experience level, you’ll surely find an investment option that works well with your financial plans. If you’re a beginner, we recommend you start with low-risk investments that offer steady returns (like HYSAs, bonds and mutual funds) before exploring more complex options.

The articles on the PiggyVest Blog are developed by seasoned writers who use original sources like authoritative websites, news articles and academic journals to perform in-depth research. An experienced editor fact-checks every piece before it is published to ensure you are always reading accurate, up-to-date and balanced content.

- James Bond Wiki

- National Pension Commission: An Overview Of Contributory Pension Scheme

- National Pension Commission: Pension Fund Administrators (PFA)

- National Pension Commission: Guidelines On Voluntary Contribution Under The Contributory Pension Scheme

- National Pension Commission: What Is A Retirement Savings Account (RSA)?